Time to watch out? Bitcoin bull score index drops to 2-year low!

- Bitcoin’s bull score index dropped to its 2023 levels as momentum weakened

- According to Coinbase, April’s U.S tariffs and earnings reports could be factors to watch out for

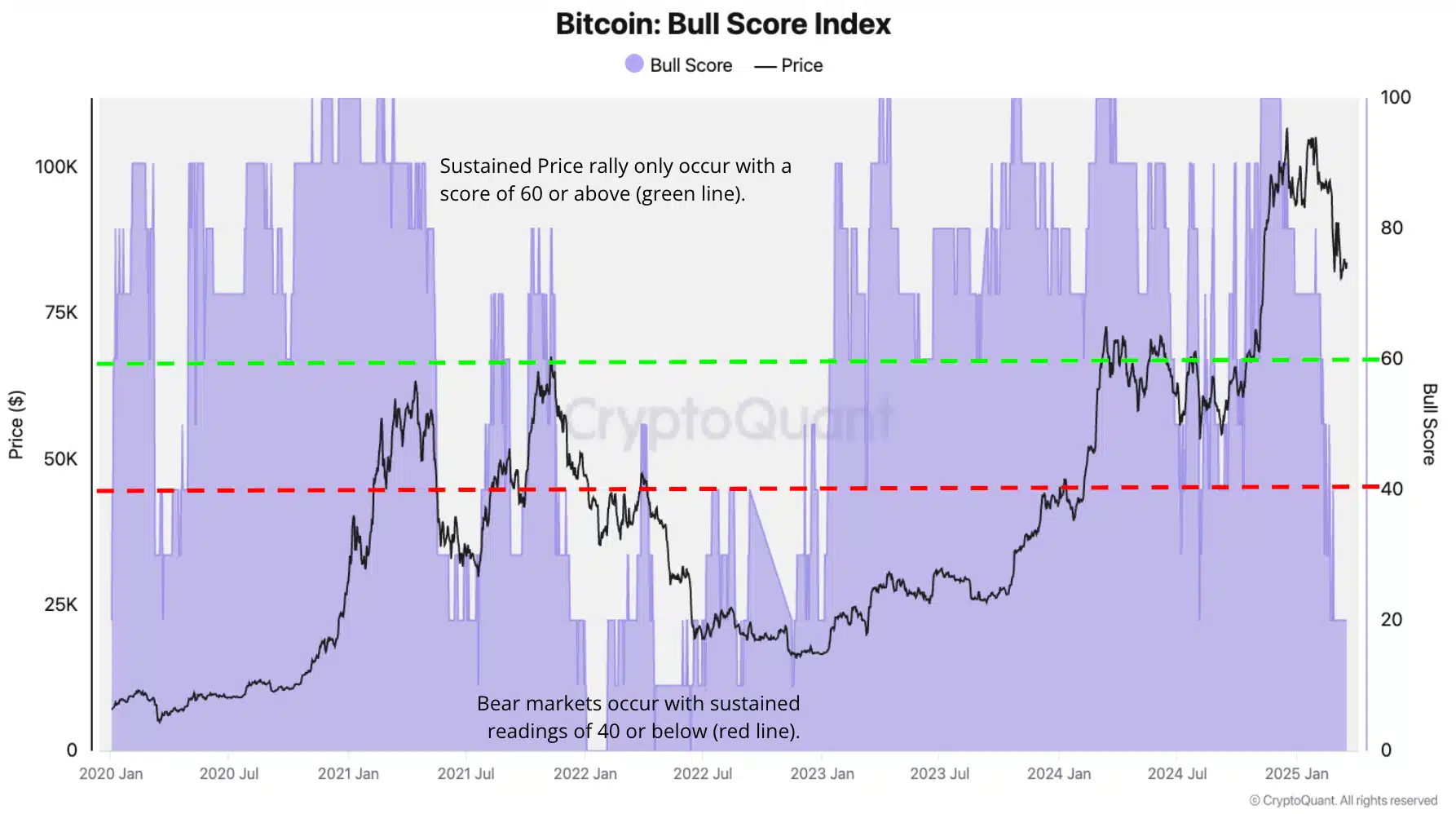

In Q1 of 2025, Bitcoin [BTC] lost momentum and dropped by 23% to $84k from $109k. According to CryptoQuant analysts’ projections, this could mean a likely longer bearish trend.

In its weekly report, the analysts noted that the Bitcoin bull score index (BBSI) fell to a 2-year low. This highlighted weak market momentum across the board.

“Currently, the index stands at 20—the lowest since January 2023—market conditions are weak, raising concerns that the recent price drop could be part of a broader bearish trend rather than a short-term correction.”

The index ranges from 0 to 100. It tracks bullish signs like network activity, demand, and liquidity.

Higher values would be deemed bullish, while lower readings would show bearish conditions. The BBSI reading of 20 mirrored the weak conditions seen in 2022 and early 2023.

What’s next for Bitcoin?

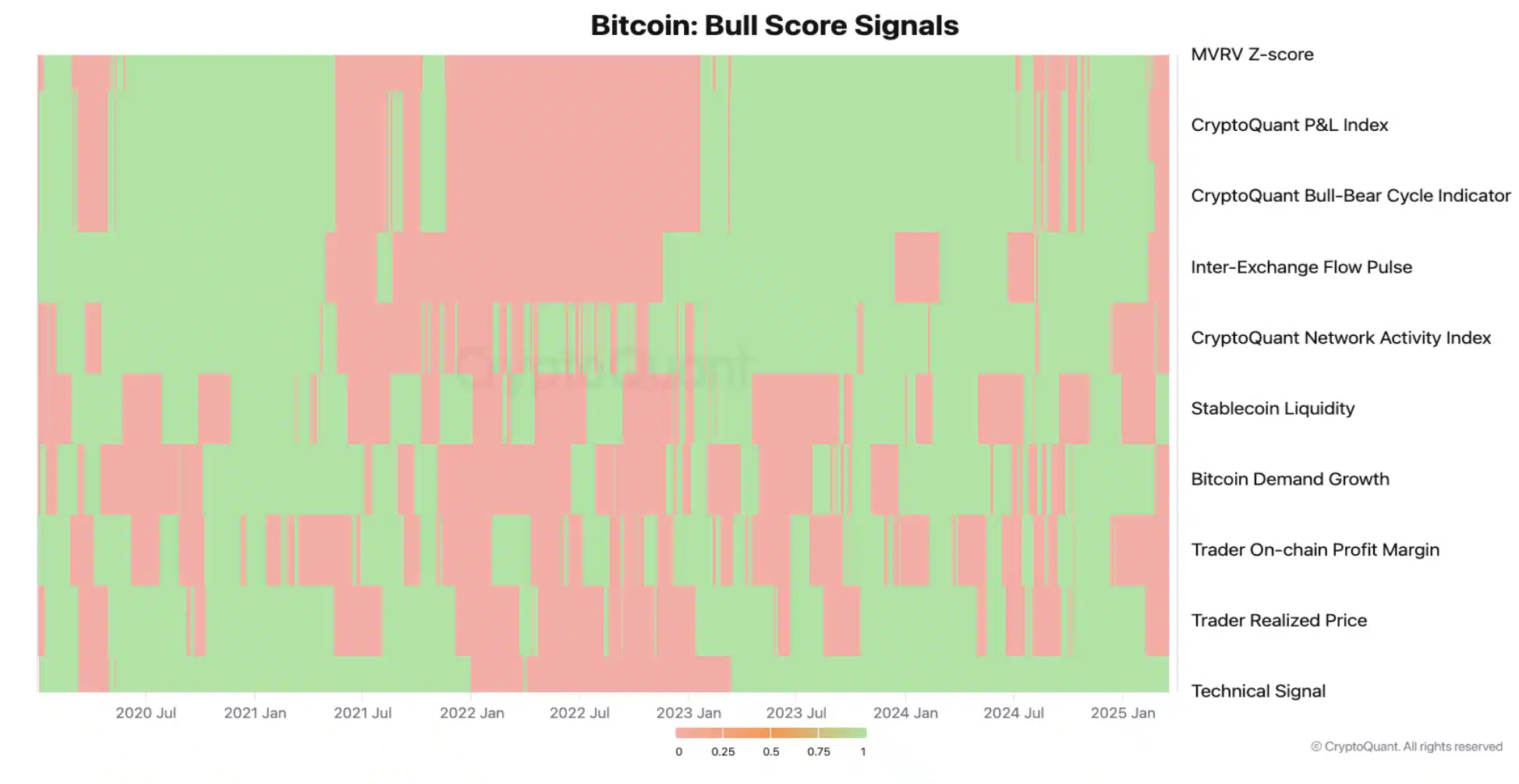

Additionally, the analysts added that other key on-chain signals, apart from stablecoin liquidity, have been bearish since mid-February.

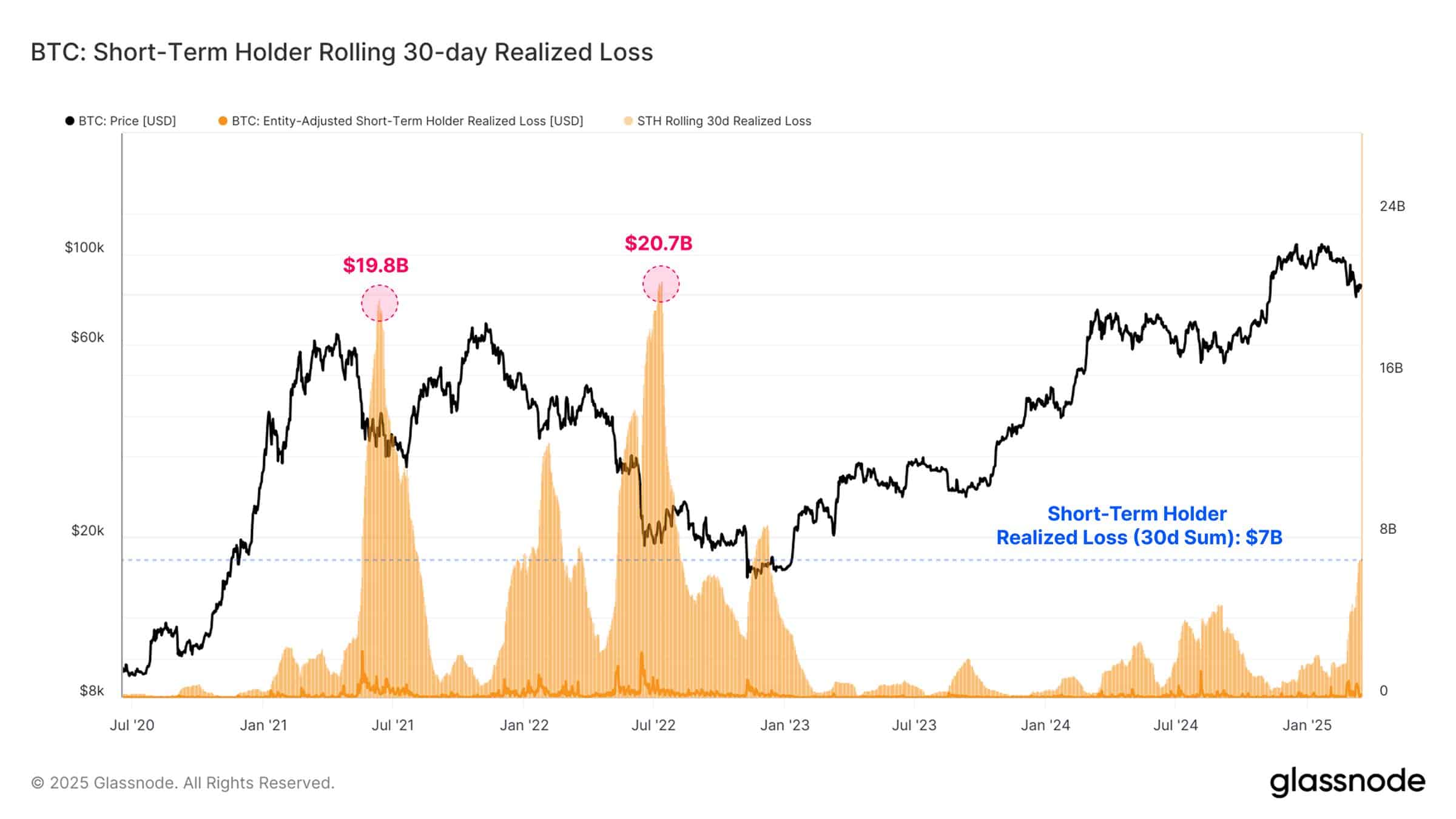

The most distressed group of investors include STH (short-term holders), who have held BTC for 6 months or less. The group saw a record loss of $7 billion in the last 30 days, according to Glassnode. However, the analytics firm noted that losses remained within the historical levels seen during previous BTC bull runs.

“The rolling 30-day realized loss for #Bitcoin’s STHs has reached $7B, marking the largest sustained loss event of this cycle. However, this remains well below prior capitulation events, such as the $19.8B and $20.7B losses in 2021-22.”

However, Coinbase analysts didn’t share this optimistic outlook. Macro uncertainty and Trump tariffs worsened the risk-off sentiment for BTC in Q1. In fact, Coinbase analysts warned that new tariff wars in early April could be a key factor to watch.

“We believe tariffs and 1Q25 earning reports (forward guidance) represent the most important factors for market players to watch in the weeks ahead.”