TON could offer new buying opportunities if it retests this value area

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- TON is in an almost neutral market structure across all timeframe charts

- TON’s correction retested a key value area that could offer a strong rebound

Since the end of January, The Open Network’s TON, has consolidated in the $2.2 – $2.6 range. At press time, its price action had retested a key value area that could induce the market to a recovery. However, a pullback retest on this key value area could offer new buying opportunities and extra gains if overall market sentiment improves.

Is your portfolio green? Check out TON Profit Calculator

Can the key value area of $2.3 boost recovery?

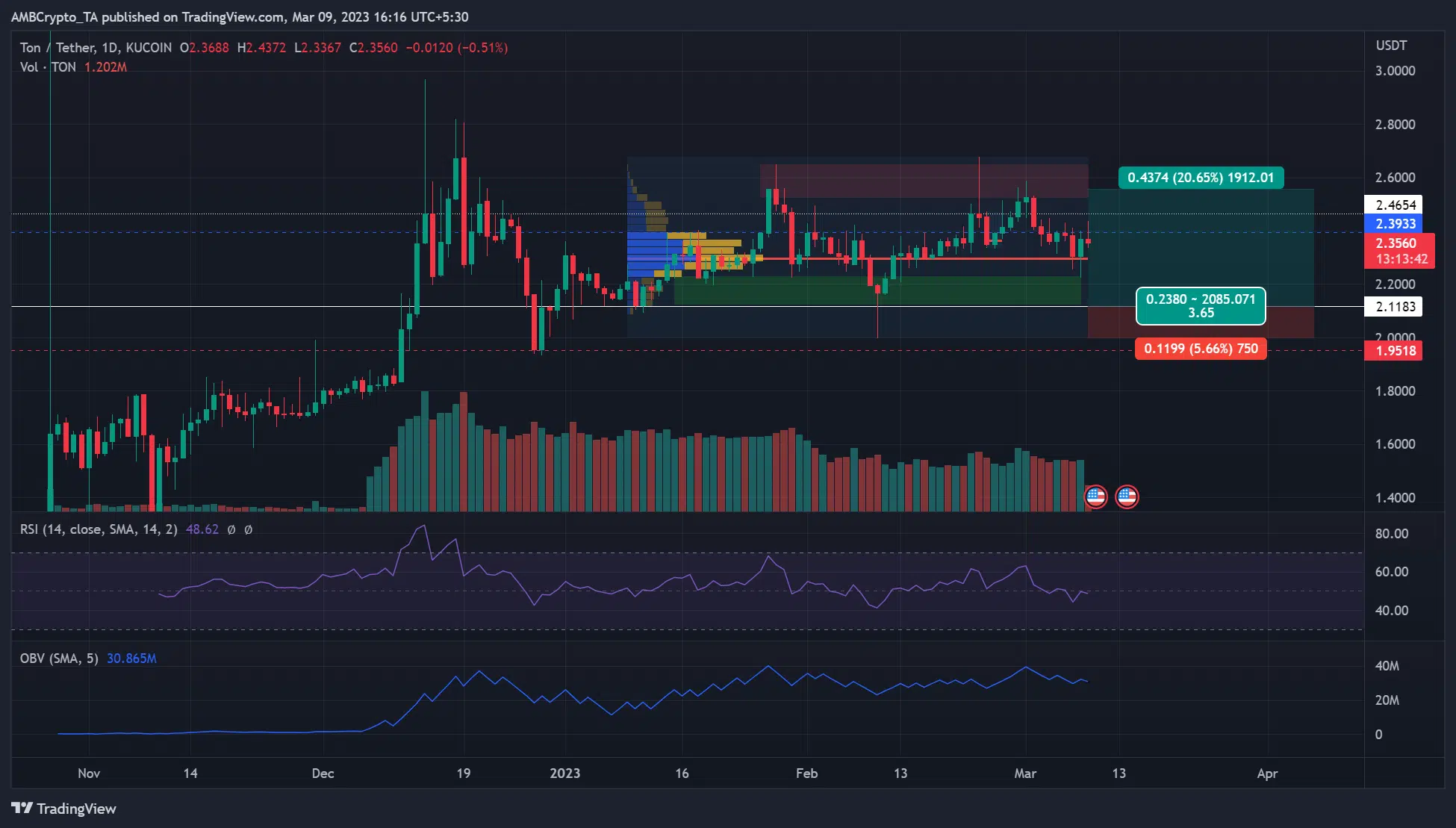

On the daily chart, the price rejection around the supply zone (red) at $2.6 set TON into a correction. At press time, TON had retested the demand zone (green) and the high-value node (HVN) of the Fixed Range Value Profile (FRVP). The FRPV’s point of control (POC), red line, of $2.3 had the highest traded volume and could offer a strong recovery if pullback retests it.

Therefore, bulls could get new buying opportunities at $2.3 if the pullback retests the POC of $2.3. However, the most ideal and secondary buying opportunity would be a retest of the demand zone ($2.16 -$2.23). The target would be the bearish order block of $2.6 in the supply zone – A 20% potential hike with a risk-to-reward (RR) ratio of 1:4.

A break below the demand zone level of $2.1183 will invalidate the aforementioned bullish thesis. Such a downswing could offer shorting opportunity at $1.9518.

The RSI (Relative Strength Index) seemed to be hovering near the neutral line too. At the same time, the OBV (On Balance Volume) fluctuated, showing a neutral structure that could extend the price consolidation if the trend persists.

TON recorded a rising Mean Coin Age

According to Santiment, TON recorded a rising 90-day Mean Coin Age, underlining a wide-network accumulation of tokens. It highlights a high probability of a bullish rally, one which could see TON pump towards the supply zone.

How much is 1,10,100 TONs worth today?

Additionally, the weighted sentiment was positive, showing investors were bullish on the digital asset. Similarly, TON registered a sharp hike in daily active addresses. This could boost the trading volumes and buying pressure in the long run.

However, dismal job reports on March 10 could deepen the market’s bearish sentiment and push TON into an extended correction. Especially if bulls fail to defend the demand zone.