TON faces an 18% drop as THESE bearish signs emerge

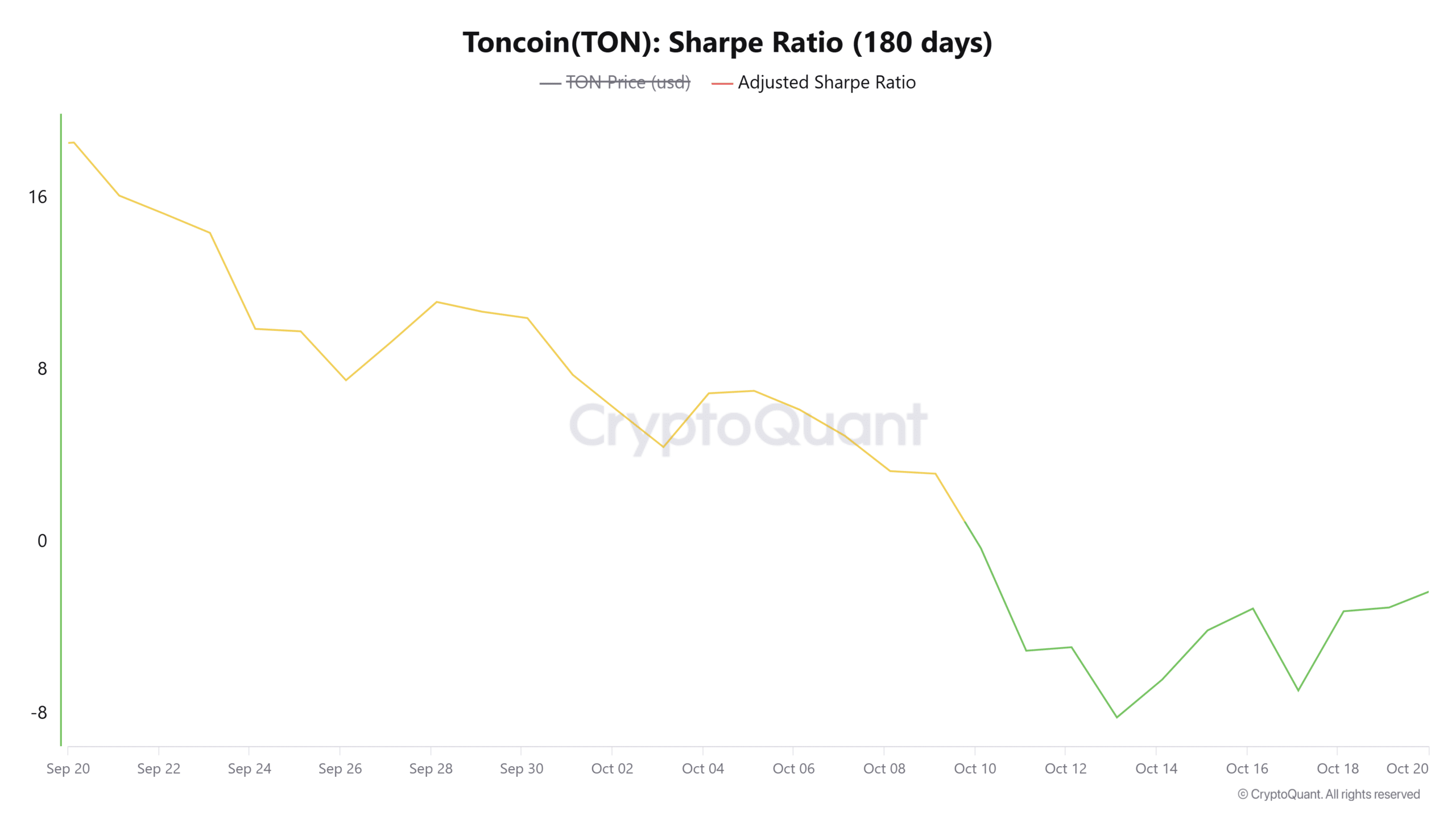

- TON’s Sharpe ratio has flipped negative showing low rewards to holders.

- TON risks an 18% drop if the price fails to make a bullish breakout from consolidation.

Toncoin [TON] has underperformed against Bitcoin [BTC] and other altcoins in the last 30 days after a 5% drop in price. At press time, TON traded at $5.28, as mild volatility hindered significant price moves.

A look at the Sharpe ratio shows that holders are currently sitting at significantly low rewards. At press time, this metric was negative, and at its lowest level in one month.

A negative Sharpe ratio shows that the risk of holding Toncoin is higher than the reward. With TON failing to post significant gains, a predominantly low and negative Sharpe ratio could dampen interest in the token causing further dips.

TON stagnates amid low volatility

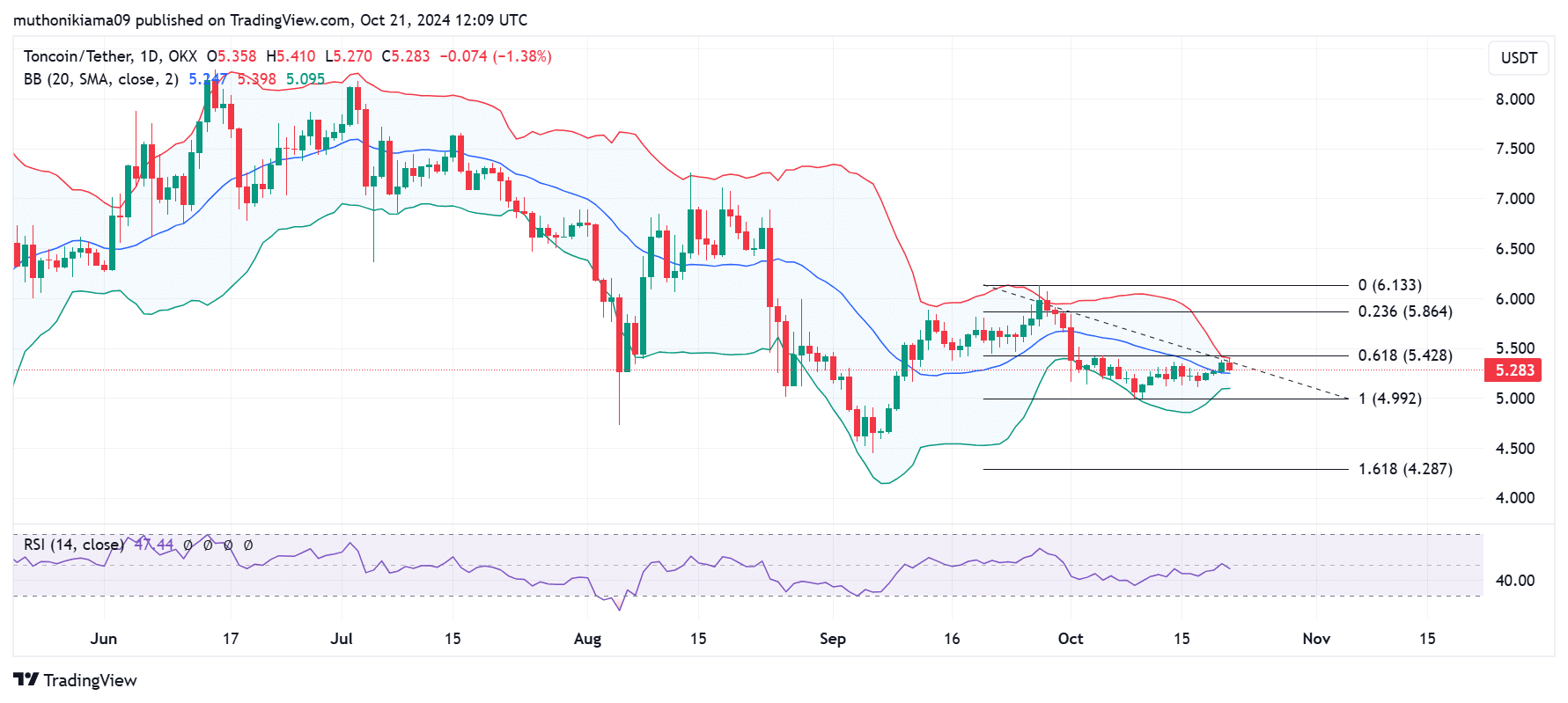

TON’s one-day chart shows that in the last two weeks, the price has oscillated between $5 and $5.40. During this time, the Relative Strength Index (RSI) has been below 50 showing a lack of buyer interest to support a breakout.

At press time, TON’s RSI stood at 47, suggesting that sellers are more than buyers. The lack of buying activity paints a contrasting image from the broader market as the crypto fear and greed index shows retail interest in crypto assets is high.

TON’s lack of a strong breakout, to either the upside or downside, also comes amid low volatility as seen in the contracting Bollinger bands.

The token touched the upper band at $5.39 before facing resistance. If the price breaks above, it could signal the start of an uptrend.

However, if Toncoin fails to break out from this consolidation phase, the price risks a steep 18% drop from the current price to the 1.618 Fibonacci level ($4.28).

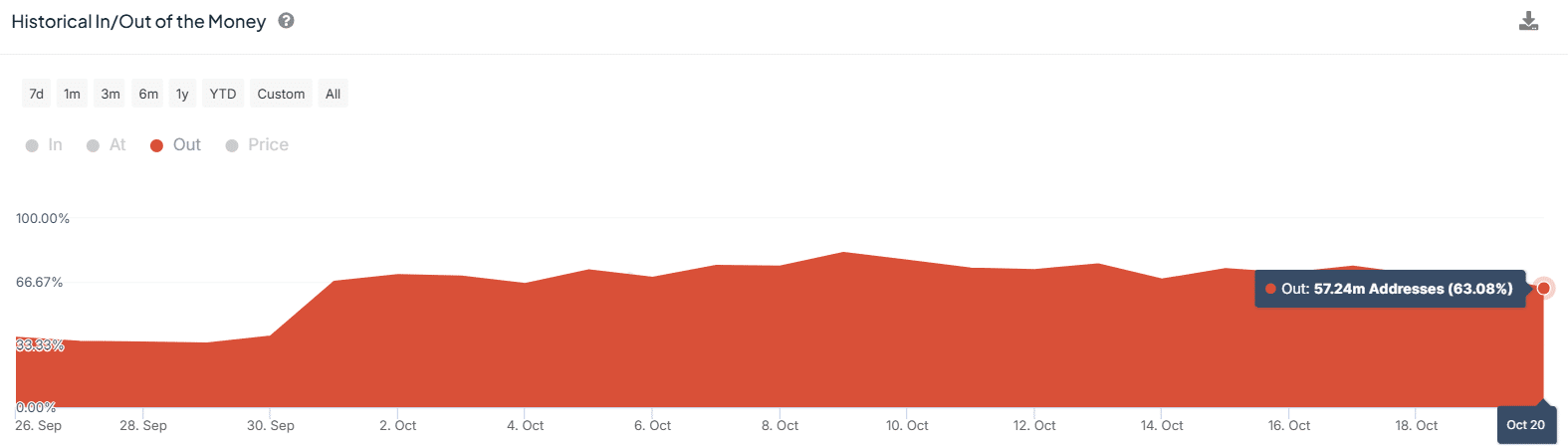

TON wallets that are in losses might be the catalyst behind such a drop. Data from IntoTheBlock shows that these wallets have increased by 29% in three weeks to 63%.

If these traders choose to minimize losses, it could increase selling pressure, and cause further dips.

TON blockchain shows signs of recovery

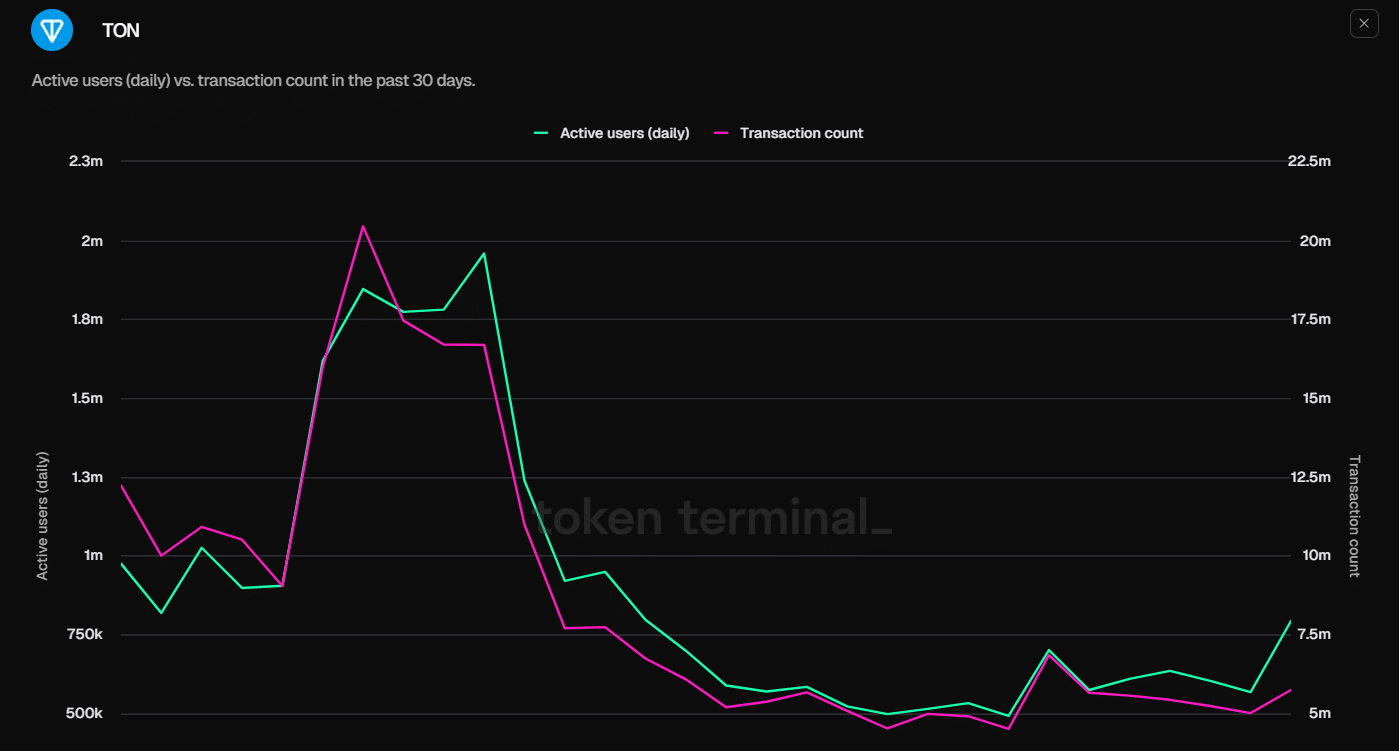

The TON blockchain saw a surge in usage in late September. However, since then, the number of active users and transactions on the network has plummeted.

Read Toncoin’s [TON] Price Prediction 2024–2025

Data from TokenTerminal shows a slight recovery. On 20th October, the daily active users on TON increased from 567,000 to 792,000. The daily transaction count also increased from 5 million to 5.7 million.

An increase in the network’s usage has previously been a catalyst for growth. Therefore, if this recovery continues, it could renew bullish sentiment around Toncoin.