Toncoin beats Bitcoin with stunning 160% gain, but there’s a catch

- TON has gained over 160% more than BTC so far.

- TON has also seen more activity in some on-chain metrics.

Toncoin [TON] has emerged as the only Layer 1 Network capable of competing effectively with Bitcoin [BTC] since the beginning of the year.

TON has outpaced BTC by over 160% and boasts a higher number of active addresses.

Despite these achievements, traders appear to lack confidence in TON, as sentiment surrounding the coin has turned negative.

Toncoin gains more than 100% over Bitcoin

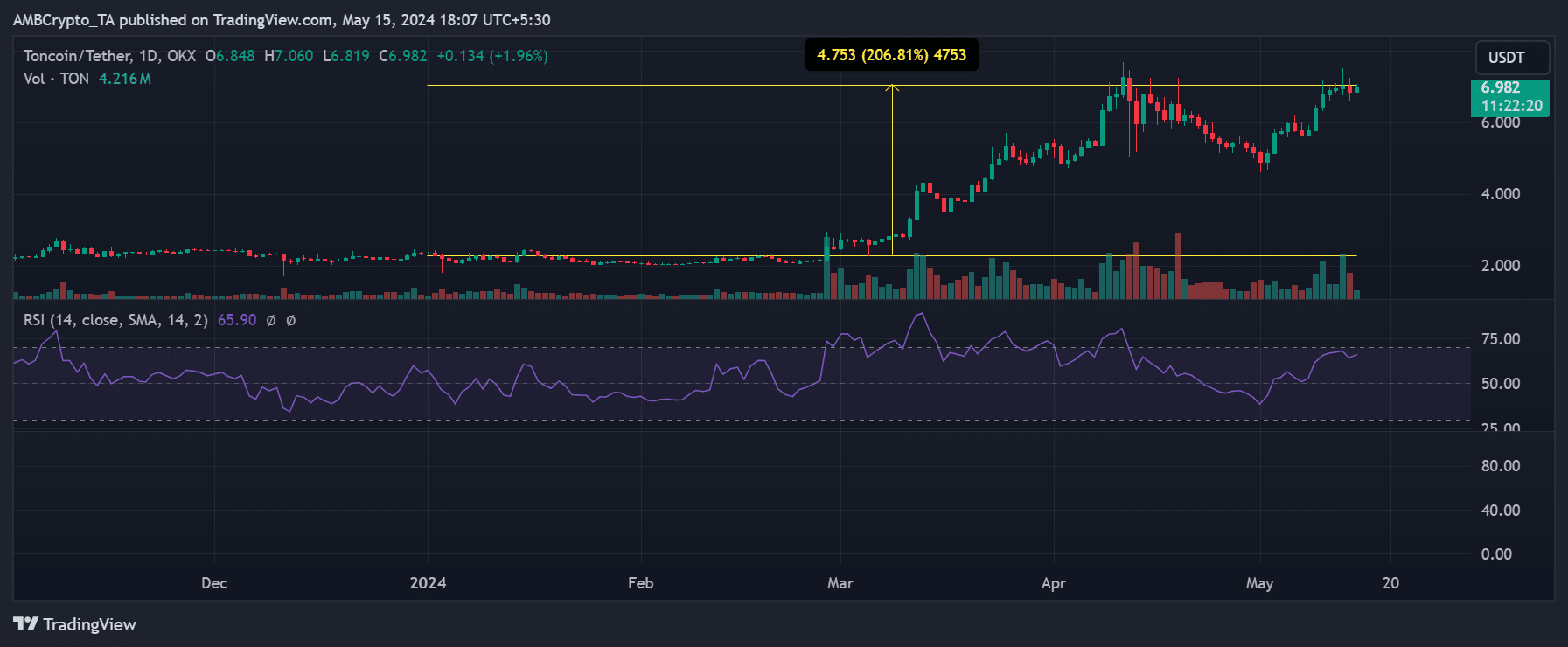

AMBCrypto’s analysis of Bitcoin and Toncoin’s price trends revealed that Toncoin had outpaced BTC in terms of gains.

TON, starting the year at around $2.3, has experienced substantial uptrends in recent months, reaching approximately $6.8 at the time of writing.

Utilizing the price range tool, it was evident that TON had surged by over 200% from the year’s beginning to press time.

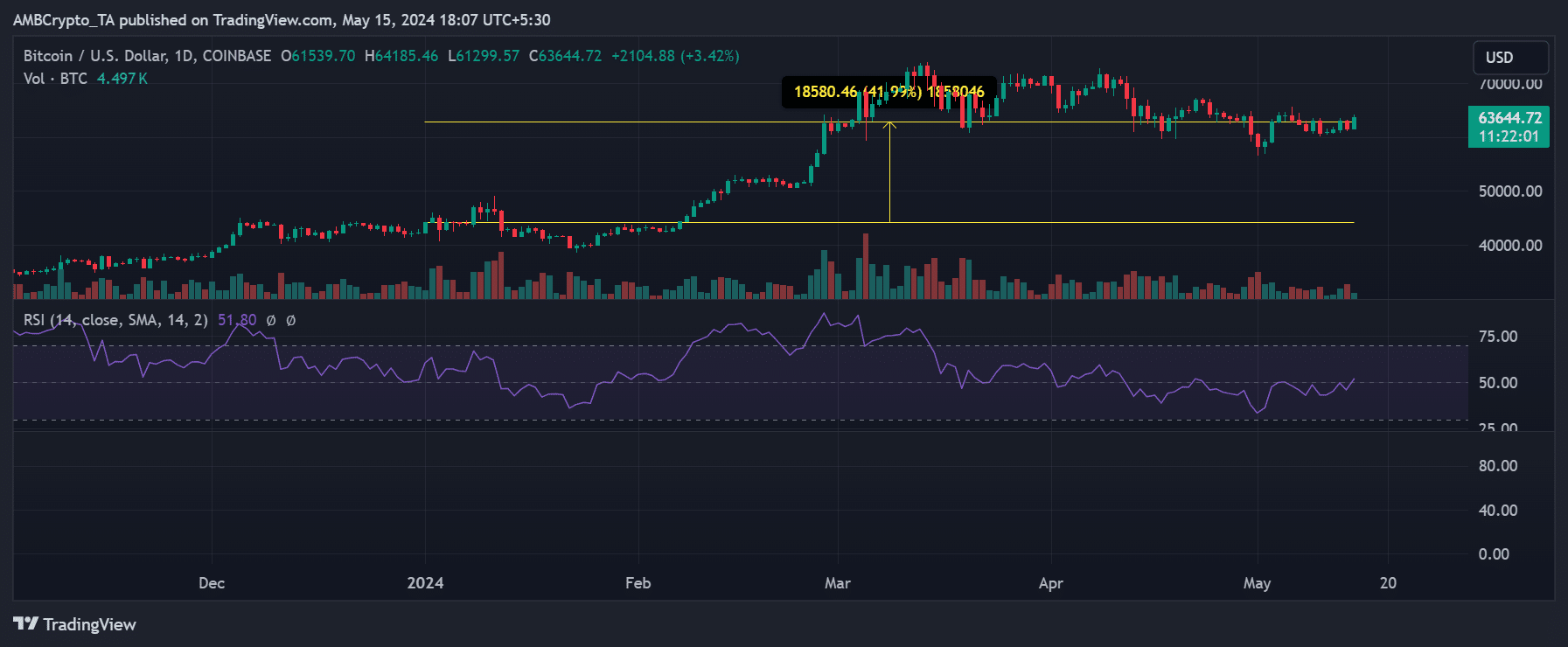

Conversely, BTC began the year at approximately $44,220 and had risen to around $62,400. This represented a growth of about 42% during the same period.

Comparing the charts, Toncoin exhibited nearly 160% more growth than BTC.

Furthermore, analysis of the Relative Strength Index (RSI) indicated that BTC was below the neutral line at the time of assessment, suggesting a bear trend.

In contrast, Toncoin’s RSI was above 60, signaling a strong bull trend.

Toncoin sees more active addresses than Bitcoin

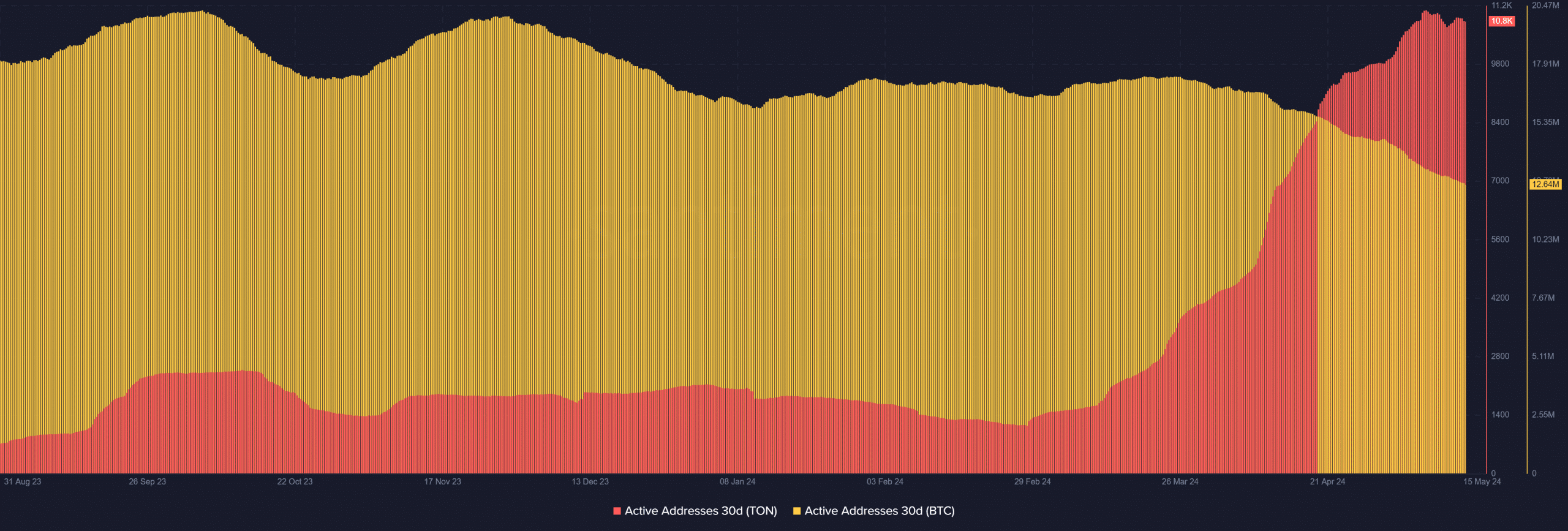

Analysis of Toncoin’s active addresses over the last 30 days has revealed a surge in activity, surpassing that of Bitcoin.

From March onwards, Toncoin’s active addresses began to climb steadily, peaking in May and maintaining this heightened level.

Starting from around 1,000 active addresses in March, Toncoin has now surpassed 10,000 active addresses, with over 10,800 recorded at the time of writing.

In contrast, Bitcoin’s active addresses metric, while having higher overall numbers, has been on a declining trend.

On the 15th of April, Bitcoin recorded nearly 16 million active addresses, but this number had decreased to around 12.6 million by press time.

This comparison highlighted that although Bitcoin has a larger number of active addresses overall, Toncoin was experiencing more activity and growth in relative terms.

Bitcoin edges Toncoin in sentiment

AMBCrypto’s look at Bitcoin’s Funding Rate on Coinglass indicated a positive sentiment at press time.

Despite a slight decline, it remained around 0.0018%, suggesting that buyers continued to dominate the trend.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Conversely, Toncoin’s Funding Rate revealed a negative sentiment. At the time of writing, the Funding Rate was around -0.047%, indicating a prevalence of sellers in the market.

These metrics reflected a scenario where more participants were betting on an increase in Bitcoin’s price. At the same time, Toncoin had a higher number of traders taking short positions.