Toncoin breaks out! Is the TON rally here to stay?

- TON experiences a bullish surge with an 8% increase and a promising ‘golden cross.’

- A healthy RSI and increased social volume suggest the rally might continue, supported by investor interest.

In a remarkable twist, Toncoin [TON] bulls took control two days ago, pushing it to increase by 8% at press time. This sudden surge was driven by increased buying pressure and traders’ abrupt change in market sentiment.

However, the question remains whether TON can sustain this rally and break through key resistance levels to establish a new uptrend.

Checking TON’s next move

The 50-day moving average recently crossed above the 200-day moving average. This ‘golden cross’ is generally viewed as a bullish signal in the market, indicating potential for a long-term uptrend.

The exponential moving average closely follows the price movements, and it is currently above the MA50, reinforcing bullish signals.

The 62 RSI means that there is still room for upward price movement before the asset is considered overbought. Given this and the golden cross, the market sentiment appears to have completely shifted in favor of the bulls.

TON’s social volume and social dominance have both increased dramatically over the past five days. These spikes in social metrics often precede or coincide with a rally.

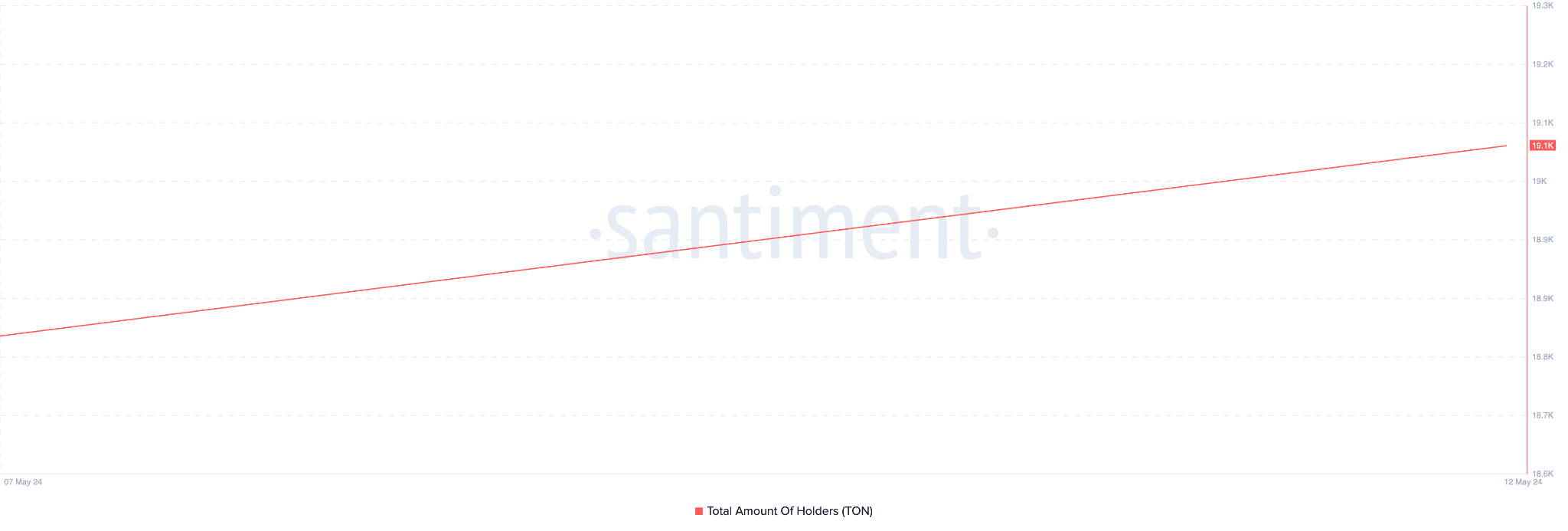

There has also been an increase in the number of investors currently holding TON. An increasing number of holders reflects a bullish sentiment, as more participants are willing to invest in the asset.

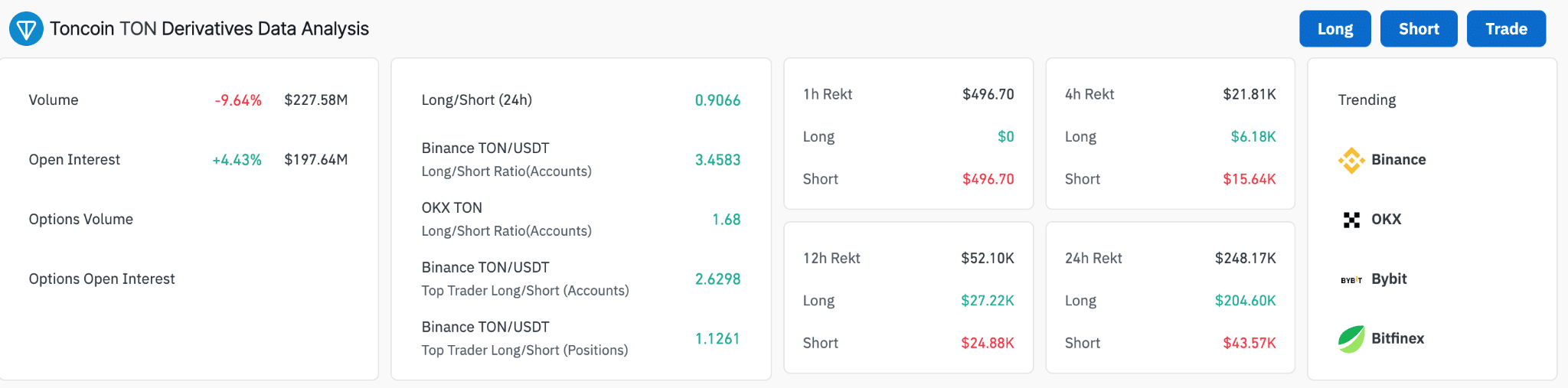

However, TON’s derivatives data shows a decrease in trading volume, which might indicate a cooling off after a period of heightened activity, likely following the recent price surge.’

Is your portfolio green? Check the Toncoin [TON] Profit Calculator

The overall market long/short ratio is slightly below 1 (0.9066), hinting at a slight dominance of short sellers in the derivative market.

However, at Binance, the long/short ratio for accounts shows a stronger inclination towards long positions (3.4583 for accounts), suggesting that more traders on Binance are betting on a rally compared to those expecting a decline.