Toncoin falls below $7: $10 or $5, where will TON go next?

- Toncoin failed to break the $8.3 resistance and slid back under $7.

- Indicators suggested bearish sentiment, with the price below key moving averages and the MACD.

In recent trading sessions, Toncoin [TON] experienced a short-lived rebound that saw its price go from $6.6 to $8.1, but fell back under $7 without crossing the key resistance level of $8.3.

TON unable to turn bullish

Analyzing TON’s trading chart, AMBCrypto found that the altcoin’s values frequently oscillating between the oversold and overbought zones.

Recent readings trended downwards towards the oversold territory at around 10.34. This essentially meant that traders were withdrawing at press time.

The RSI hovered around 33.25 to 36.19, suggesting that Toncoin was approaching oversold conditions.

This typically means the asset may be undervalued, and a price increase could be possible if other bullish conditions align.

The 50-day Moving Average periods showed that TON has acted as support and resistance dynamically. As of the latest writing, the price was slightly above this line, indicating potential support.

The Exponential Moving Average portrayed a resistance role as well, with the price recently crossing below this line, indicating bearish sentiments.

The MACD lines were near the zero line but remained below it, also suggesting a bearish momentum, as the signal line (orange) was above the MACD line (blue).

Not all hope is lost

TON was near the lower Bollinger Band at press time, suggesting that the asset was oversold. It was also below the Ichimoku Cloud, which is a strong sign of bears being in control.

However, TON’s on-chain metrics revealed that all hope isn’t lost for the bulls. There is still a chance they might flip the script.

Is your portfolio green? Check the TON Profit Calculator

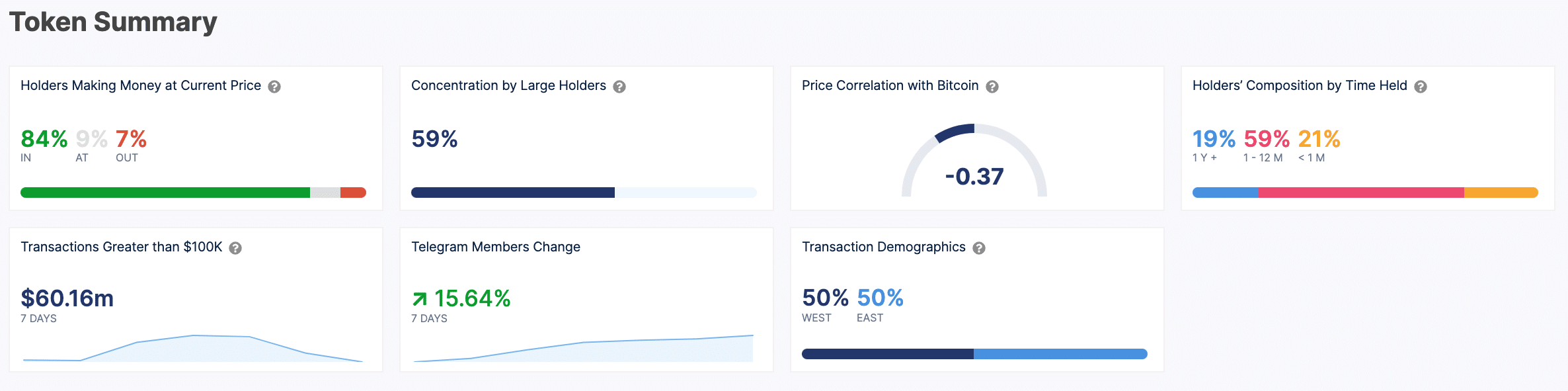

A whopping 84% of all TON holders were ‘In the Money,’ at the time of writing, meaning that the holders bought their tokens at a lower price than the current market price, so the bulls have an underlying strength.

Trading had surged, and transaction volumes were flowing through the roof as well. The majority of holders were also long-term, showing a healthy amount of investor confidence.