Toncoin in downtrend since July: What are the odds of a bullish reversal?

- Toncoin technical analysis showed some bullishness.

- The on-chain and futures market metrics showed firm bearish conviction for the near-term.

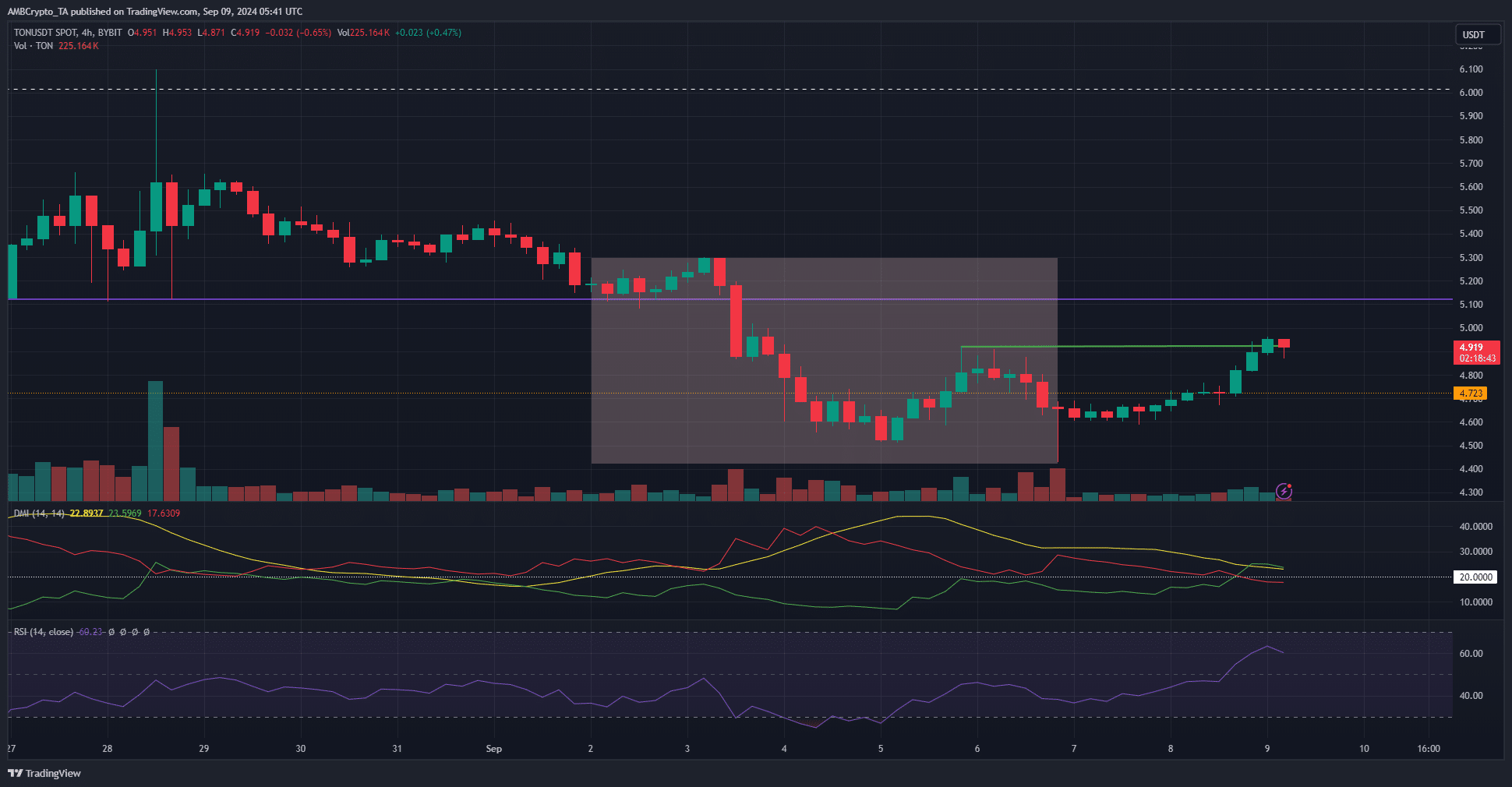

Toncoin [TON] was beginning to claw back some of its losses last week. TON formed a bullish market structure on the 4-hour chart, but the prospects of a short-term recovery appeared unlikely based on AMBCrypto’s investigation.

The shaded box represented the last week’s trading. Over the weekend the price was able to push higher- but this is unlikely to last. The downtrend of TON has been clear since the latter half of July and on-chain metrics showed why a recovery is difficult.

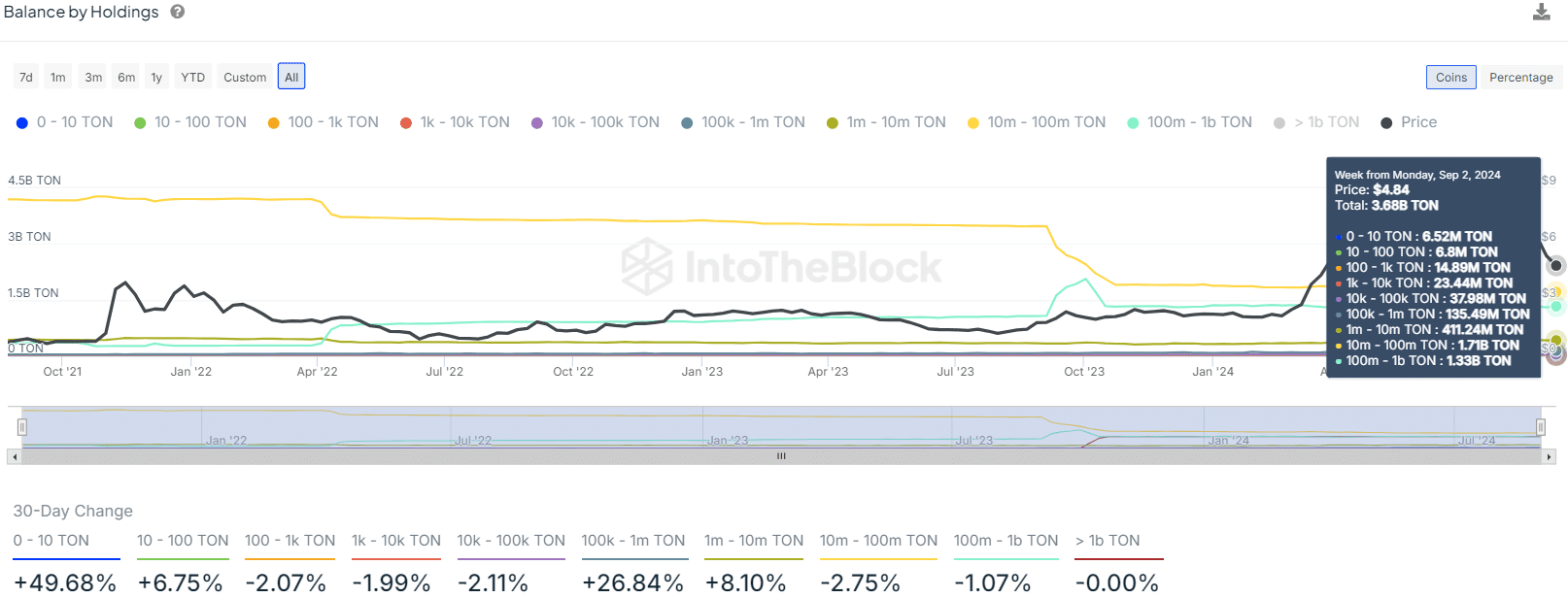

Accumulation and distribution amongst whales

Source: IntoTheBlock

The 100K-1M TON holding wallets rose by 26.84% and 8.1% respectively, showing that some sharks and smaller whales have been accumulating in the past 30 days. However, the larger whale addresses saw some distribution.

Balance in their addresses was down by 2.75% and 1.07% respectively. This distribution meant the selling pressure on TON was likely to remain.

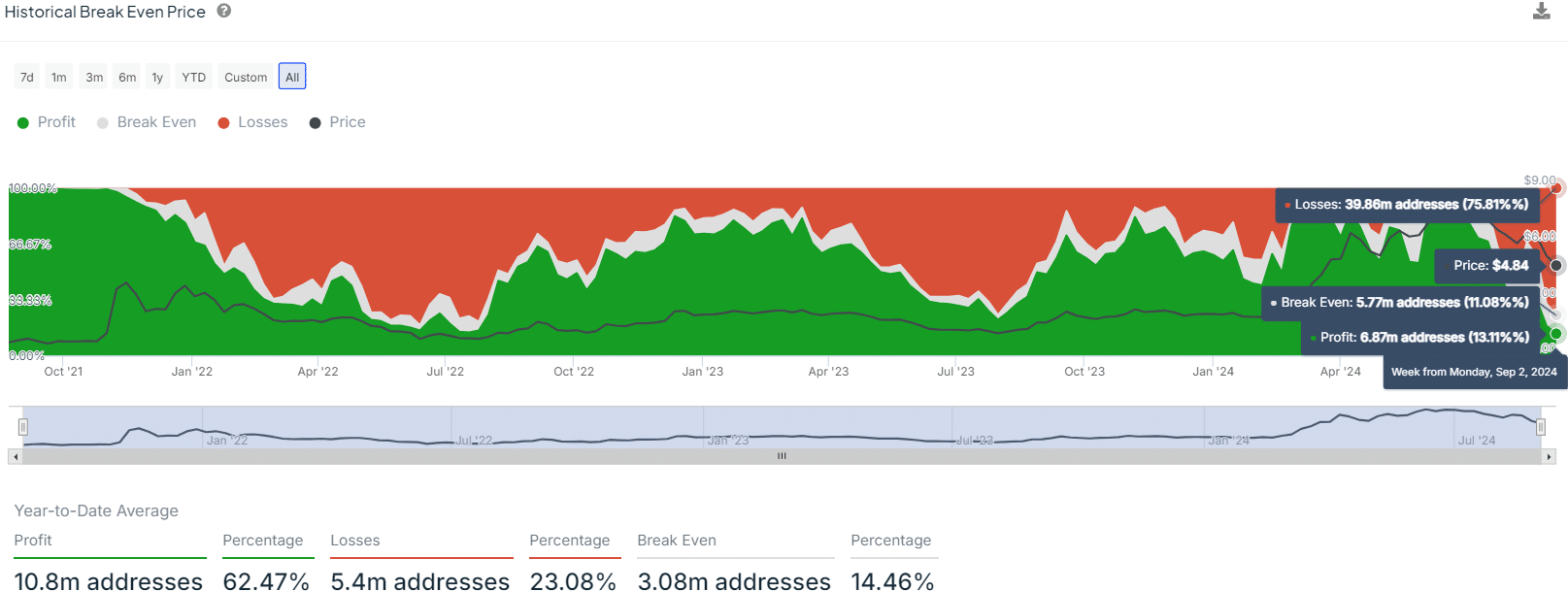

Source: IntoTheBlock

A look at the historical break-even price showed that many addresses were in profit during the rally in April and May. Since then, the price trend has begun to reverse.

The addresses that bought when the price was above $6 would be looking to get out at break even. Of the addresses that bought TON over the past week, 75.81% of them were at a loss. This meant that any price rallies would immediately run into heavy selling pressure.

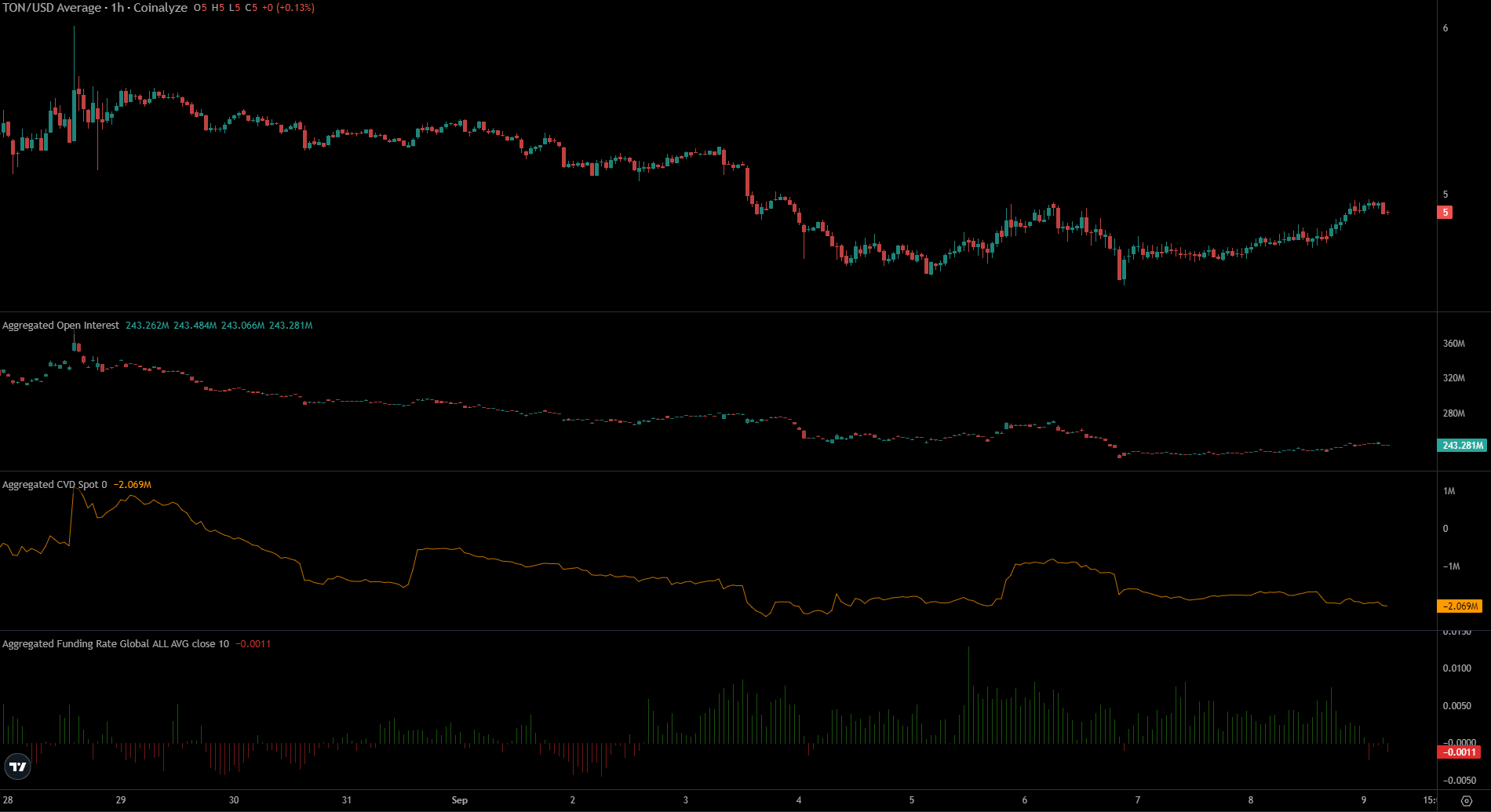

Further evidence that a short-term TON recovery was unlikely

Source: Coinalyze

The Open Interest rose by $13 million from the 6th of September as prices bounced from $4.4 to $4.92.

Read Toncoin’s [TON] Price Prediction 2024-25

However, this did not indicate bullish speculators. The funding rate was turning bearish to show the majority were starting to sell Toncoin short.

The spot CVD was also in decline to reflect reduced buying pressure in the spot markets. Overall, Toncoin is likely to have a tough couple of weeks ahead.