Toncoin – To long or short depends on THIS $5 TON price prediction

- Correlation between the OI, price and, active addresses indicated a potential fall to $4.93

- Late shorts might not get any reward as TON might begin a slow recovery soon

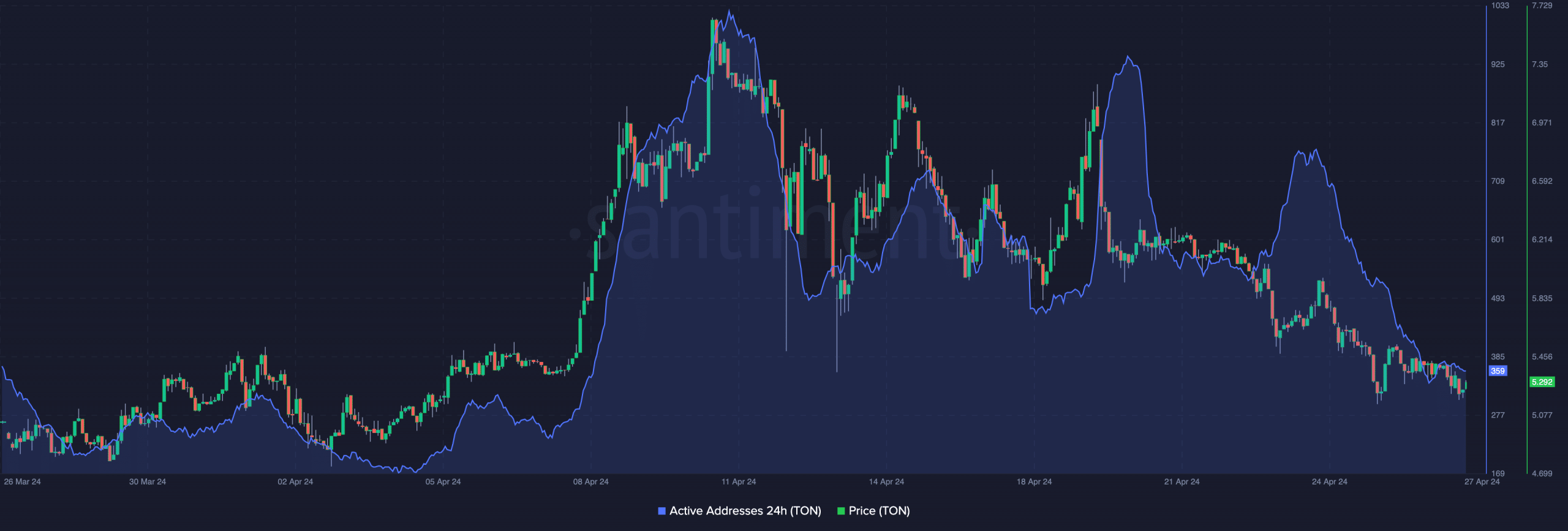

The number of active addresses on the Toncoin [TON] network has fallen from the notable peaks it hit on numerous occasions, according to AMBCrypto’s analysis. At press time, the 24-hour active addresses count was 359. On 24 April, however, the count was double this number, while the metric was at a much higher level on 11 April.

A hike in active addresses implies a surge in the number of unique addresses transacting on the network. Thus, this decline may be a sign that deposits and withdrawals on Toncoin fell.

Interestingly, TON’s price and network activity seem to have a strong correlation. In fact, based on the chart below, one can assert that TON’s price jumps almost every time the metric hikes on the charts.

Indicators spot a fall below $5

It also did otherwise as soon as activity on the network dropped. With this connection, it might not be out of place to predict a further drop in TON’s value. If this is the case, the price of TON might hit $4.93. Here, it’s worth noting that the Open Interest (OI) recorded a decline on the charts too.

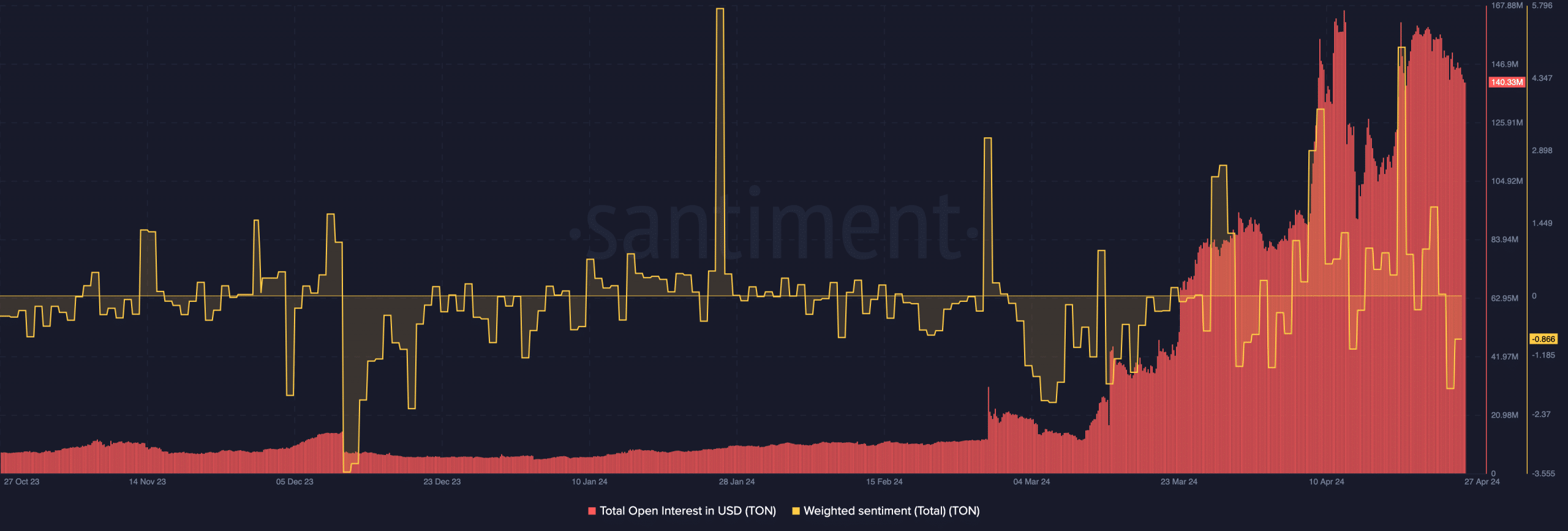

For context, OI increases or decreases based on net position. If it increases, it means buyers are aggressive and liquidity flowing into contracts is increasing. On the other hand, a decline implies that sellers are the aggressive ones.

At press time, Toncoin’s total OI had fallen to $140.33 million. From a trading perspective, this value could cause the token to dump into the underlying support. Thus, the value of TON might drop below $5 in the short term.

Furthermore, market participants who once had confidence in the cryptocurrency’s performance have switched to the other option. Evidence of this was shown by the Weighted Sentiment. At press time, the Weighted Sentiment had a reading of -0.866. This negative reading reinforced the aforementioned conclusion, indicating that most comments involving TON were bearish.

TON is not dead

If this lingers, demand for TON might be difficult to come by. However, in the instance where altcoins start to move upwards, the sentiment around the token might be in favor of a price hike.

One other way to evaluate TON’s short-term potential is by looking at the liquidation levels. Liquidation levels show the estimated prices where large-scale liquidation events might occur.

If a trader has any idea of this, it can provide him an advantage over others without the data. From our analysis, many short positions might be liquidation if Toncoin rises to $5.78. At the same time, longs risk a wipeout if TON drops to $5.02.

Meanwhile, the Cumulative Liquidation Levels Delta (CLLD) was negative at press time. Here, this indicator is the difference between open long liquidations and those on the short end.

Is your portfolio green? Check the TON Profit Calculator

As it stands, the CLLD reading suggests that late shorts trying to catch the dip might get punished. This, because the sharp price decline might fuel a bullish bias later on, and TON might initiate a slow recovery.