Toncoin’s latest uptrend – Here’s how traders can capitalize on TON’s price!

- Toncoin’s recent hike has been influenced by BTC’s ETF inflows, with $6.8 resistance being a key level to watch

- If TON fails to break above $6.8, it may retreat to the $6.1 support before trying again

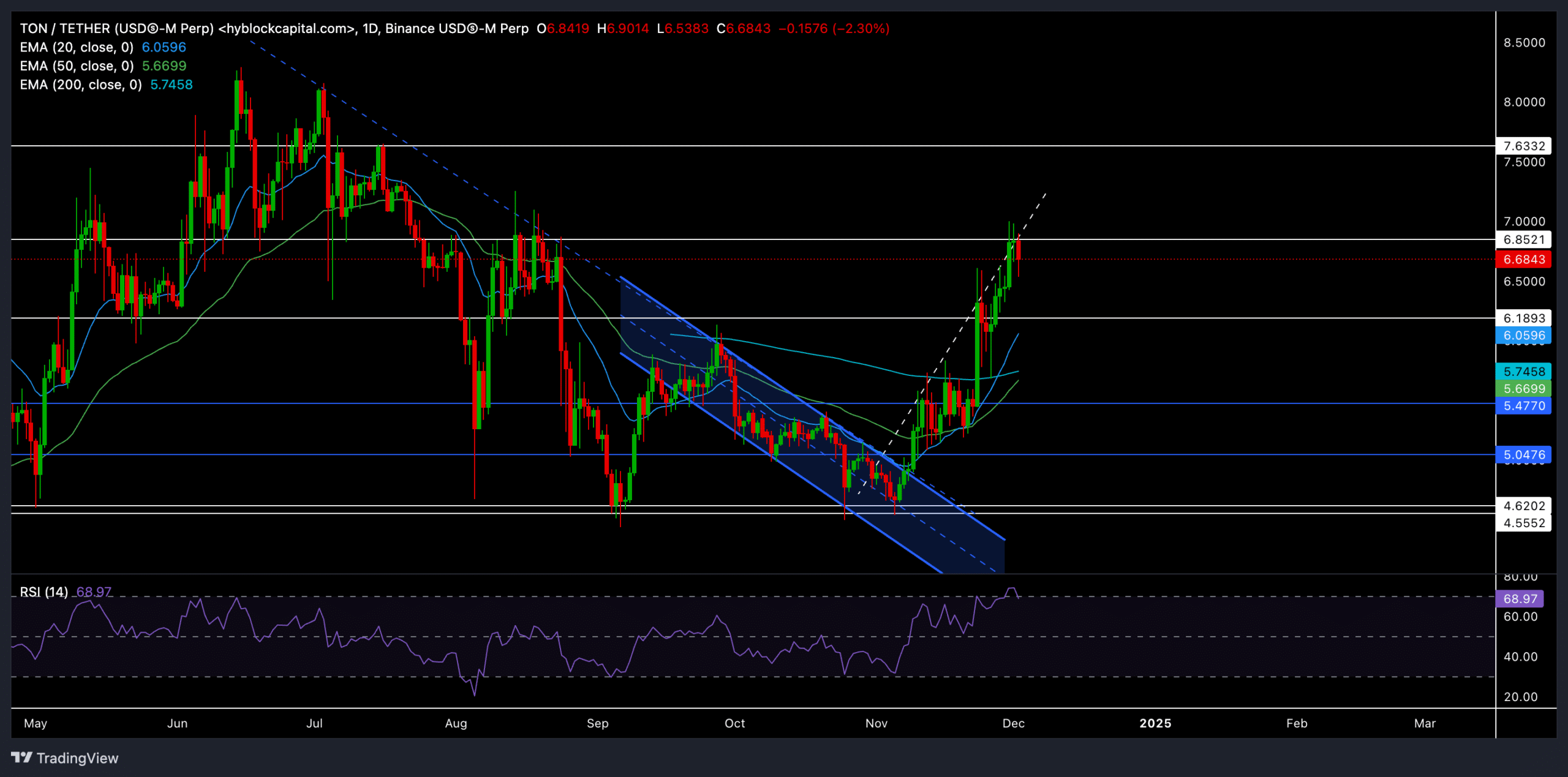

Toncoin [TON] has registered a strong rebound from its long-term support level near $4.6, benefiting from the broader market rally and renewed buying interest across the altcoin market.

With a series of green candles and a solid push above key resistance levels, TON has managed to capture traders’ attention. At the time of writing, TON was trading at $6.7, while also testing its 3-month high.

Will Toncoin continue its rally?

The altcoin’s latest rally saw the price break above the descending channel it had been trapped in since September.

The latest leg of the rally marked a golden cross, where the 20-day EMA crossed above the 200-day EMA – Historically signifying the potential for a long-term uptrend. In addition, the altcoin found a comfortable spot above its 20, 50, and 200-day EMAs after noting some healthy bullish sentiment.

The next milestone for the bulls will be to see the 50-day EMA cross the 200-day EMA. A successful crossover could set the stage for a sustained bullish rally, with the first major resistance at $6.8, followed by $7.6.

However, if TON struggles to maintain its prevailing momentum, a near-term correction could bring the price to test the support zone around $6.1. This support level also seemed to coincide with a liquidity zone, providing a decent safety net for the bulls. A successful rebound from this support could reignite buying pressure.

The Relative Strength Index (RSI) stood at nearly 69 at press time, indicating that Toncoin may be approaching overbought territory. Traders should monitor the RSI closely—Any movement below 70 could lead to a period of consolidation or a minor pullback before the next potential leg up.

Toncoin’s derivatives analysis revealed THIS

Trading volume surged by 69.39% to hit $444.65M, indicating heightened trader activity amid the recent rally. However, Open Interest dropped by 8.15%, suggesting some traders may be closing their positions, perhaps to lock in profits after recent gains.

The long/short ratio for TON across exchanges was 0.8591, indicating a slight preference for short positions overall. However, Binance’s long/short ratio was more favorable for the bulls, at 3.8473, indicating optimism among traders on this exchange.

Additionally, the top trader long/short ratio for TON on Binance stood at 4.5 for accounts and 2.38 for positions.

You should also monitor Bitcoin’s broader movement, as it could influence TON’s trajectory in the short term.

![Solana [SOL] - Is there any good news after trading volume hits 2024 low?](https://ambcrypto.com/wp-content/uploads/2025/03/Solana_Abdul-400x240.webp)