Toncoin’s Q3 recovery hits 100% – Are more gains likely?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- At press time, TON was up +70% while BTC was down -12% in Q3 price performance

- Short and long-term trends were bullish as per Futures market data at press time

Toncoin [TON] outperformed Bitcoin [BTC] on quarterly and weekly fronts. Over the past week (11-17 September), BTC was up 2.65% while TON rallied by 34.9%, according to TradingView.

Is your portfolio green? Check out the TON Profit Calculator

On the quarterly front, TON was up +70% in Q3 2023 based on the press time value of $2.35. However, BTC was down 12% over the same period.

It translates to a +100% recovery if the price performance is extrapolated to the recent high of $2.55 from the July low of $1.15. The double value pushed TON into the top-10 club based on market cap.

What’s next ahead of the Fed decision?

Extra market volatility is likely in the next few hours as the FOMC Meeting gets underway on 19-20 September. A likely dovish stance could tip TON to front an extra rally, and the next crucial target is $2.9 (December 2022 high).

At press time, price action had reclaimed the $2.22-level, a key support in Q3 2023. If bulls defend it and the Fed’s decision is favorable, the rally could extend to December highs. Besides, the $2.5 and $2.65 levels are key roadblocks to clear to hit the $2.9-target.

Conversely, a drop below $2.22 will confirm the H4 market structure weakening. However, the breakout level and previous weekly bearish order block (OB) of $1.8 – $2.07 could ease the extended retracement.

Meanwhile, the RSI retreated slightly from the overbought zone but didn’t extend at press time. It indicates a potential reversal, but a favorable Fed decision could drive more buying pressure.

The CMF was also positive on the chart, despite wavering above zero over the past few days. This indicated that capital inflows were positive, but fluctuated.

Futures market data was bullish, but…

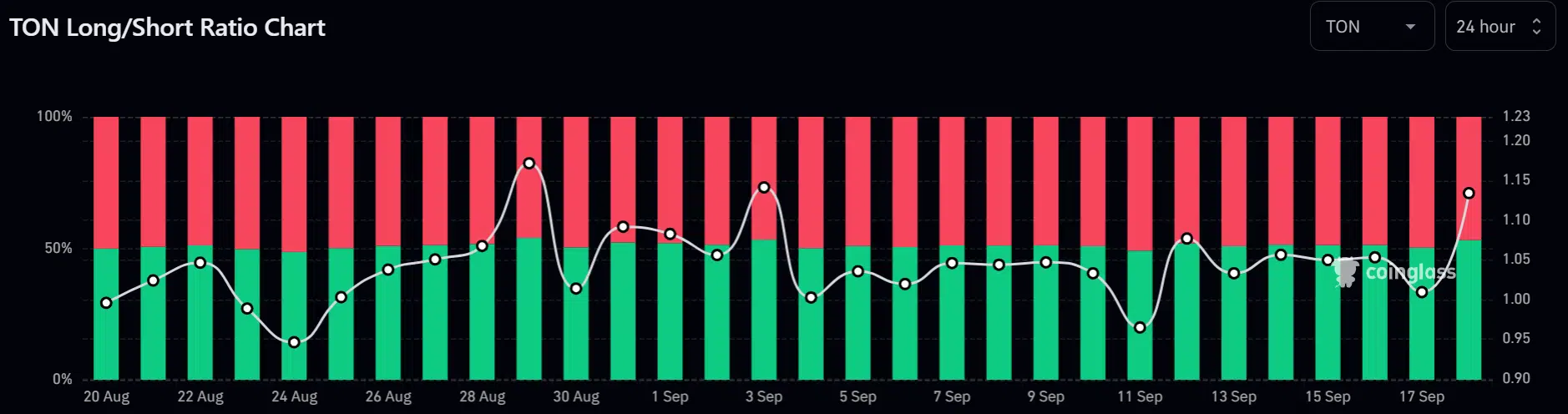

According to Coinglass’s Long/Short Ratio, there were over 50% long positions on daily charts since 13 September. It signified more players are going long on the asset – A bullish bias.

How much are 1,10,100 TONs worth today?

The positive Open Interest (OI) rates and Accumulative Swing Index (ASI) further corroborated the bullish sentiment in the Futures market.

The OI surged from <$10 million on 10 September and was up >$21 million at press time, indicating an uptick in demand.

Similarly, the ASI, which tracks the strength of price swings, was positive at 6.77. This highlighted that the long-term price trend was bullish and in a solid uptrend at press time.

Hence, further extra gains could be likely in the short term. Even so, the fluctuating funding rates could be a problem.