Toncoin’s trends: Analyzing the impact of an 80% transaction surge

- Toncoin has experienced an 80% surge in large transactions and a 30% increase in active addresses, reflecting strong market interest.

- Despite these positive trends, the declining long-short ratio sends cautious signals caution with increased market volatility.

Toncoin [TON] is gaining incredible momentum within the cryptocurrency space. According to recent metrics, the number of large volume transactions has surged massively by 80% in the past 24 hours.

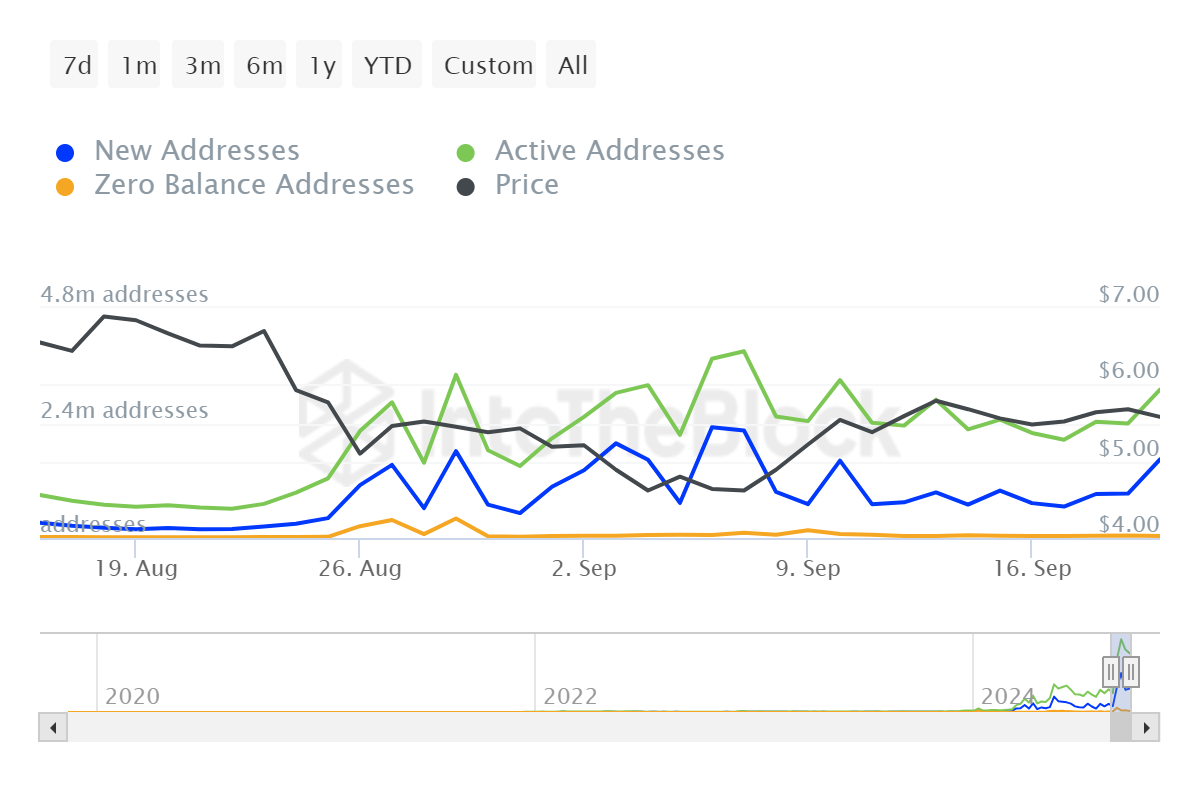

Adding to the aforementioned whale surge, trading activity has just started to climb, with active addresses up 30% at press time.

A surge to celebrate

The high increase of 80% in large transactions indicates strong interest in Toncoin. Often, with whales putting more efforts and pressure into the market, confidence increases among smaller investors.

This could, therefore, suggest upward price pressure and perhaps a breakout for the altcoin.

Toncoin active addresses on the rise

Also worth noting is the trading activity. A 30% increase in active addresses in the last 24 hours means more people are active in the Toncoin market.

This increased influx usually means greater liquidity. The presence of more participants within the market increases the possibility of conducting smoother transactions.

Read Toncoin’s [TON] Price Prediction 2024-25

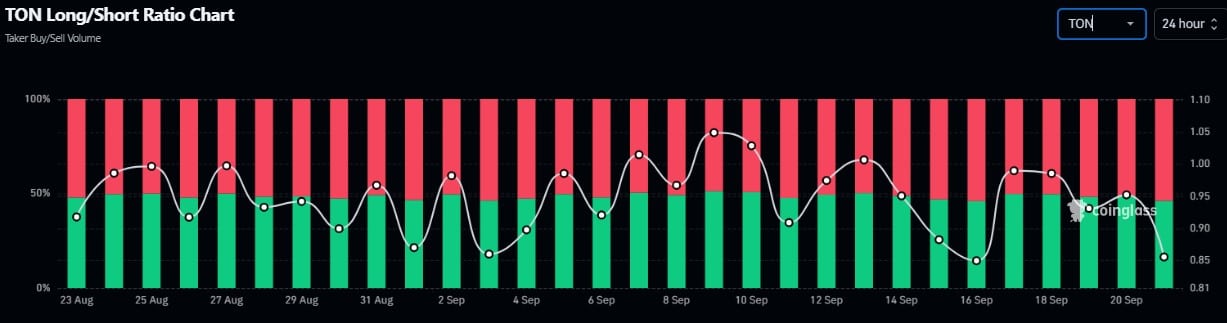

Declining long-short ratio

However, not all indicators were positive. According to Coinglass data, the long-short ratio has been sliding deeper in the last 24 hours. This indicates that fewer investors are long on the expectation of the appreciation in the Toncoin prices.

Especially with the recent Fed interest cuts. While this might mean a cautious approach, it is also indicative of repositioning for possible adjustments in price.

![dogwifhat's [WIF] 3-day rally has eyes glued, yet a hidden risk lurks](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-8-400x240.jpg)