TON’s decline odds are high, but ONE key factor could save it!

- At press time, the asset was trading near a level of strong selling pressure that could drive its price lower

- While bearish sentiment seemed to be mounting, a recovery remains possible

TON’s performance has been mixed lately, with gains and losses across timeframes. In fact, at the time of writing, it was down 4.95% over the past month, though it rebounded 1.19% on the weekly timeframe.

However, its recent price action suggested that TON may face a sharp decline as selling pressure builds, potentially driving it further down.

Selling pressure meets resistance as TON struggles at key level

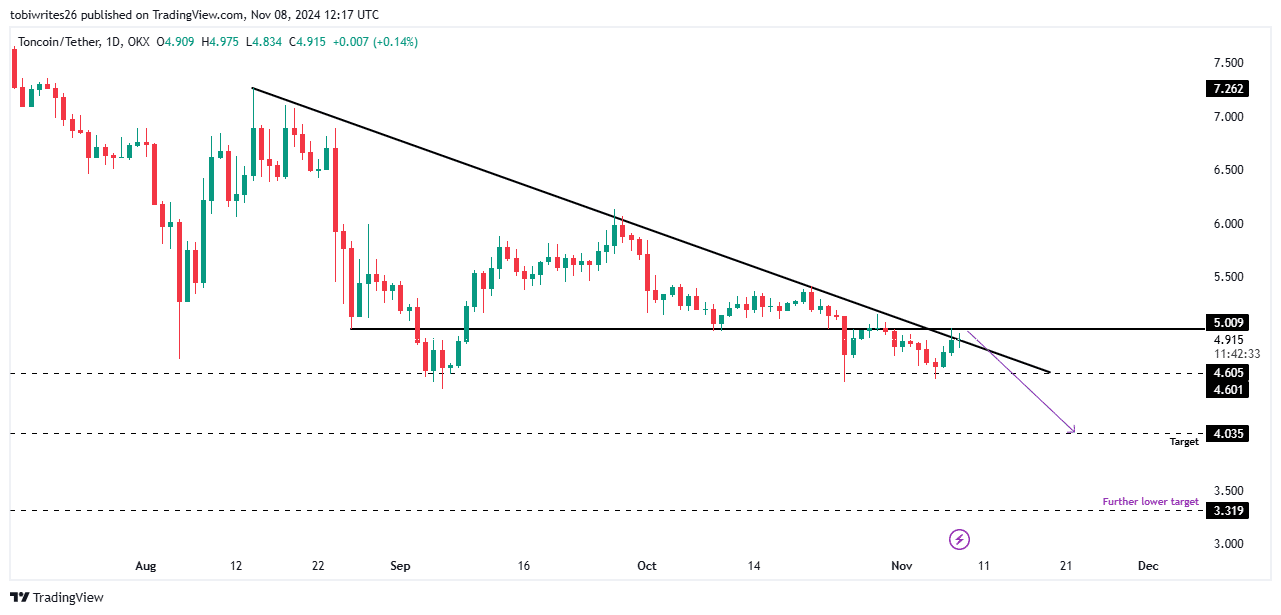

TON has reached a critical point on its price chart. Despite forming a bullish triangle pattern that usually signals a rally, TON is yet to break higher and appeared set to drop, at press time.

TON seemed to be facing a significant resistance zone at $5.009, a level known for heavy selling pressure that could stall or push the price south.

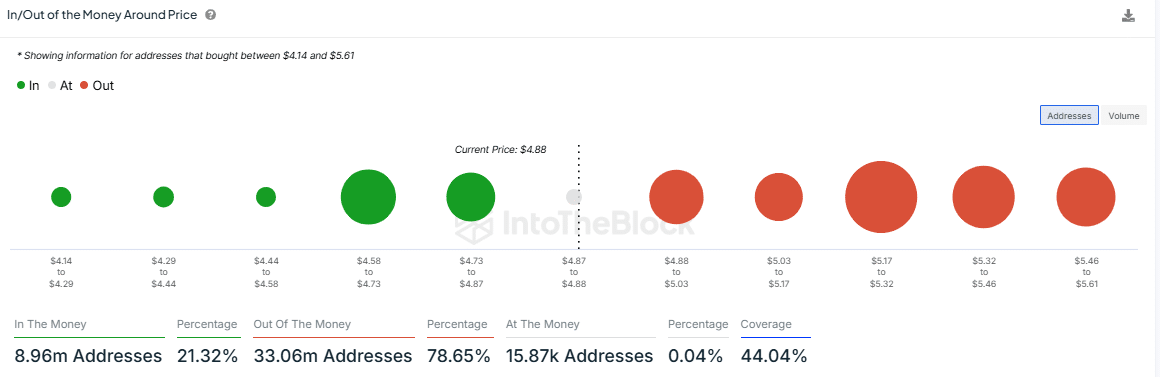

This resistance level aligned with the In/Out of the Money Around Price (IOMAP) indicator, showing that an average price of $4.93 (with range between 4.88 and 5.03) has seen $80.9 million worth of TON sell orders from 5.1 million addresses.

Here, it’s worth pointing out that the IOMAP tracks where holders bought relative to the press time price, helping identify key support and resistance areas.

With mounting selling pressure, TON is likely to target the next support at $4.035 – A level last seen in March 2024. If this pressure continues, the asset could face further declines to $3.319.

Bears in control as selling pressure drags TON south

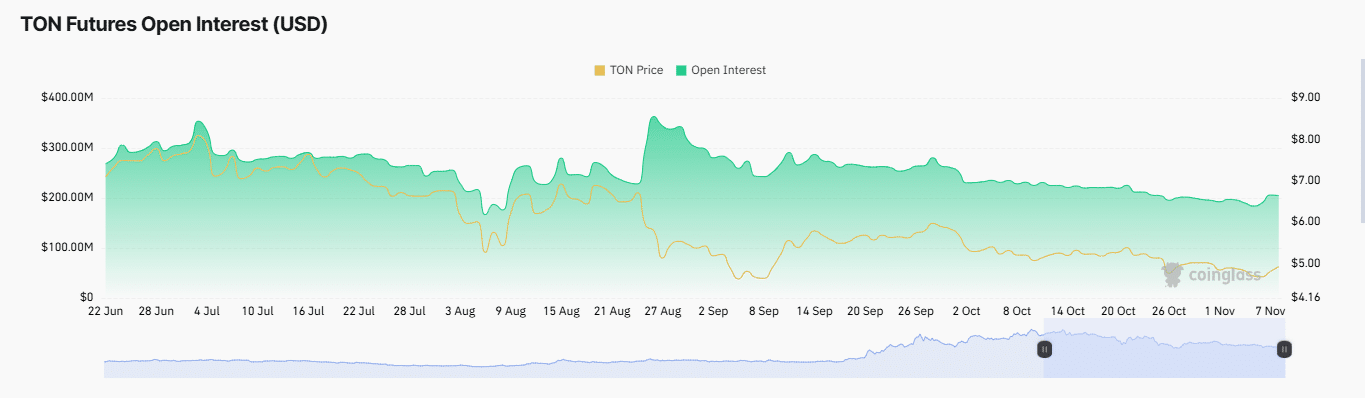

According to AMBCrypto’s analysis, TON has been under consistent selling pressure lately. In fact, the Open Interest—representing the number of outstanding futures contracts—has been on a downtrend since 27 August.

This decline in Open Interest alluded to reduced market participation and contributed to TON’s price slipping further into bearish territory.

Open Interest, which indicates market activity and liquidity, has not seen a reversal since. Without this, TON can be expected to remain vulnerable to downward pressure.

Additionally, recent liquidation data revealed long traders faced increasing losses as TON’s price moved against their upward bets. At press time, approximately $151,620 worth of long positions had been liquidated. Sustained price declines will likely drive further long liquidations, deepening the downward pressure.

The combination of decreasing Open Interest and rising long liquidations pointed to a likely continuation of TON’s downtrend.

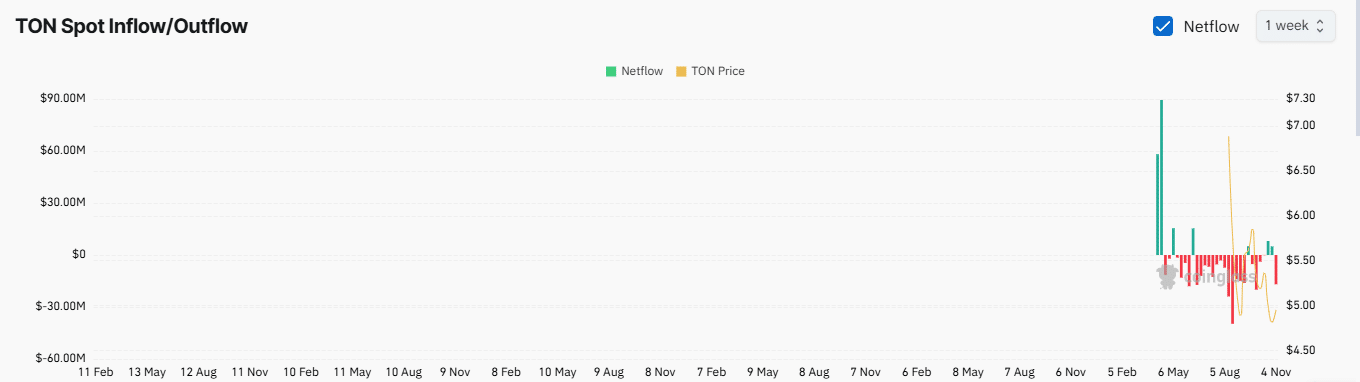

However, there may be optimism from recent exchange outflow data. Large TON outflows from exchanges, recorded by Coinglass, suggested that investors may be shifting to long-term holding, rather than selling. When assets are moved off exchanges, it often reflects confidence in the asset. Especially as holders intend to hold for the long term.

Over the last 24 hours, $3.35 million worth of TON has left exchanges, with $17.38 million withdrawn over the last seven days. These outflows may have temporarily helped support TON’s price against the downtrend.

If this trend of outflows continues, it could stabilize TON. However, if outflows slow, TON may face further losses on the charts.