TON’s staking patterns echo March 2024’s rally – Higher highs coming?

- The staking ratio has begun to dip while the price bounced to $6

- If the dynamics from March repeat themselves, a strong price move higher can be expected

Toncoin [TON] has a strongly bullish outlook for this cycle. In fact, a recent AMBCrypto report outlined bullish targets for this run to be as high as $19.5. Observations of the staking ratio showed that a short-term price surge could be on the way.

Social sentiment has also been on the rise lately. At the same time, the growing number of non-zero TON balance addresses also underlined organic demand for the token.

Comparing the present-day and March

Source: CryptoQuant Insights

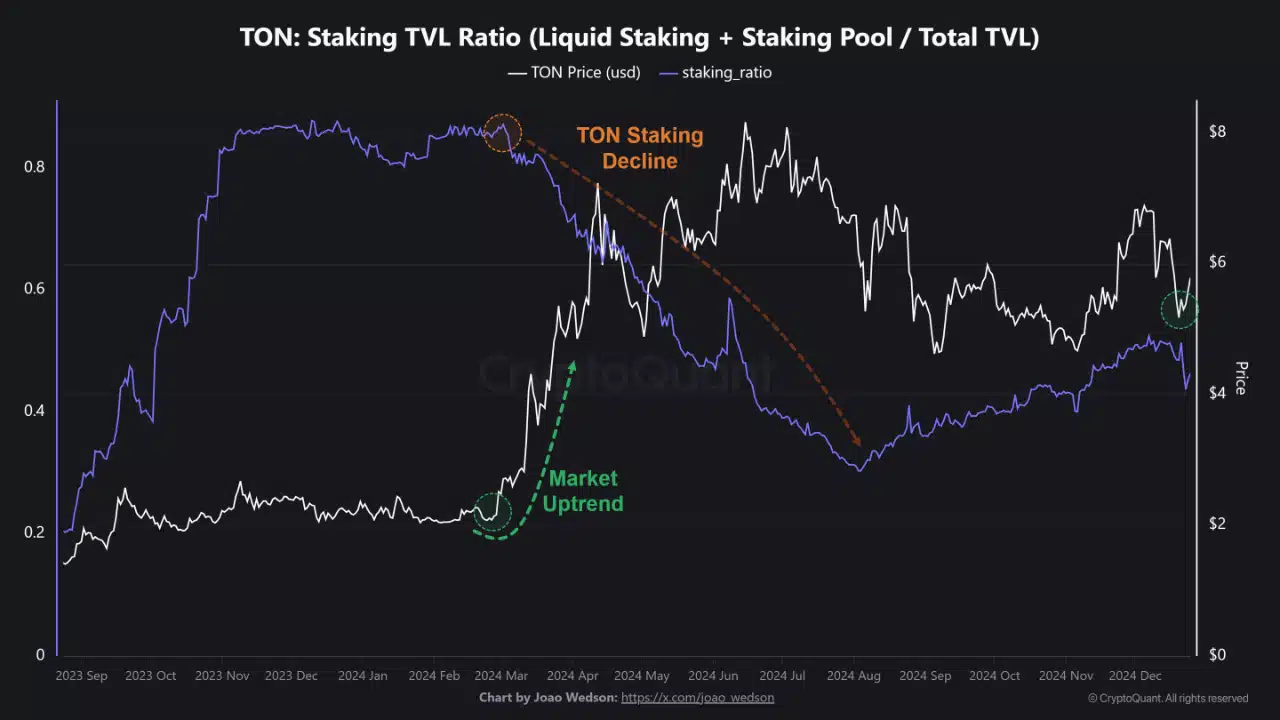

In a post on CryptoQuant Insights, analyst Joao Wedson highlighted the correlation between a rising market price trend and falling TON staking. He observed that in March 2024, the amount of TON locked in staking (staking TVL ratio, purple) dropped significantly while the price trended higher.

This can happen when investors sense a sentiment shift across the altcoin market and withdraw their funds to use them on exchanges for trading purposes. This token movement spurs further demand for the coin, boosting its price.

Locked tokens are not flexible, and they could be much better utilized during periods of higher volatility and gains, explaining the swift drop in the staking TVL ratio last summer.

The analyst also observed that TON appeared to shift away from a downtrend in price. In turn, this could see another drop in the staking TVL ratio, which could help sustain an uptrend in the coming weeks.

High network growth shows faith in Toncoin

Source: Santiment

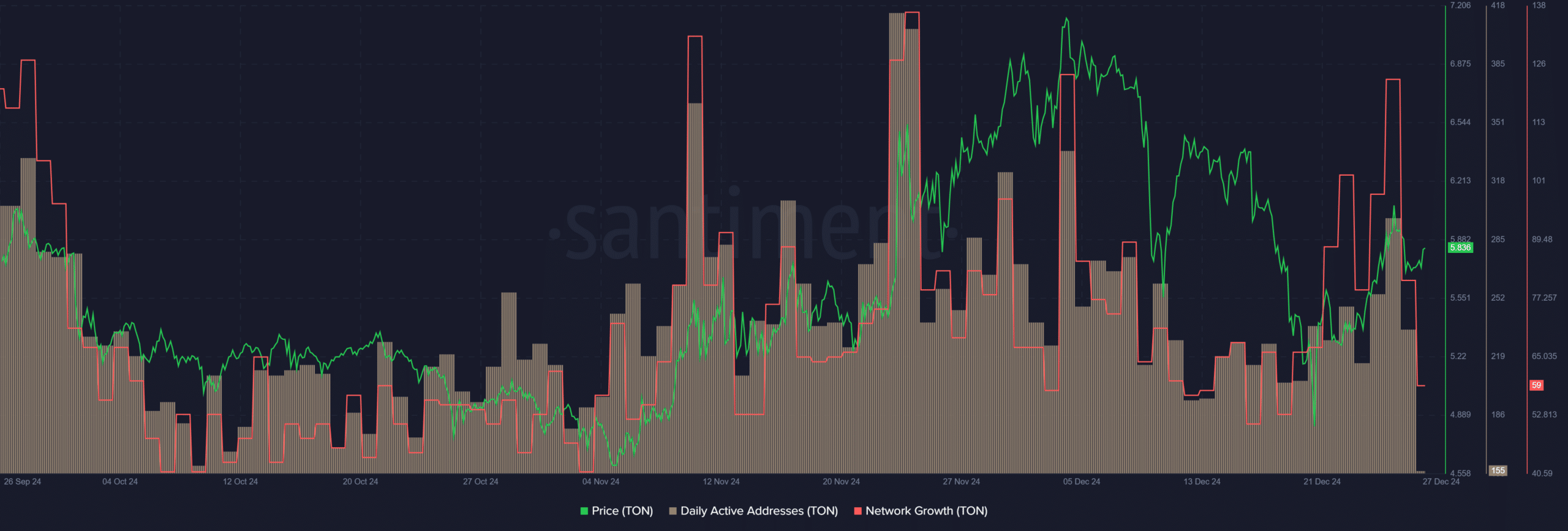

AMBCrypto found that the daily active addresses and the network growth have trended higher over the past two weeks too. During this time, TON’s price bounced from $5 to $6.

A rising number of unique addresses involved in transactions daily, combined with the creation of new addresses on the network, buttressed the idea that there has been high demand for Toncoin.

Source: Santiment

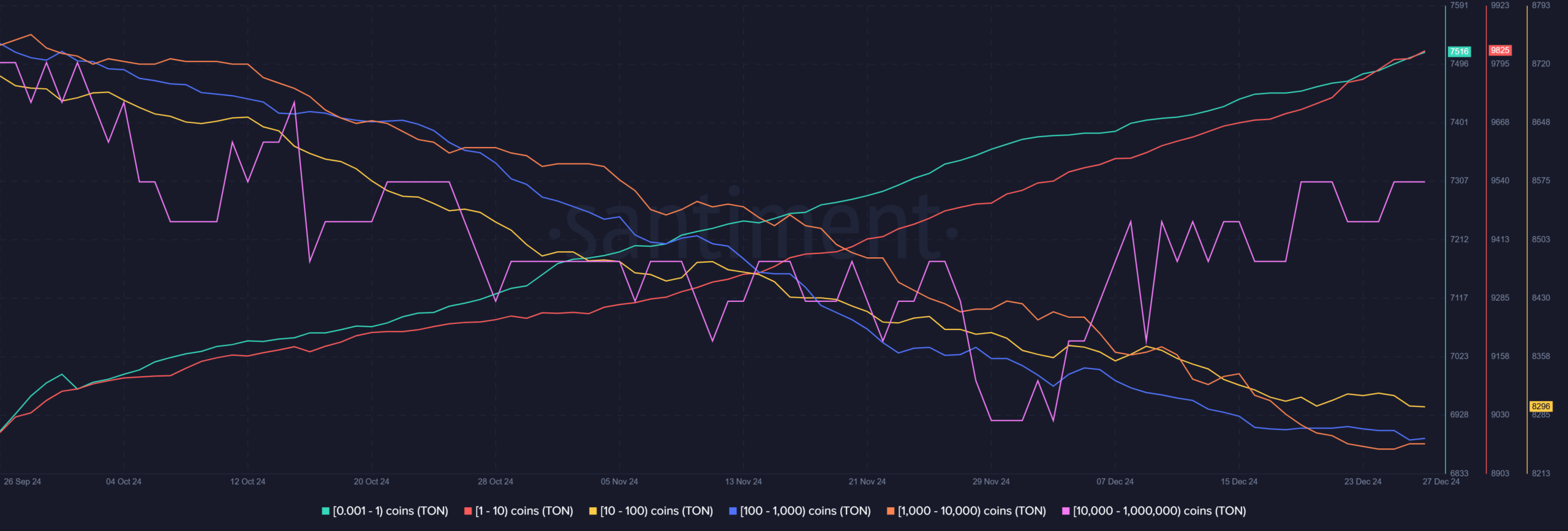

The supply distribution showed that larger holders have been actively selling in recent months. Cohorts of holders with 100 or more TON up to a million have steadily dwindled in numbers, showing selling pressure in the last three months.

Read Toncoin’s [TON] Price Prediction 2025-26

Meanwhile, smaller addresses with less than 10 Toncoin have continued to buy up more. The lack of whale accumulation seemed to be at odds with the idea of high TON demand.

Another drop in the staking TVL ratio would be a sign that sentiment has begun to shift bullishly. Over the next month or so, further price gains could see more tokens withdrawn from staking to explore opportunities in trading.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/08/Bitcoin-BTC-400x240.webp)