Top 8 crypto-exchanges that don’t require KYC in 2022

Disclaimer: The information shared is for educational purposes only. While AMBCrypto might be compensated for any links shared herein, that does not affect our writers’ evaluations in any way.

A few years ago, the cryptosphere seemed eager to eliminate the burdensome KYC verification process to give rise to a new kind of economy, where users can avoid the watchful eyes of tax agencies and make transactions without restraint.

However, KYC in the cryptocurrency world has become an unavoidable reality for most crypto users as regulators continue to strongly advocate the adoption of KYC and Anti-Money Laundering (AML) implementations to safeguard investors’ security and protection against financial fraud. KYC is widely used by organizations to manage transactions, trace criminal activity, and avoid terrorist financing.

But many investors still believe that the KYC requirement is a barrier to the Bitcoin (BTC) Standard, which has favored anonymous peer-to-peer transactions. Even though most crypto exchanges have started adopting regulatory guidelines, investors have the option to choose crypto exchanges that encourage greater anonymity by not imposing KYC processes.

Such exchanges are essential for privacy-conscious users who want to buy and sell cryptocurrencies without revealing their identities. Following are some of the best KYC Free Exchanges.

Binance

Binance, one of the largest cryptocurrencies ensures customers’ anonymity and protects their funds with state-of-the-art security measures and strict data privacy measures. This includes a 360-degree risk management system, real-time monitoring, and advanced data privacy tools.

Users do not need to complete KYC if their daily withdrawal limit is less than 2 BTC. Binance recently updated the daily withdrawal limit for no KYC users, and now they allow daily withdrawal of 2000 USDT for users who have done basic verification.

The exchange is striving to become a licensed financial institution, allowing it to work closely with government agencies to crack down on illegal activity. The simple and intuitive user interface of the exchange makes it highly user-friendly. The exchange offers a variety of features, including margin trading and various order types, making it suitable for both beginners and experienced traders.

Binance is registered in Malta and is outside the jurisdiction of the USA, China, or other countries that require user data. Worth pointing out, however, that while Binance does serve U.S customers, it does so indirectly and in compliance with local regulations.

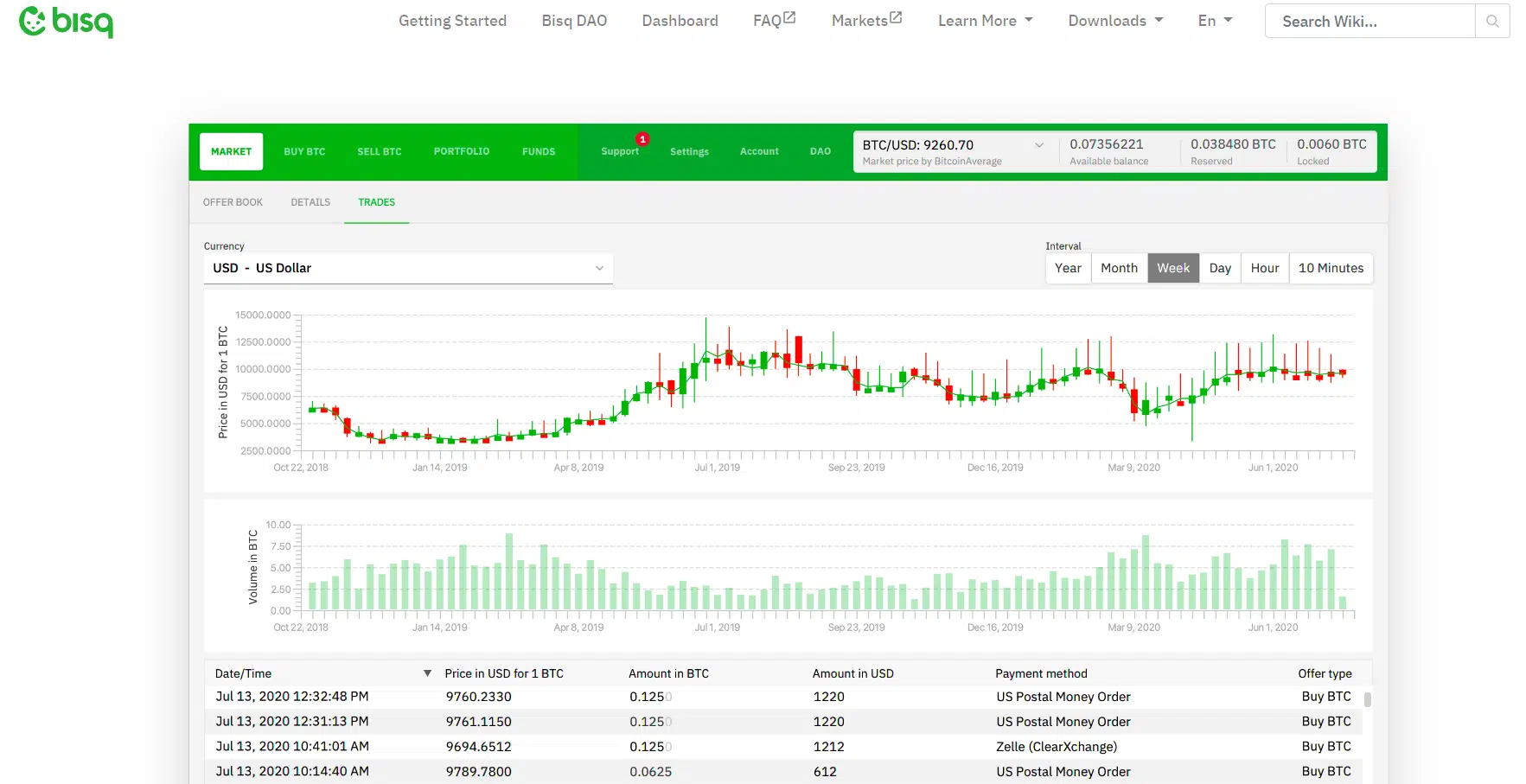

Bisq

Bisq is a cryptocurrency exchange that offers decentralized exchange (DEX) where users can buy and sell crypto without identity verification. The exchange requires no name or email ID, and users can make a trade even without registering with the exchange.

Bisq is not a website and does not provide any centralized services because it is a peer-to-peer trading network. Users can connect and conduct transactions with other BISQ Network users using simple software that they run on their PC or mobile device. Bisq automatically hides the wallet information (like public keys and such) of both parties involved in a trade.

Since Bisq is a decentralized exchange, nobody can control it. The users maintain the exchange as no external entity is required for its proper operation. This stands in sharp contrast to most other exchanges, which are centralized and therefore much more vulnerable to attacks.

Thus, the platform allows users to trade cryptocurrencies without fear of being tracked or monitored.

ByBit

ByBit, a P2P exchange for cryptocurrency derivatives based in Singapore has approximately 1.2 million registered users and specializes in perpetual swaps. The exchange has an average daily trading volume of more than $1 billion, indicating the platform’s market depth and capacity to execute orders rapidly.

The exchange allows users to withdraw tokens worth 2BTC daily without needing any KYC. Users can sign up from any part of the globe unless they live in a sanctioned country or the USA. The sign-up process is fast and hassle-free.

The platform offers one of the most intuitive mobile apps and a web-based trading terminal. It has features like one-click coin swaps, unlimited withdrawals, advanced order types, and an advanced security system. ByBit is registered in UAE and has offices in Taiwan and Hong Kong, countries that promote crypto adoption.

KuCoin

KuCoin is a decentralized crypto exchange that specializes in spot trading, margin trading, derivatives, mining pools, staking, and lending. The exchange allows customers to trade cryptocurrencies with or without completing their KYC by making verification optional. Like most exchanges, KuCoin also has a limitation on trading amount and volume without completing KYC. However, the restrictions are far less stringent than those of other crypto exchanges.

KuCoin lets users deposit Bitcoin directly into an account without needing personal information, allowing them to skip the time-consuming verification procedure many exchanges need to begin trading. Also, users are in total control of all deposited coins and have the option to withdraw them whenever they want.

The exchange only supports crypto-to-crypto trading pairs and has a daily trading volume of close to $100 million. KuCoin platform offers several distinct features, including a robust API interface, bank-level asset security, a quick trade matching engine, affiliation programs, and bonuses and aims to provide users with a highly secure and efficient trading environment.

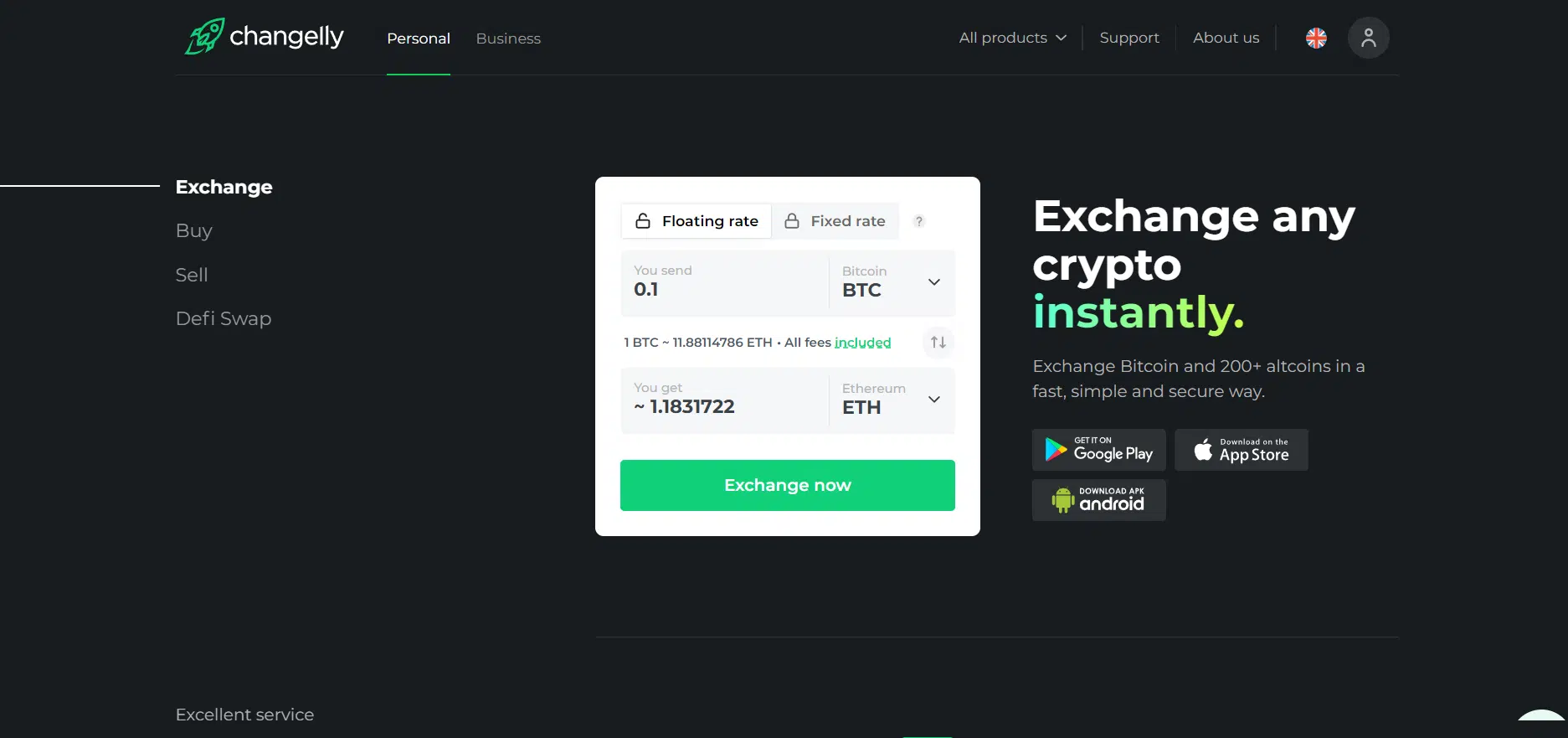

Changelly

Changelly is a centralized Altcoin swapping service that does not compel users to complete KYC or AML to utilize its services. It offers a user-friendly service that enables users to buy cryptocurrency directly from their bank account without providing an ID. Users can withdraw tokens worth 2BTC daily without needing any KYC. Users can use this service in conjunction with a VPN for further protection.

Changelly offers a wide range of cryptocurrencies, including the most popular ones where users can swap whatever cryptocurrency they choose, which is not feasible on a majority of other exchanges. Transactions are completed within a few minutes, which makes the platform a convenient option for those who need to exchange cryptocurrencies quickly.

The exchange offers a simple layout for easy navigation. Users can quickly locate the options they require to finish the transactions with only a few clicks.

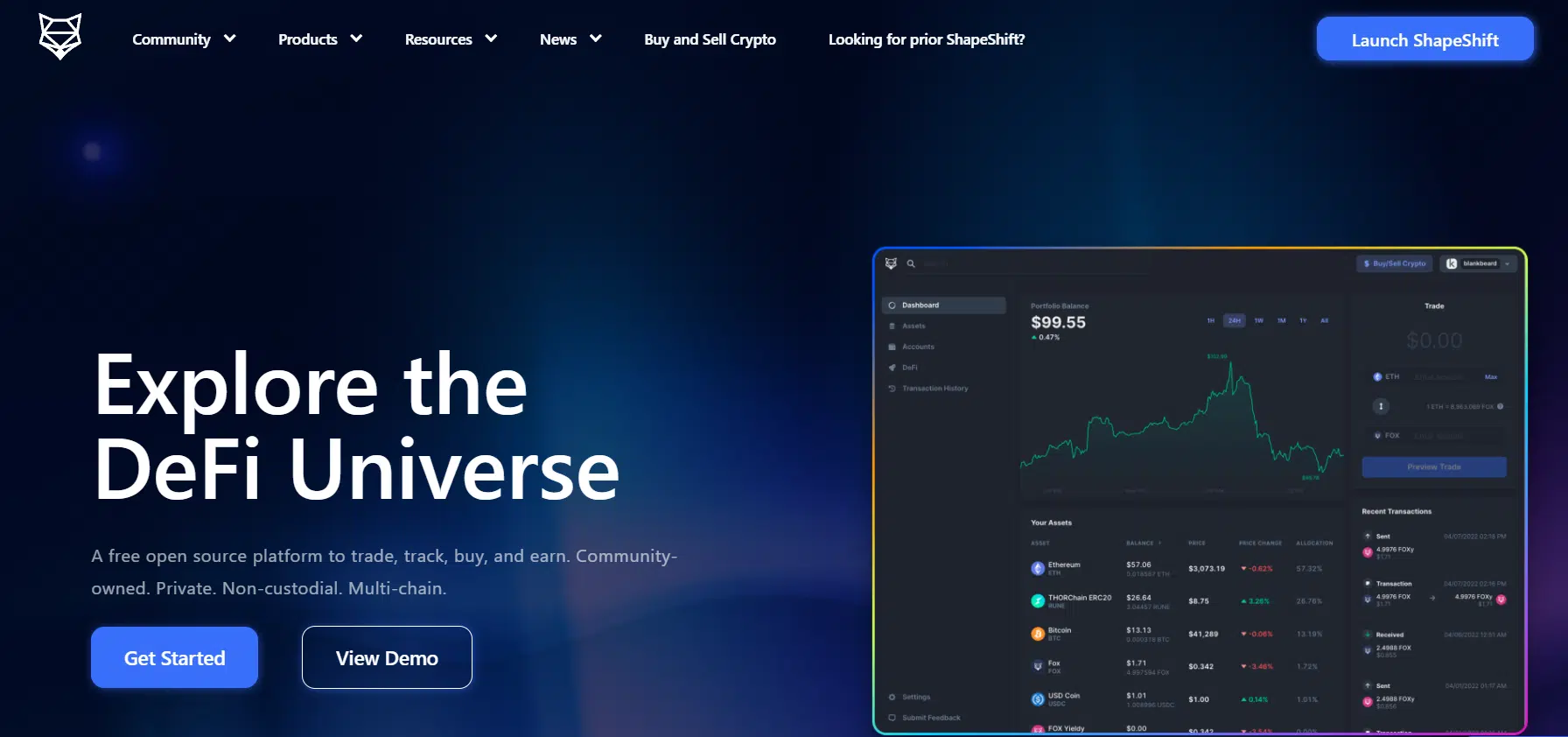

ShapeShift

Shapeshift is a cryptocurrency exchange founded in 2013 and is based in Switzerland. The exchange transformed from a centralized to a decentralized company and lets users buy or sell crypto without verifying their identity. With its simple user interface and wide range of payment options, the exchange is a user-friendly and convenient option for those looking to trade cryptocurrencies anonymously.

Shapelift doesn’t require users to create accounts or provide personal information like an email address or a password. It lets customers pay using a wide variety of cryptocurrencies and offers various payment options, including all major credit cards and debit cards.

Users can easily convert BTC or other cryptos into ETH without a middleman exchange and then buy the token by simply sending ETH to a smart contract address. The exchange allows users to create a digital wallet in seconds to store their Crypto and holds a majority of crypto in cold crypto wallets to lower the risk of theft.

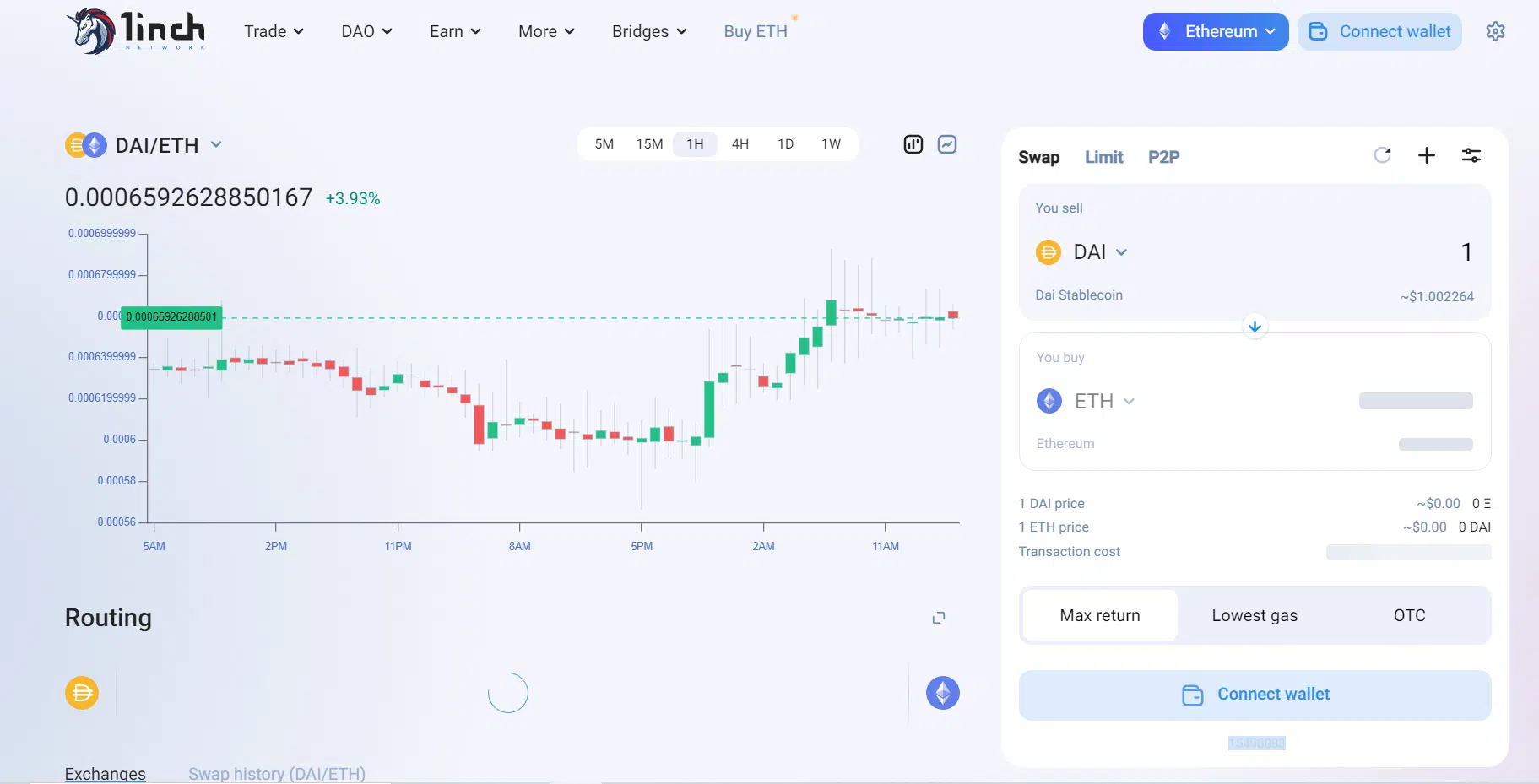

1InchExchange

1InchExchange is a DEX aggregator and one of the top non-KYC exchanges for ERC20 tokens. To find the best exchange rates, it divides orders between other DEXs and private liquidity providers rather than operating as an exchange itself.

It is easy to connect a web3 wallet and then exchange ERC-20 tokens at the most competitive prices. To obtain the best price for a whole transaction, the exchange further divides orders across various exchanges.

By combining DEX order books and restricting the number of transactions, the exchange assures high liquidity and excellent rates without any trading, deposit, or withdrawal fees. With the new 1inch Liquidity Protocol, users may now perform yield farming. To trade without KYC, users can connect to 1InchExchange using Metamask or any other wallet that supports Crypto wallets.

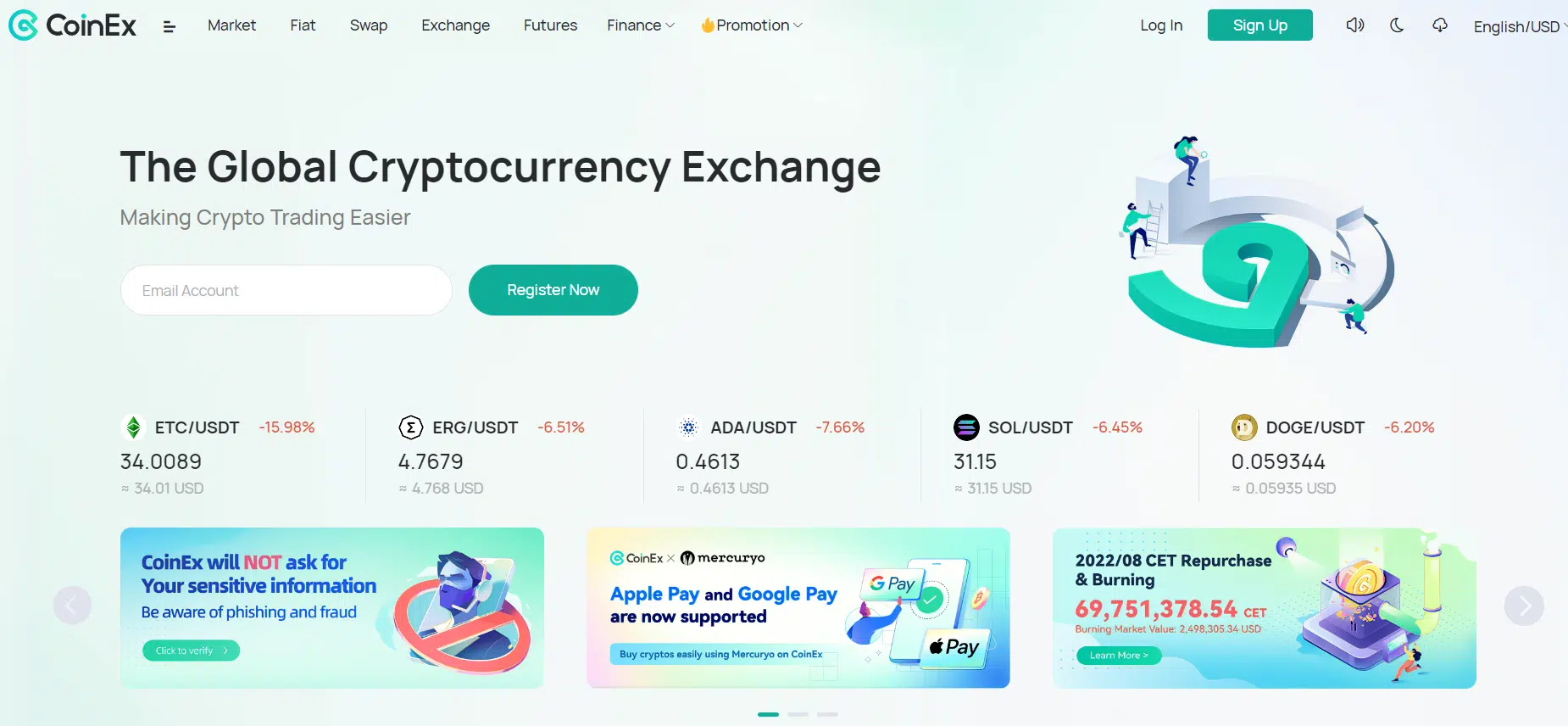

CoinEx

Founded in 2017, CoinEx allows for the trading of more than 500 tokens, including its CoinEx token named CET, and over 860 trading pairs. The KYC verification procedure is only required from users who wish to withdraw more than $10,000 in 24 hours.

The platform offers a variety of tools and features that include fiat currency trading, a swap market, crypto mining, etc. CoinEx provides futures and margin trading in addition to spot trading, only a few platforms provide these services to American investors.

CoinEx levies a standard trading fee of 0.2%, which is a decent amount. Also, large trade volumes are rewarded with favorable terms on CoinEx.

Bottom Line

Limitations apply to the trading value, accessible tokens, and other services provided by non-KYC crypto exchanges and such exchanges can expose investors to the risk of permanently losing their funds. Therefore, monitoring the platform’s track record and the people running it becomes essential when trading on non-KYC platforms.