Top trending cryptos of the week – BTC, PEPE, HOOK

- PEPE and Bitcoin’s weighted sentiment dropped despite massive price rises.

- Both BTC and HOOK’s market indicators suggested a price correction.

The market witnessed quite some volatility as several cryptos displayed commendable performances over the last seven days. As per a tweet from CoinMarketCap, PEPE, Bitcoin [BTC], and Hooked Protocol [HOOK] were the top three trending coins of the week.

Since these coins were trending, AMBCrypto took a look at their social metrics.

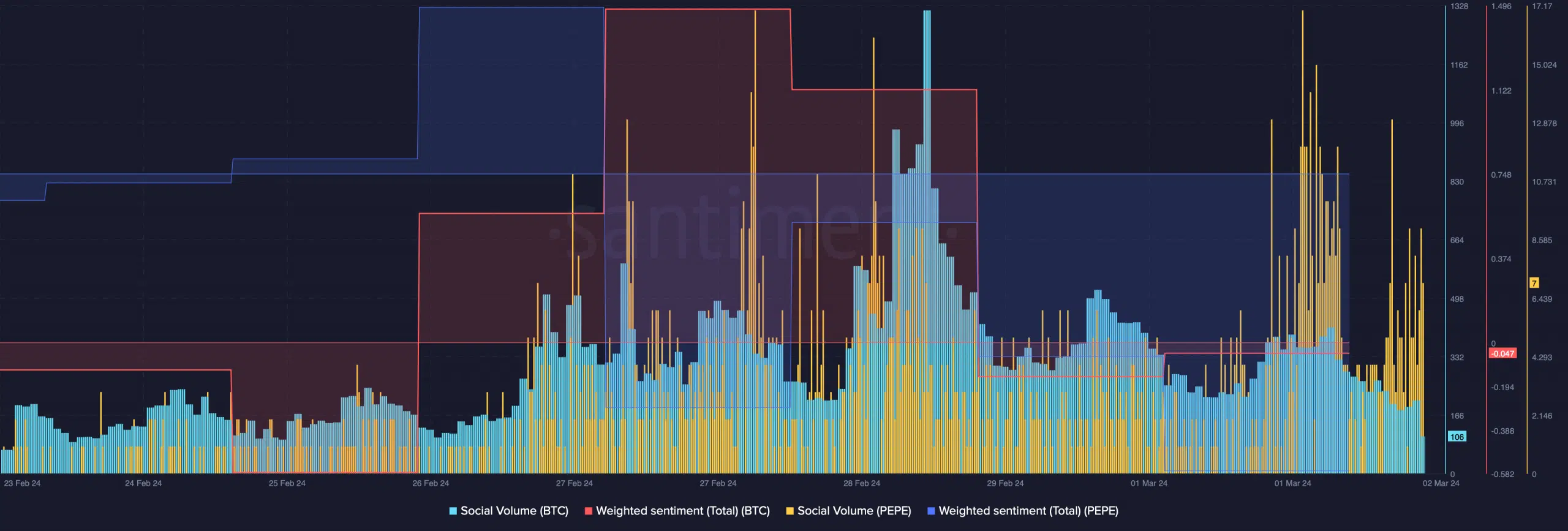

Our analysis of Santiment’s chart revealed that PEPE’s social volume did rise last week. However, its weighted sentiment dropped sharply, hinting that bearish sentiment around the token increased.

A similar trend was also noted on BTC’s graph. The coin’s social volume spiked on the 28th of February, but its weighted sentiment dropped, signifying more bearish sentiment.

What’s on the price front?

The hike in these coins’ social metrics, because of which they trended on CoinMarketCap, can be attributed to their price actions.

As per the tweet, PEPE’s price surged by more than 144% in the last seven days. At the time of writing, the memecoin was trading at $0.000004393 with a market capitalization of over $1.85 billion.

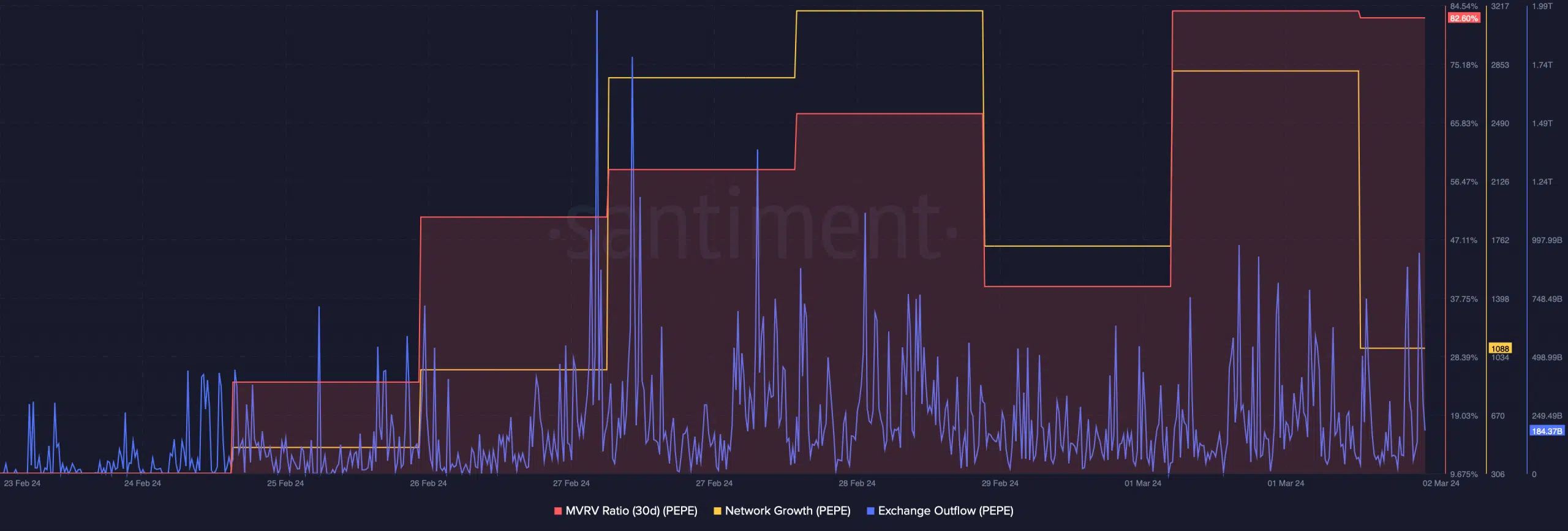

The coin’s exchange outflow spiked last week, reflecting high buying pressure. Other metrics also looked optimistic for the next week.

For instance, its MVRV ratio registered an uptick. Additionally, its network growth also remained high, meaning that more new addresses were created to transfer the coin.

Though things looked good for PEPE, BTC’s metrics told a different story. During the last week, the king of crypto’s price rallied by over 20%.

At press time, it was trading at $61,811.45. The coin’s open interest dropped while its price surged. Whenever the metric goes down, it indicates that the possibility of a trend reversal is high.

Additionally, after spiking on the 29th of February, BTC’s Binance funding rate also went down slightly. This meant that derivatives investors were not actively buying the coin.

Market indicators also looked bearish on BTC. Its Relative Strength Index (RSI) was in the overbought zone, suggesting that selling pressure on the coin might increase soon.

Additionally, its Chaikin Money Flow (CMF) also registered a downtick. This indicated that the possibility of BTC’s price going down during the next week is high.

Read Bitcoin’s [BTC] Price Prediction 2024-25

HOOK’s scenario was also similar to that of BTC, as most indicators remained in sellers’ favor. Its RSI was also in the overbought zone.

Moreover, its price has touched the upper limit of the Bollinger bands, indicating that investors might witness a price correction due to high selling pressure. At press time, HOOK was trading at $1.32 with a market cap of over $169 million.