Tracing The Graph’s [GRT] upward trajectory since the beginning of 2023

![Tracing The Graph's [GRT] upward trajectory since the beginning of 2023](https://ambcrypto.com/wp-content/uploads/2023/04/The-Graph.jpg)

– On a YTD basis, GRT exploded 107% to its press time value of $0.1658.

– The number of GRT tokens getting staked on the network was continuously increasing.

The Graph [GRT] has witnessed remarkable growth in 2023. On a year-to-date (YTD) basis, its native token exploded 107% to its press time value of $0.1658, per data from CoinMarketCap. The market cap has more than tripled in the same time period.

Even though the price retracted owing to broader market uncertainty in March, the recovery was quick and GRT made gains of more than 15% in the past week.

Read The Graph’s [GRT] Price Prediction 2023-24

Upward growth ‘Graph’ in Q1

Often referred to as the ‘Google for blockchain data’, The Graph is an open-source indexing protocol allowing users to search for data without being directly connected to the chain or going through a centralized third-party provider. Indexers, delegators, and curators perform indexing services and receive query fees from users.

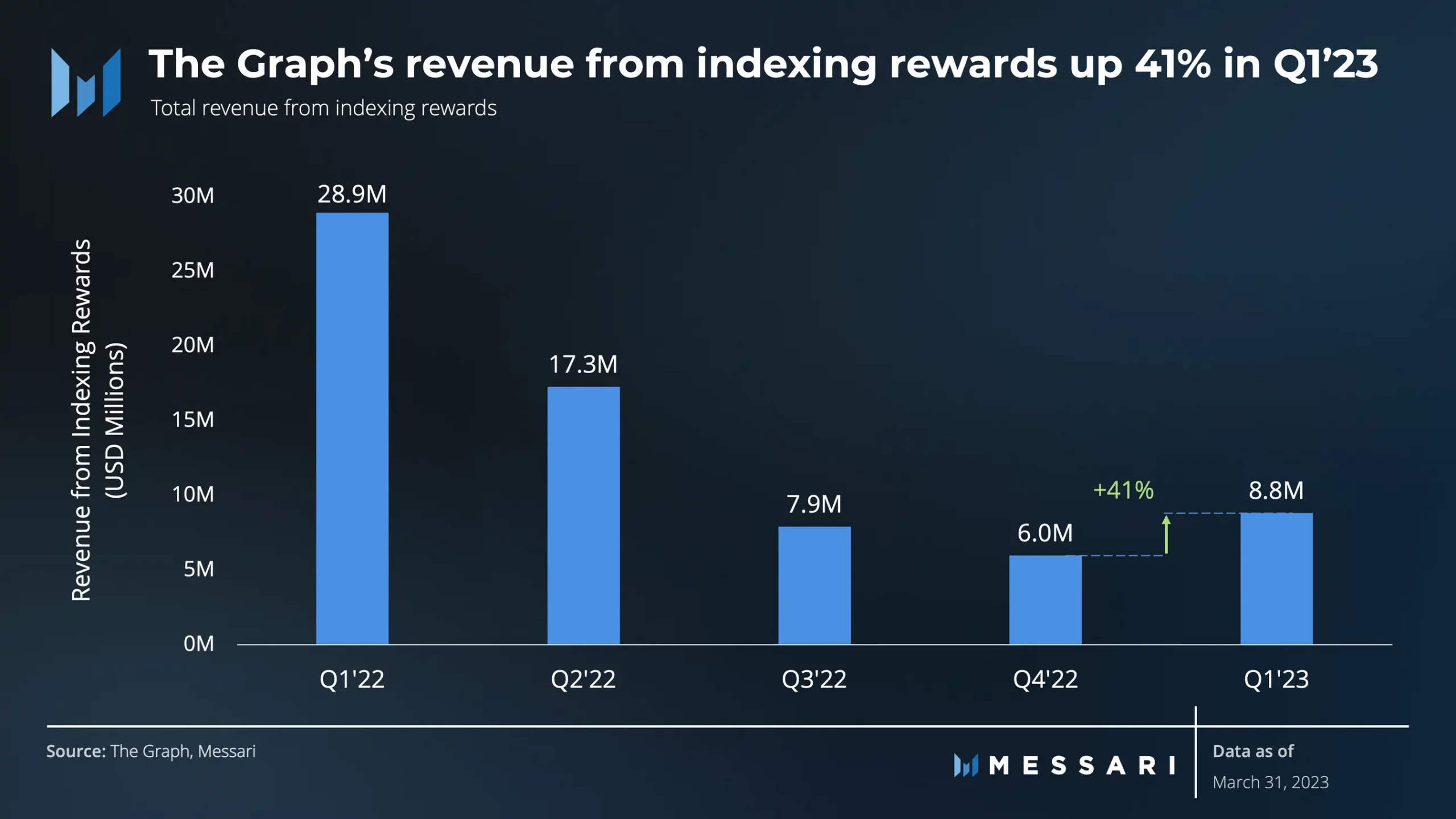

Blockchain analytics firm Messari published a report on The Graph’s network performance in the first quarter (Q1) of 2023. Among the key findings was the 41% increase in quarter-on-quarter (QoQ) revenue from query fees.

The revenue from indexing rewards also surged 41% from the previous quarter. It should be noted that The Graph’s two primary sources of income are the indexing rewards and query fees collected from data users.

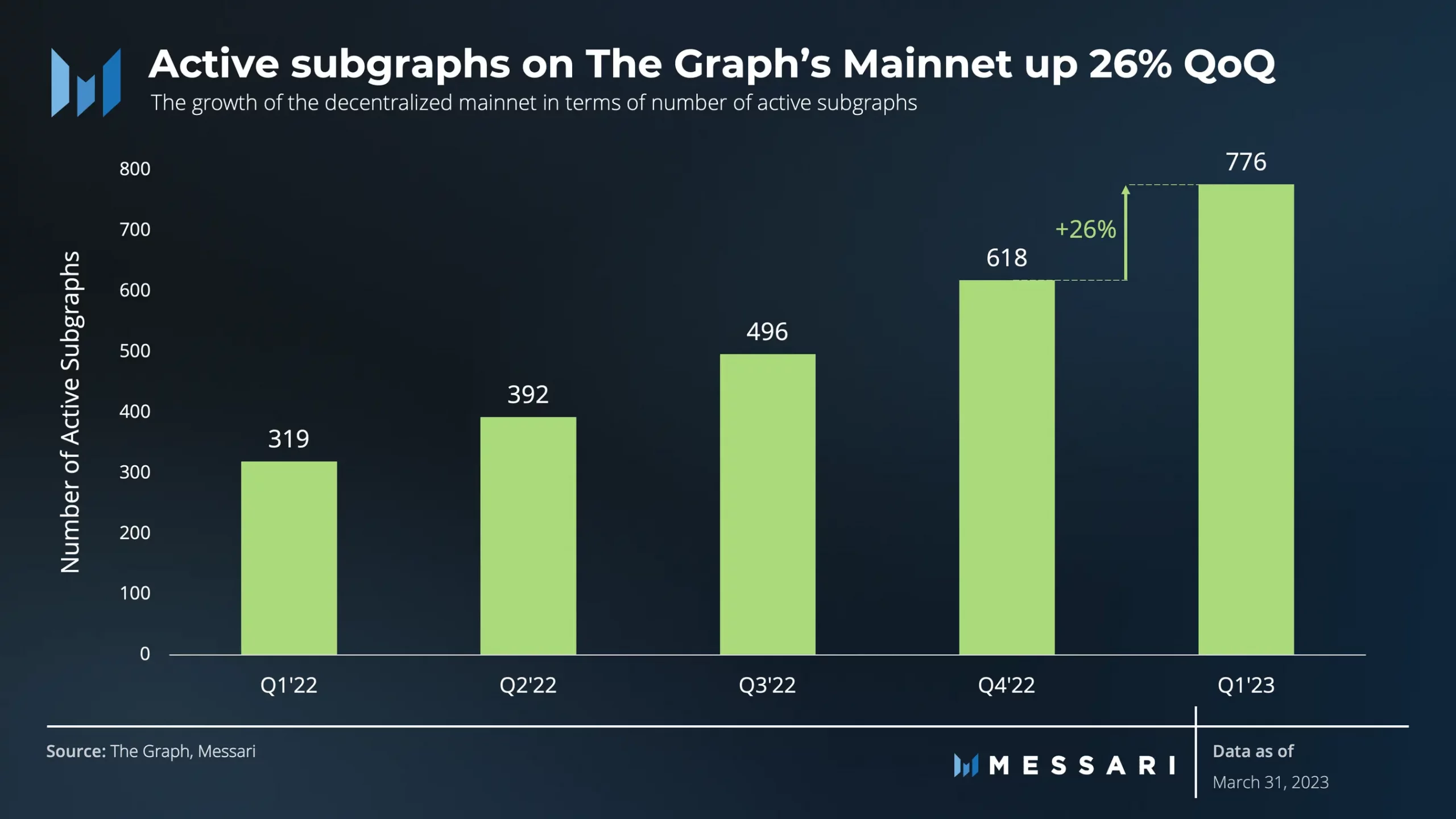

Furthermore, there was a steady rise in the number of subgraphs over the last five quarters. As of March, 776 active subgraphs were present, representing a 26% QoQ growth.

As more subgraphs got launched, the participation of Indexers, Delegators, and Curators increased. Indexers, who are critical in scaling The Graph’s network, recorded a 58% QoQ increase in their number.

GRT inflows increase

The Graph follows the Stake-for-Access model, meaning that participants need to stake GRT tokens to earn revenue for their services. As per data from Dune, more number of GRT tokens were getting staked, implying the growth of the network. In fact, the incoming volume hit its six-month high of 40 million GRTs on 13 March.

How much are 1,10,100 GRTs worth today?

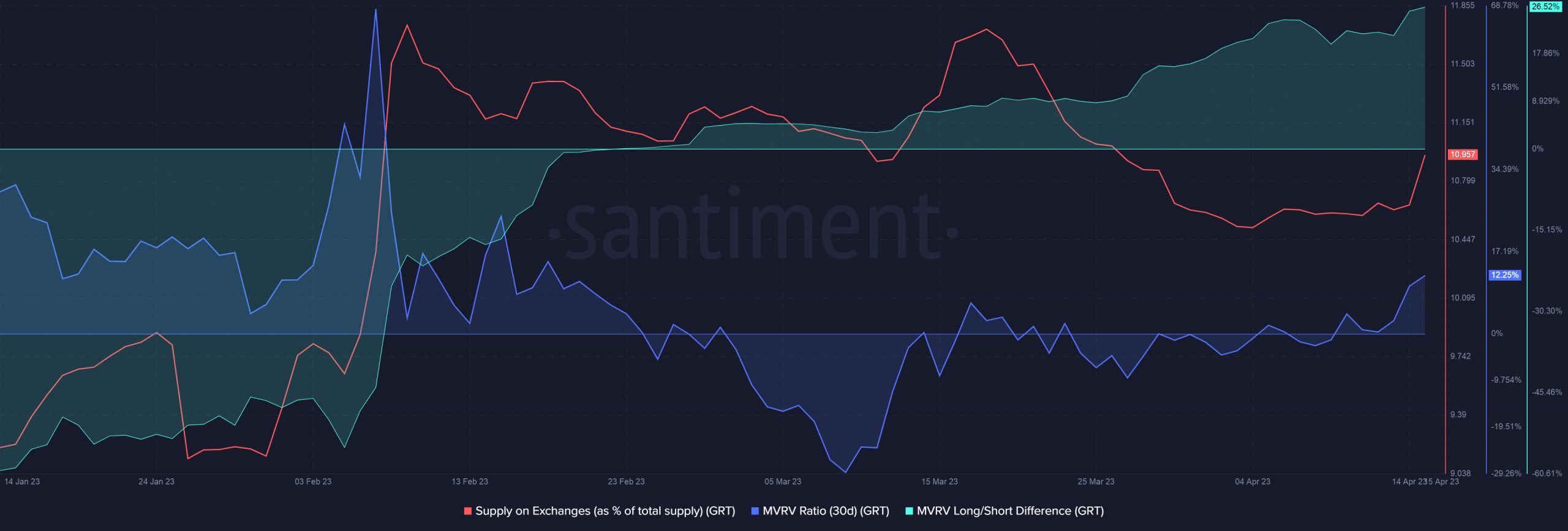

Moreover, the supply of GRT on exchanges has shrunk considerably since mid-March, indicating bullish sentiment.

The MVRV Ratio entered the positive territory, indicating that the network was overvalued and holders would realize profits if they were to sell their tokens.

The positive MVRV Long/Short Difference meant that it was the long-term holders who would profit more, sparking concerns of a sell-off.