Traders bet on Bitcoin as Ethereum ETFs see $760 mln outflow – What’s spooking them?

- Ethereum ETFs see $760M in outflows as investor sentiment shifts towards Bitcoin amid favorable conditions.

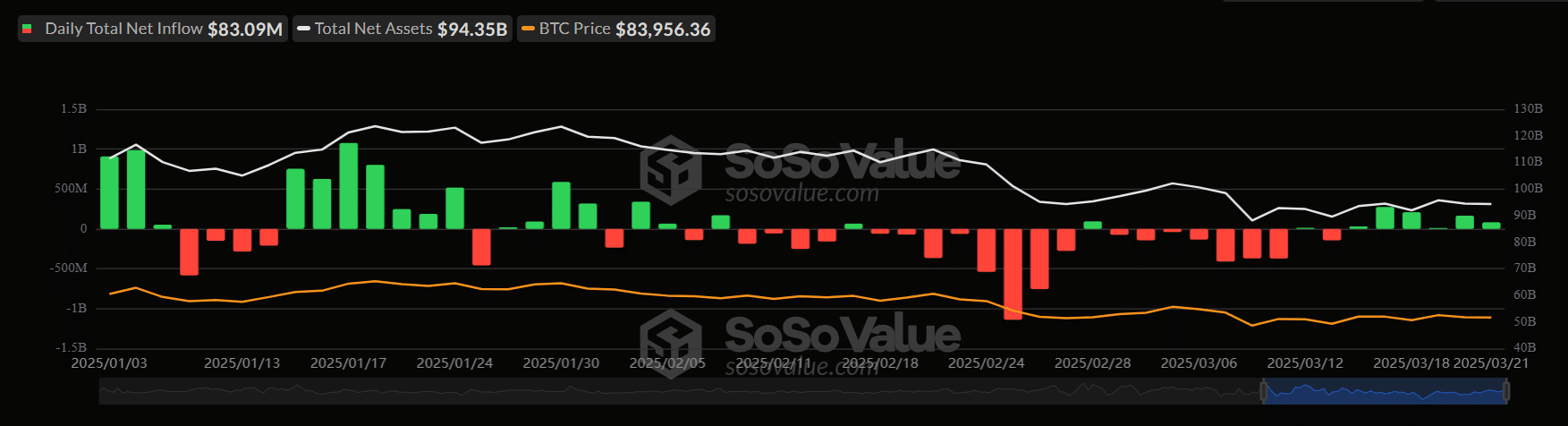

- Bitcoin ETFs attract $785M in inflows, signaling renewed investor confidence, while Ethereum faces investor retreat.

Ethereum [ETH] is falling out of favor — at least for now. Over the past month, U.S.-listed Ethereum ETFs have recorded more than $760 million in outflows, a sharp contrast to the surging interest in Bitcoin [BTC].

In just the last six days, Bitcoin ETFs have pulled in $785 million in fresh capital, signaling a decisive shift in investor sentiment and raising fresh questions about Ethereum’s role in the evolving digital asset landscape.

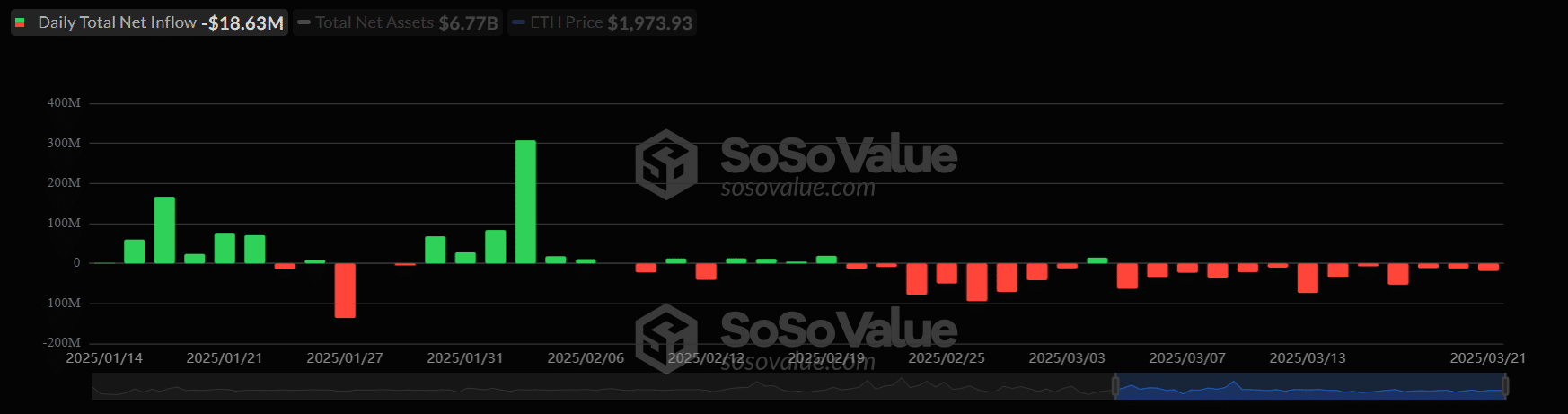

Ethereum ETFs see steady outflows as market sentiment turns cautious

Ethereum ETFs have entered a prolonged period of investor retreat, shedding over $760 million in net outflows over the past month.

Inflows peaked briefly at the end of January — most notably with a single-day surge above $300 million — but quickly reversed into consistent outflows through February and March.

Since mid-February, red bars dominate the chart, illustrating a nearly unbroken stretch of daily net outflows that reflect growing caution toward Ethereum.

Total net assets for Ethereum ETFs now sit at $6.77 billion, with ETH itself trading just under $2,000.

Institutional investors are losing confidence in Ethereum’s near-term performance, especially amid a broader narrative increasingly centered around Bitcoin.

With outflows accelerating, Ethereum risks losing its standing as the second most favored crypto asset among ETF investors.