Traders’ skepticism keeps ENA down – Why and what next?

- ENA’s native platform, Ethena, overtook Tether in fees generated, with its stablecoin surpassing MakerDAO’s DAI by market capitalization

- Market metrics ddi not fully support a sustained price rally for ENA

Despite a 67.24% surge last month, ENA has been on a losing streak in recent weeks. In fact, it has declined by 11.19% on the weekly charts, while also losing 3.96% of its value in the last 24 hours.

While positive sentiment around ENA persists, AMBCrypto’s analysis revealed that market participants remain unconvinced. Especially as selling pressure continues to weigh on the asset.

Good news for ENA—But is it really?

Positive news continues to envelop ENA though, with several developments alluding to potential price impact. Ethena, the platform native to ENA, recently overtook Tether.io in transaction fees generated over the last 24 hours.

During this period, Ethena recorded $24.32 million in fees, surpassing Tether’s $17.83 million. This indicated higher or more valuable activity on Ethena’s network, compared to Tether’s.

Additionally, Ethena’s stablecoin, USDe, has surpassed MakerDAO’s DAI in market capitalization. At the time of writing, USDe was valued at $5.81 billion, while DAI trailed at $5.36 billion.

This pointed to greater adoption of USDe, with its supply expanding to meet the growing demand as the Ethena network rapidly scales.

With ENA at the core of these developments, one would expect it to benefit from the heightened activity. However, AMBCrypto’s analysis revealed a different trend, with market participants taking a more cautious stance.

A different pattern – Traders are selling

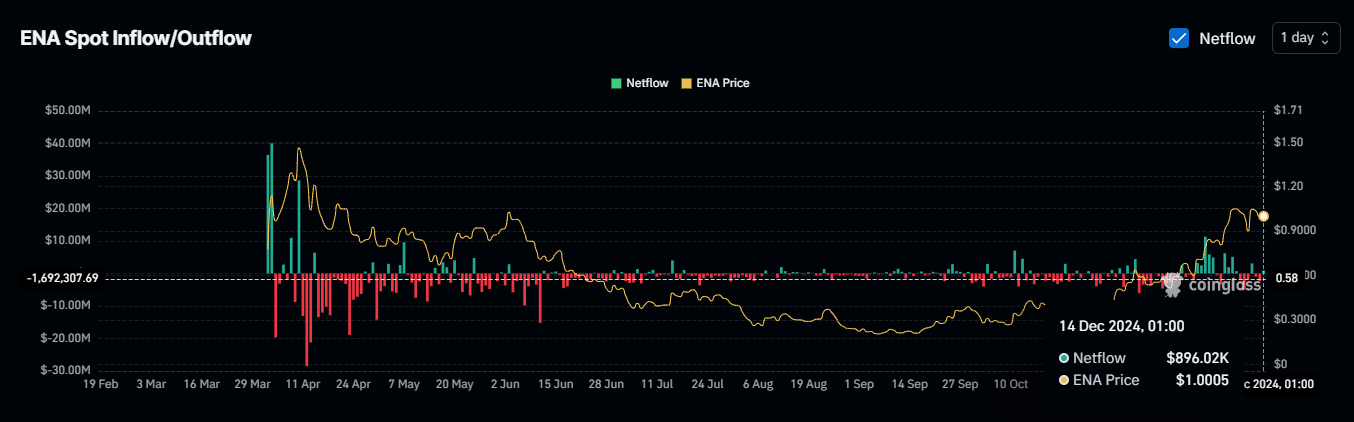

On-chain metrics analyzed using Coinglass underlined a shift in market behavior—Traders are selling. Open interest has been declining, while Exchange Netflows turned positive – Indicating a hike in selling activity.

Open interest dropped by 4.09% too, with the same sitting at $504.07 million at press time. This alluded to a hike in unsettled sell contracts, pointing to a growing bearish sentiment in the market.

Additionally, spot traders started moving their ENA tokens to exchanges, with an intent to sell rather than hold in private wallets.

In total, ENA tokens worth $899,020 were transferred to exchanges. And, selling pressure is gradually building, contributing to downward price movement.

Forceful closure for bulls

A significant number of long trades on ENA have been forcefully closed, with $636,300 worth of the asset removed from the market. This type of move suggested that market sentiment does not support further price hikes for ENA, with the majority expecting a price decline instead.

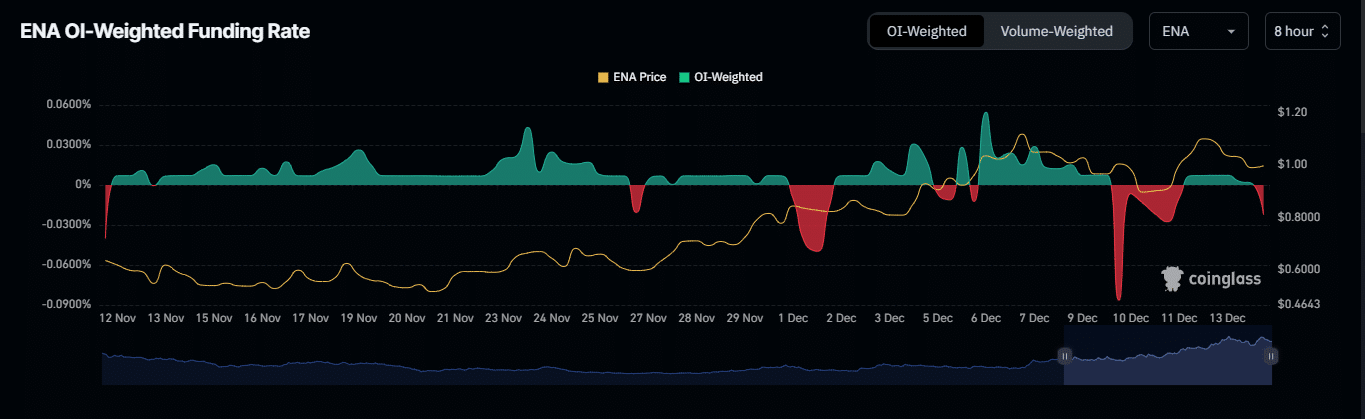

AMBCrypto also analyzed the OI-weighted Funding Rate to gain deeper insights into market sentiment. The funding rate adjusts based on the size of open positions in perpetual futures.

On the 8-hour chart, the OI-weighted Funding Rate remained in the red zone, reflecting a period of decline with a value of 0.0224%.

With major indicators turning bearish despite positive developments, it seems that ENA will continue its downward trend.