Tron alert: Over $13M TRX withdrawn in 24 hours – What’s brewing?

- Market sentiment around Tron remained bullish last week.

- Most technical indicators looked optimistic and hinted at a price rise.

While most cryptos faced massive declines over the last week, Tron’s [TRX] performance was commendable as its weekly and daily charts remained green.

While the token’s price action was positive, another interesting development happened that hinted at a further price rise in the coming days.

Tron stands strong

CoinMarketCap’s data revealed that top cryptos like Bitcoin [BTC] and Ethereum [ETH] registered nearly double-digit drops last week.

On the contrary, TRX stood strong as its price increased marginally last week. The last 24 hours were even better, as the token’s value surged slightly.

At the time of writing, TRX was trading at $0.1289 and had a market capitalization of over $11.235 billion, making it the 11th largest crypto.

AMBCrypto’s look at IntoTheBlock’s data revealed that TRX’s longer-term holders (investors holding a token for more than one year) have been on the rise.

To be precise, there were over 82 million longer-term holders. This clearly reflected investors’ confidence in TRX, as they hope for a further price rise in the coming days.

Meanwhile, IntoTheBlock posted a tweet highlighting the fact that investors were buying the token.

As per the tweet, $13.1 million worth of TRX was withdrawn from exchanges over the past 24 hours. This is the largest in over a month, signaling accumulation.

Is TRX preparing for another rally?

As mentioned above, buying pressure on TRX increased. Generally, a rise in buying often results in price hikes.

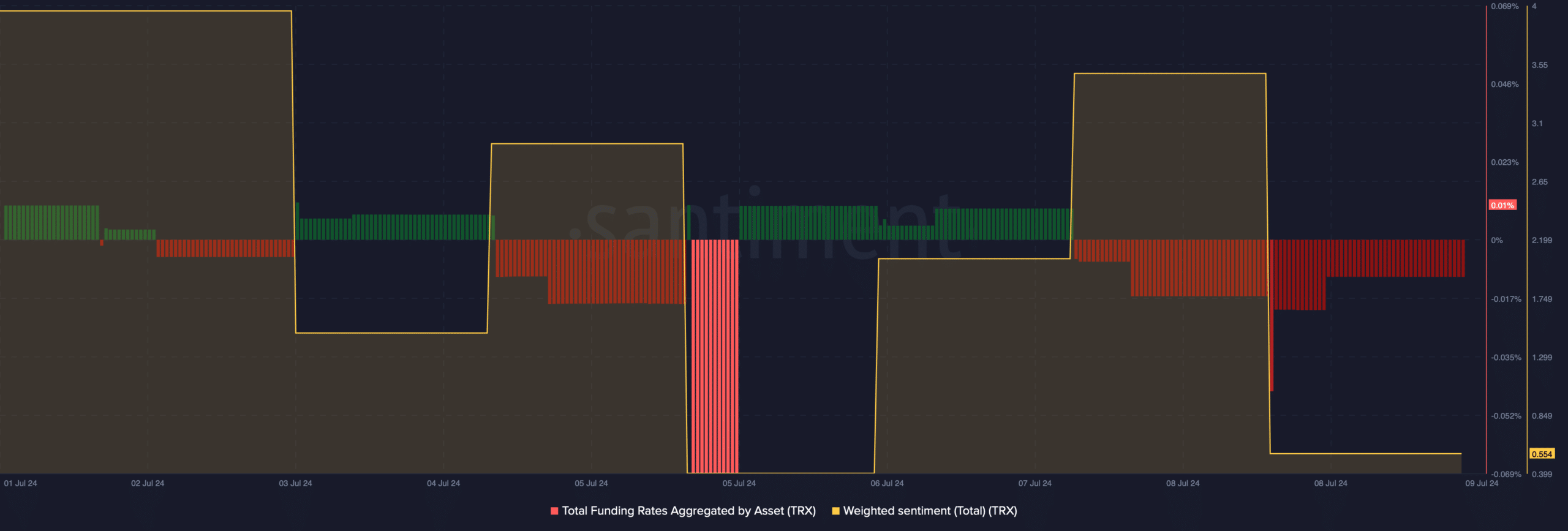

Therefore, AMBCrypto planned to have a closer look at other datasets to find whether a bull rally was around the coroner. As per our analysis, TRX’s weighted sentiment remained high last week.

This meant that bullish sentiment around the token was dominant in the market. Its funding rate dropped.

Usually, prices tend to move the other way than the funding rate. AMBCrypto’s look at Coinglass’ data revealed yet another signal.

Tron’s long/short ratio improved, meaning that there were more long positions in the market than short positions.

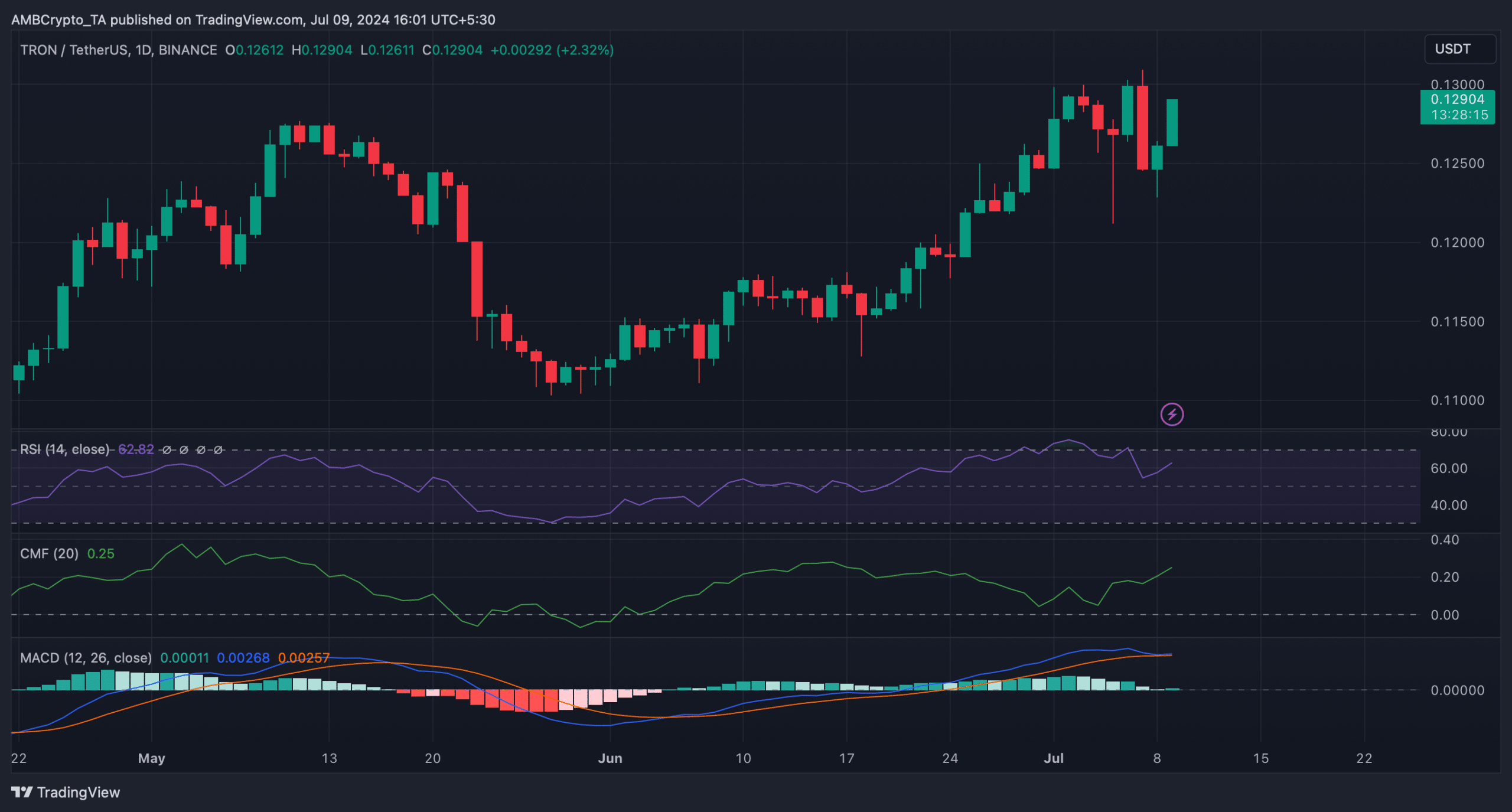

The technical indicator Relative Strength Index (RSI) registered an uptick. Additionally, the Chaikin Money Flow (CMF) also followed a similar trend, suggesting that the chances of a continued price rise were high.

Nonetheless, the MACD remained in sellers’ favor as it displayed the possibility of a bearish crossover.

Realistic or not, here’s TRX market cap in BTC‘s terms

Our analysis of Hyblock Capital’s data revealed that if TRX remained bullish, then it might first touch $0.131.

A successful breakout above that mark would allow the token to touch $0.14 in the coming days.