Analysis

Tron bears stand firm to halt bullish momentum, which way will TRX move?

Buyers and sellers showed indecision, as TRX’s bullish momentum stalled at key resistance level. Investors should thus put serious thought into TRX’s price action before making their next move.

- TRX experienced a retracement after its recent bullish rally

- Traders adopt a cautious approach to buy/sell positions

Tron [TRX] carried over its strong bullish momentum from April into May. TRX’s bullish rally forced prices above a key resistance level at the $0.067 price zone. This saw Tron post gains of 11.5% between 27 April and 5 May.

Realistic or not, here’s TRX’s market cap in BTC’s terms

However, the market correction led by Bitcoin [BTC] over the last 48 hours halted TRX’s bullish momentum. Further bearish action by BTC might see TRX bears attempt to test the strength of the new $0.067 support level.

Buying pressure eased off…

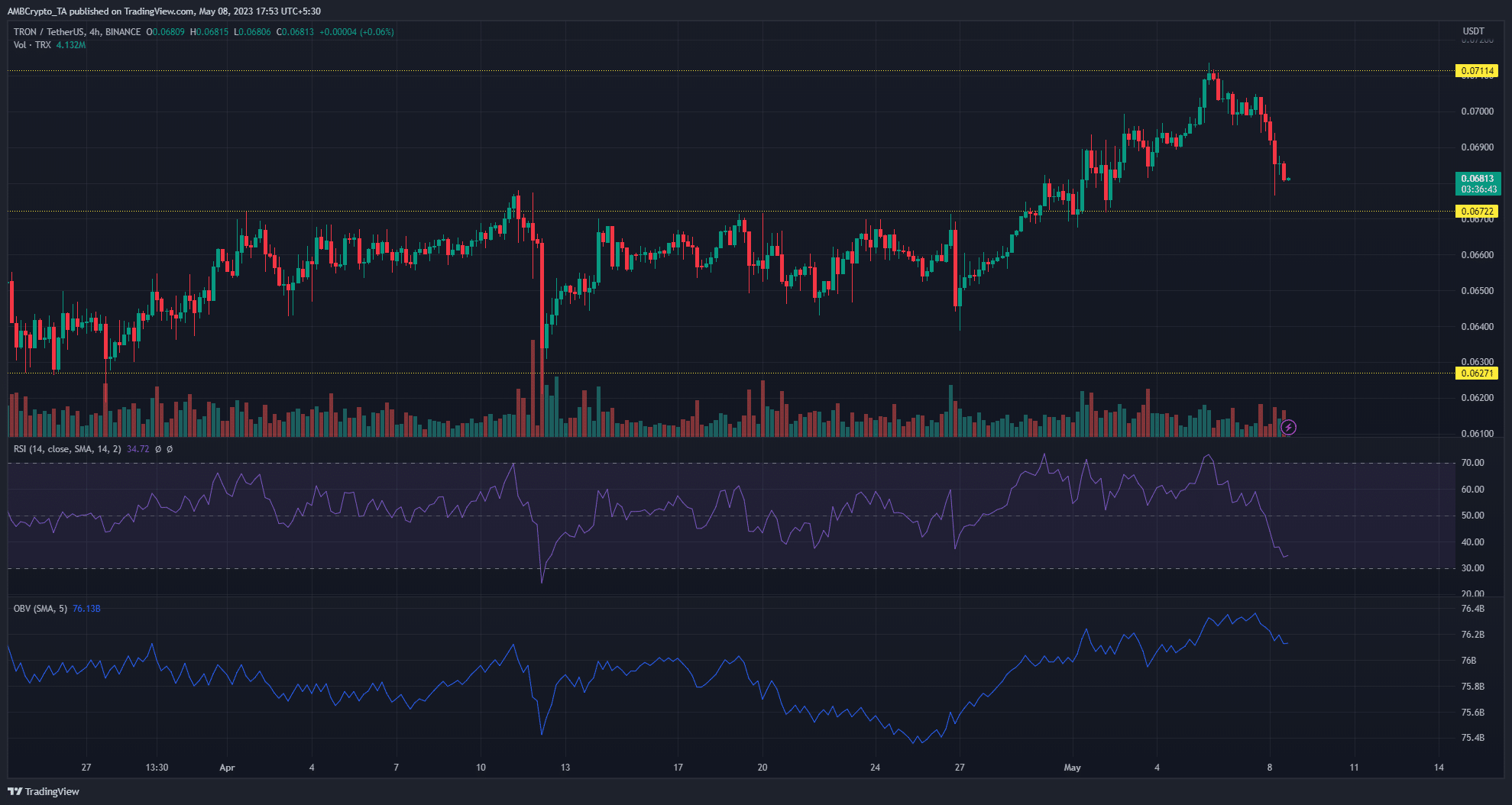

TRX has been on a bullish rally, since 27 April. However, bears took advantage of a general market correction to halt the bullish momentum at the $0.071 resistance level. This led to a 5% dip in its price over the past 48 hours.

A look at the four-hour chart showed that the short-term price action favored the bears, as TRX posted multiple bearish candles in a row. Zooming out to the daily timeframe showed a bearish order block confluence at the $0.071 resistance level.

The evidence at hand pointed to caution for both bulls and bears. The Relative Strength Index (RSI) stood way below the neutral line at 34.71. This indicated the lack of significant momentum for TRX at press time. However, the OBV was on a strong upward trend but at press time, the OBV did fall to 76.13.

The next move for Tron remained unclear. Buyers can wait for a retest of the support level with a daily candle close above it. Alternatively, bears could see more short opportunities, if the price successfully breaks the $0.067 support level.

How much are 1, 10, or 100 TRX worth today?

Futures market remained undecided

Buyers and sellers in the futures markets continued to weigh up their next moves carefully. The funding rate data from Coinalyze showed that funding rates had been a mix of positive and negative with no clear direction.

The Open Interest also showed neither bulls nor bears had succeeded in establishing a clear directional trend for TRX.