TRON crypto price action: Examining if TRX can push past $0.25

- TRON crypto’s momentum and buying pressure were not strong enough to enforce a price breakout.

- The overlap of liquidation levels and the resistance meant there could be a bearish reversal for TRX.

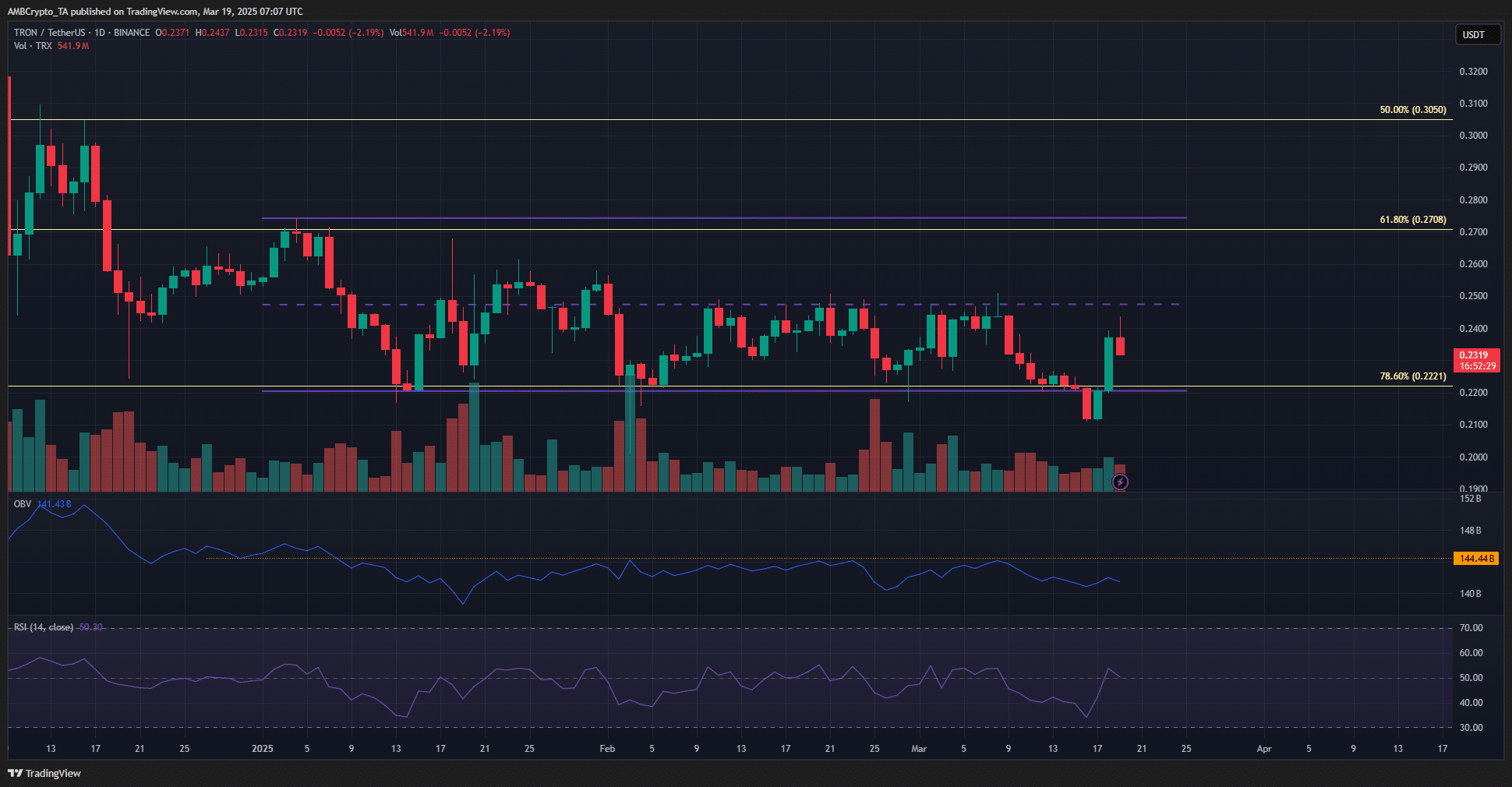

TRON [TRX] was trading at $0.232, at press time, after experiencing a double-digit price gain from the weekend’s drop. Despite the swift price bounce, TRON crypto was not yet above the local resistance at $0.25.

Bitcoin [BTC] also hovered around the $83k mark and showed little short-term bullish intent, which could be affecting TRON’s market outlook. Technical analysis showed that traders might want to sell TRX if it retested the overhead resistance.

TRON crypto range formation to check bulls’ progress again

TRON has been trading within a range of $0.2745 to $0.22 (purple), with $0.248 serving as the mid-range level. Over the past six weeks, this mid-range level has consistently acted as strong resistance, with prices repeatedly failing to break through and subsequently dropping to the range low.

On the 16th of March, TRX dipped below the range low, but the bulls initiated a recovery, pushing the price up by over 10% in the past three days. However, the OBV has not surpassed a local high, indicating a lack of significant bullish dominance.

At the time of writing, the RSI was at 50, suggesting a potential momentum shift. However, similar shifts have been observed in the past two months without leading to a breakout beyond the mid-range level.

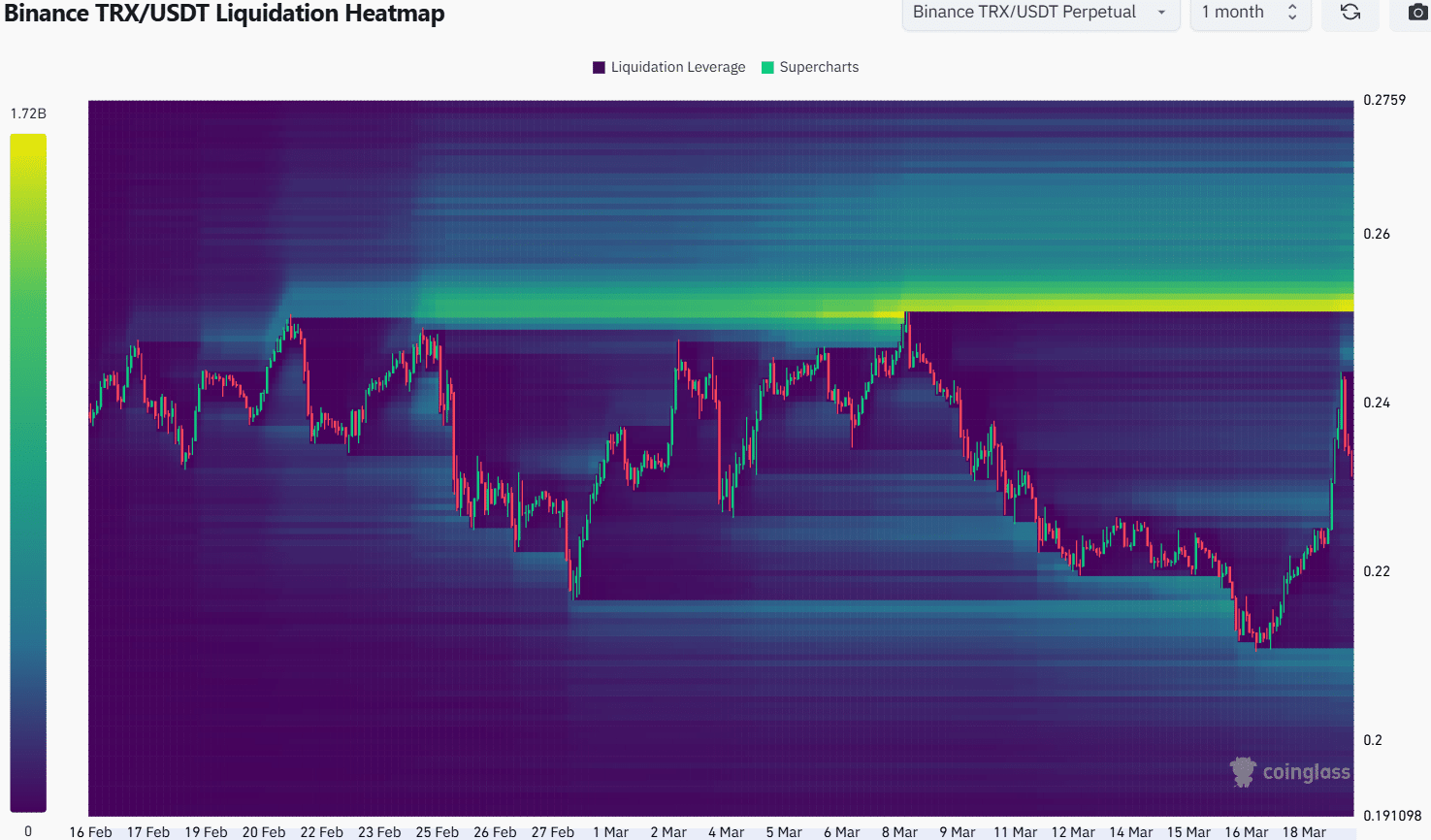

The 1-month liquidation heatmap outlined the $0.25 region as a magnetic zone. The recent price bounce meant that a move higher to the mid-range, and the liquidation levels, lined up well.

The cluster of liquidity just above the mid-range level could attract TRON higher before a bearish reversal.

Hence, traders can expect TRON to brush the $0.25 level before a bearish reversal. Traders can use this retest to sell or go short, but it was a bit late to try to buy TRON hoping for more gains.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion