Tron, NEO, KLAY, LUNA Price Analysis: 21 April

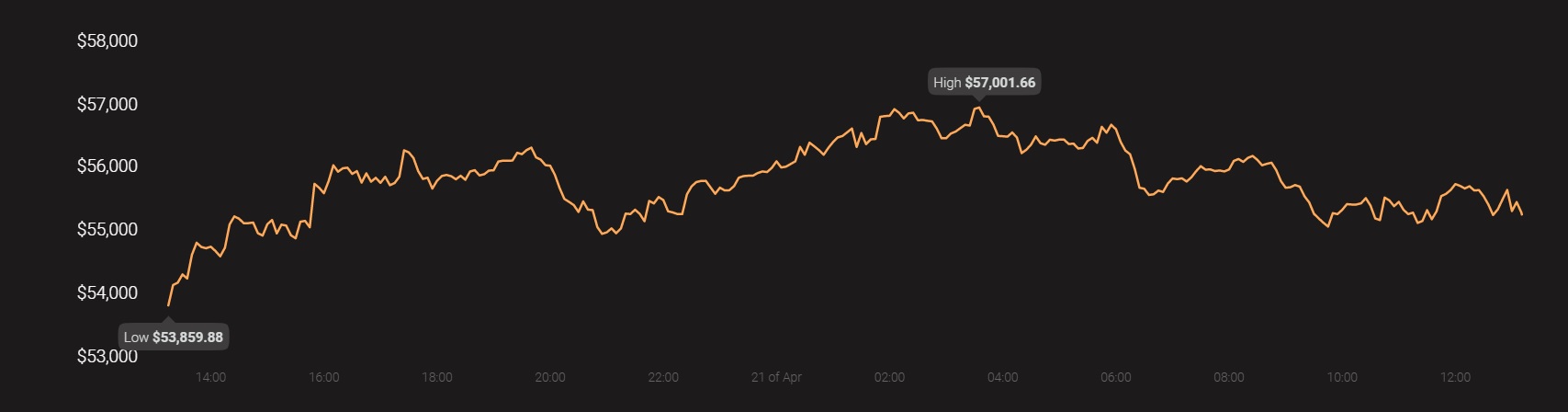

At the time of writing, Bitcoin, the world’s largest cryptocurrency, was still struggling to recover its position on the price charts after it fell below the $60,000-mark. The crypto-market’s altcoins, however, were noting price actions of their own.

Source: Coinstats

Tron [TRX]

Source: TRX/USD on TradingView

Once one of the mainstays of the crypto-market’s top-10, TRX, at the time of writing, was down at 18th on CoinMarketCap’s charts. While the altcoin has been on an uptrend over the past few months, just like the rest of the market, its price movement hasn’t been as steep as the movements of alts such as VeChain, Chainlink, and UNI. The month of April was especially bullish for TRX, with the alt climbing by over 45% in a week.

At press time, however, TRX was yet to recover from the corrections that later set in, with the alt’s latest price candles accompanied by ill-supported trading volumes.

While the Parabolic SAR’s dotted markers highlighted the bearishness of the market with its placement above the price candles, Relative Strength Index was holding firm between the oversold and overbought zones.

TRON was in the news recently after Tether on the blockchain surpassed the volume of USDT on Ethereum.

Neo [NEO]

Source: NEO/USD on TradingView

Neo, the crypto ranked 21st on CoinMarketCap’s charts, was one of the many alts to surge on the back of the altcoin market’s bullishness in April. In fact, NEO hiked by almost 100% in less than 10 days, with the same touching the $120-mark too. While corrections had set in over the last few days, the crypto was still trading at a level unseen in months, at press time.

That being said, the altcoin’s valuation was still under 50% away from its ATH of $198.38.

The widening mouth of Bollinger Bands suggested that some price volatility was inevitable in the short-term. MACD line was climbing well above the Signal line, underlining the bullishness in the market despite recent bouts of depreciation.

In some quarters, it is believed that China’s interpretation of cryptos like Bitcoin as investment tools, rather than as currencies, has contributed to the growth of more “China-friendly” alts like Neo.

Klaytn [KLAY]

Source: KLAY/USD on TradingView

2021 has seen KLAY hike up the charts, with the surge in its price accompanied by the altcoin climbing up CoinMarketCap’s charts to position itself at 24th, at press time. However, contrary to the rest of the market, the month of April hasn’t been the best for KLAY, with the crypto falling by over 40% since the 1st.

At press time, while some recovery was afoot on the hourly timeframes, the same hadn’t been well reflected on the daily timeframes. While KLAY did register some price appreciation over the last 48 hours, it was fairly insignificant in relative terms.

While Chaikin Money Flow was holding steady right under the half-line to highlight the continuing strength of capital outflows in the market, Awesome Oscillator’s histogram was in the negative zone despite an uptick in momentum.

Terra [LUNA]

Source: LUNA/USD on TradingView

LUNA’s price action has mirrored KLAY’s, rather than the broader altcoin market. While 2021 did see the crypto hike consistently on the price charts, the alt has been on a downtrend since the last week of March. In fact, LUNA was down by almost 40% since. At the time of writing, a trend reversal in the alt’s value seemed unlikely over the near term since trading volumes were very low.

While Bollinger Bands were holding steady and pointed to steady price volatility, Relative Strength Index was skirting the oversold zone. Another period of depreciation on the price charts could pull the RSI well into the oversold zone.

![Why Chainlink [LINK] and Polygon [MATIC] are more similar than you realise](https://ambcrypto.com/wp-content/uploads/2024/04/Chainlink_and_Polygon-1-400x240.webp)