Tron [TRX] bulls should keep an eye on these triggers before going long

![Tron [TRX] bulls should keep an eye on these triggers before going long](https://ambcrypto.com/wp-content/uploads/2024/07/TRX-YASH-1200x686.jpg)

- Tron saw a strong rebound as it broke above a crucial resistance level.

- However, the altcoin struggled to back its recent rally with high volumes.

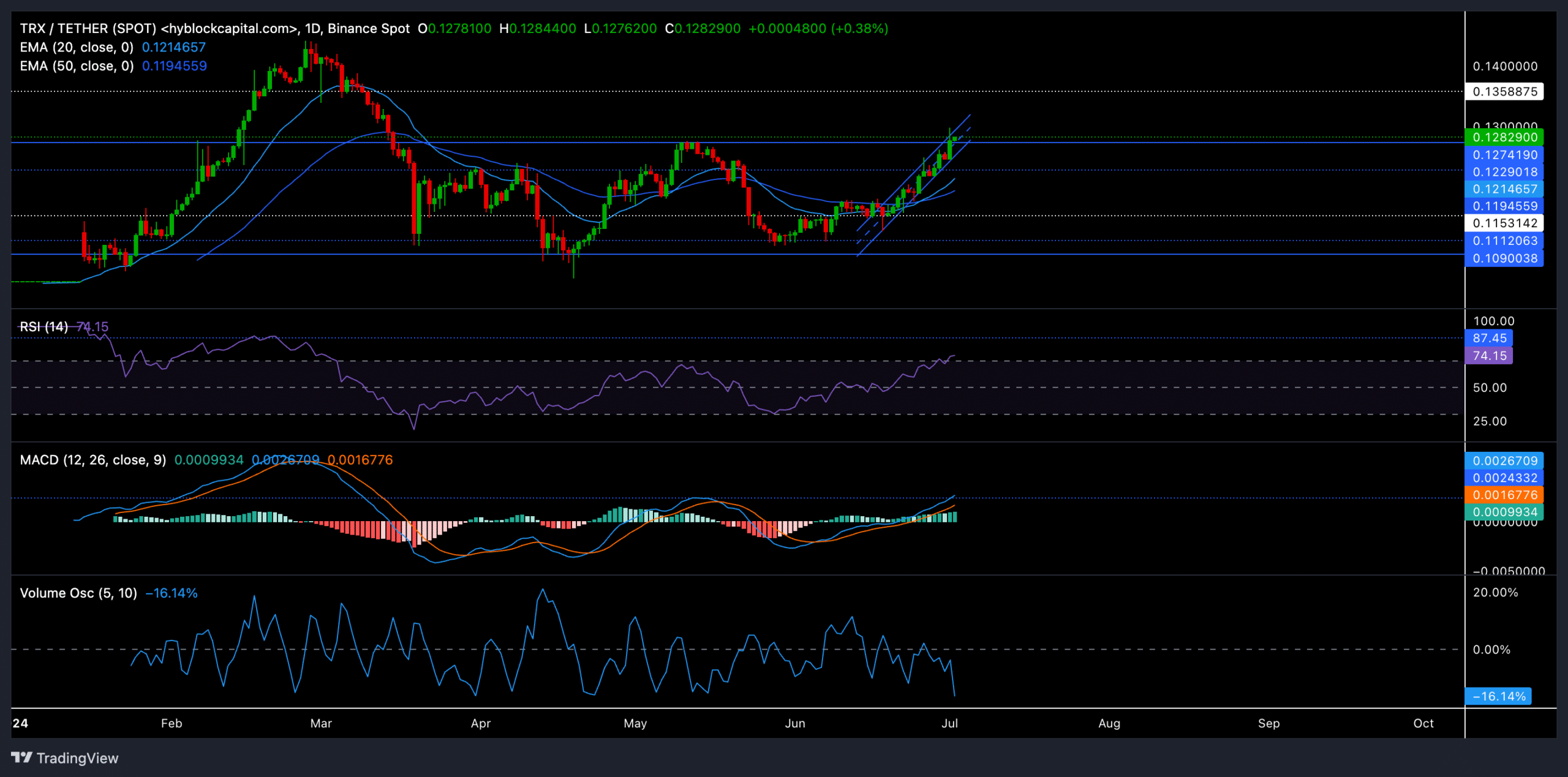

Tron [TRX] saw double-digit gains over the last two weeks after a convincing rebound from the $0.115 level support. The resulting rally formed a bullish pattern on the daily chart.

Should the bulls continue their ongoing rally, TRX could see an extended uptrend before a likely bearish reversal. At the time of writing, the altcoin was trading at nearly $0.128, up by over 2% in the past day.

Can TRX bulls continue this uptrend?

In the second and third weeks of May, TRX bears caused a downturn which correlated with the broader market decline. However, TRX bulls found renewed power at the $0.111 support level.

The altcoin then saw an over 11% jump in the past two weeks as the coin broke above the crucial $0.127 resistance level at press time. As a result, TRX closed above its 20-day and 50-day EMA on the daily chart.

Recent price movements have created an ascending channel pattern on the chart. If the bulls continue to exert pressure and keep the price above the $0.127 support level, TRX could continue its ongoing rally.

The $0.135 region could be the first major resistance in this case.

On the contrary, an immediate decline below the current ascending channel pattern could ease the bullish edge. The first major support level would be near the 20 EMA in the $0.11 range, followed by the $0.109 level.

The Moving Average Convergence Divergence (MACD) jumping above the zero level confirmed a strong shift in momentum toward the buyers.

The MACD line’s sustained close above the immediate resistance level could extend the uptrend for a while before likely reversing.

On the other hand, the Volume Oscillator witnessed a streak of lower highs and lows as it saw a bearish divergence with the TRX price.

A decrease in Funding Rates

According to Coinglass data, TRX’s Funding Rate was on a slight downtrend and even turned negative over the past day. This showed a rather declining investor interest in the Futures market.

Read Tron’s [TRX] Price Prediction 2024-25

Nonetheless, the Open Interest saw an uptick of over 12% in the last 24 hours, which coincided with the increase in price.

Buyers should keep an eye on Bitcoin’s [BTC] movement and assess its impact on the broader sentiment before making a buying decision.

![Dogecoin [DOGE] drops 16% – But is a $0.25 rally now loading?](https://ambcrypto.com/wp-content/uploads/2025/06/08519350-41B0-4D47-8530-DADB272A4AD3-400x240.webp)