TRON [TRX] is ready for a further rally; investors can profit from this level

- TRX was in a bullish market structure.

- A break of the current support resistance at the 38.2% Fib level ($0.5345) is possible.

- TRX saw improved sentiment and an increase in funding rates from Binance Exchange.

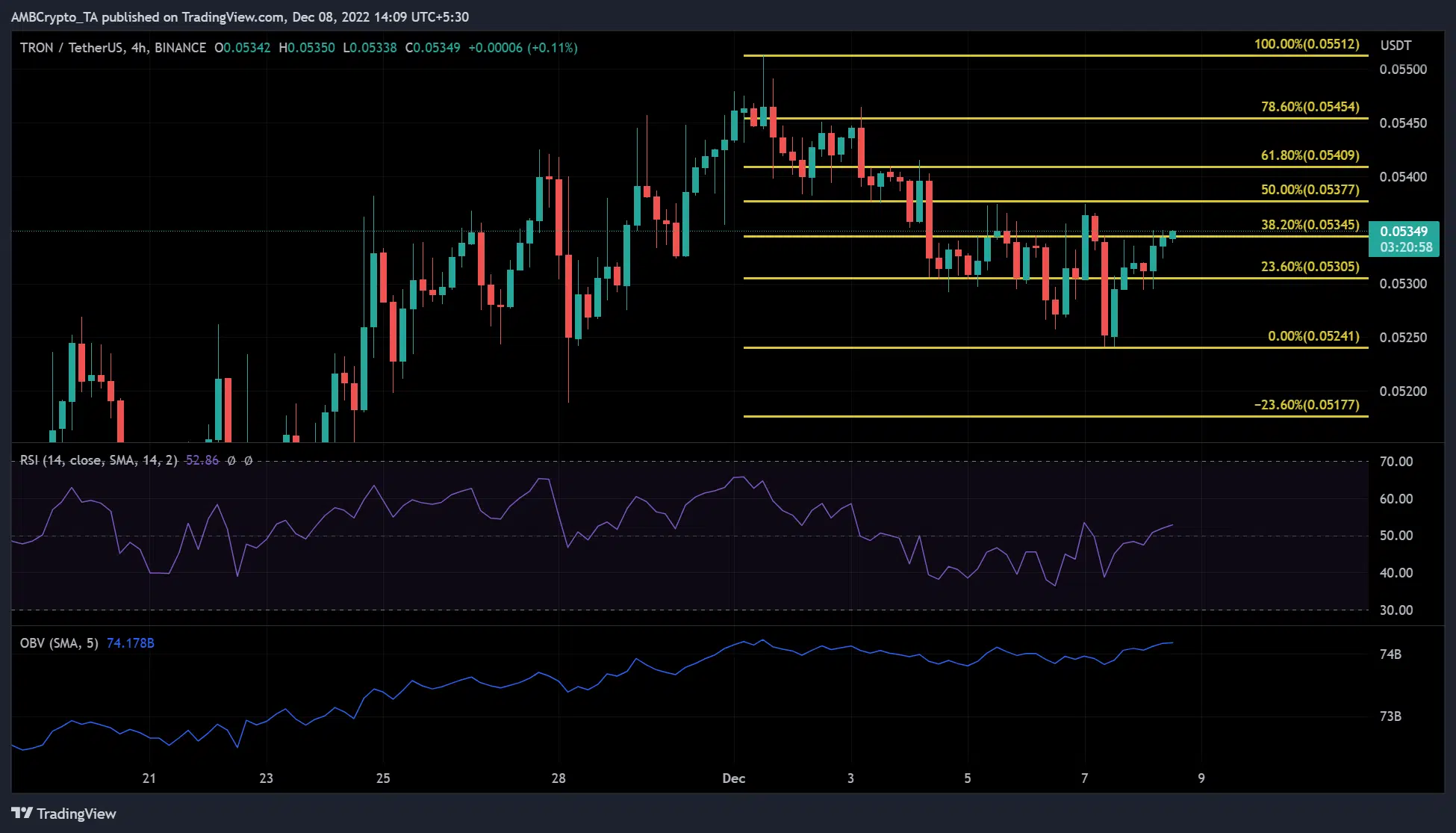

TRON (TRX) is poised to rally further as technical indicators point to a massive uptrend. At press time, TRX was trading at $0.05349 and looked primed to break through current resistance at the 38.2% Fib level.

In other news: Tether chose the TRON network for its latest Chinese Yuan (CHNT) launch. Adding this development to the impressive metrics and technical indicators, TRX is facing massive gains in the near term.

TRX’s bulls face the current resistance: Will the uptrend continue?

The immediate hurdle for TRX is the current resistance at the 38.2% Fibonacci retracement level ($0.05345). However, the technical indicators on the 4-hour charts suggest that the bulls could break this level.

In particular, the Relative Strength Index (RSI) climbed out of the lower range and was slightly above the neutral point with an uptick. This shows that selling pressure has been steadily easing, and the bulls have significant leverage in the current market.

Accordingly, the On Balance Volume (OBV) recorded increasing trading volumes indicating increasing buying pressure. Therefore, TRX could break out above the current resistance at $0.05345. Then, bulls can focus on the new target at the 50% Fib level ($0.05377).

However, a candlestick close below the current support at $0.05305 would negate this prediction. In this case, new supports could be found at $0.05372 and $0.05341 if TRX drops lower.

TRX saw improved weighted sentiment but a decline in development activity

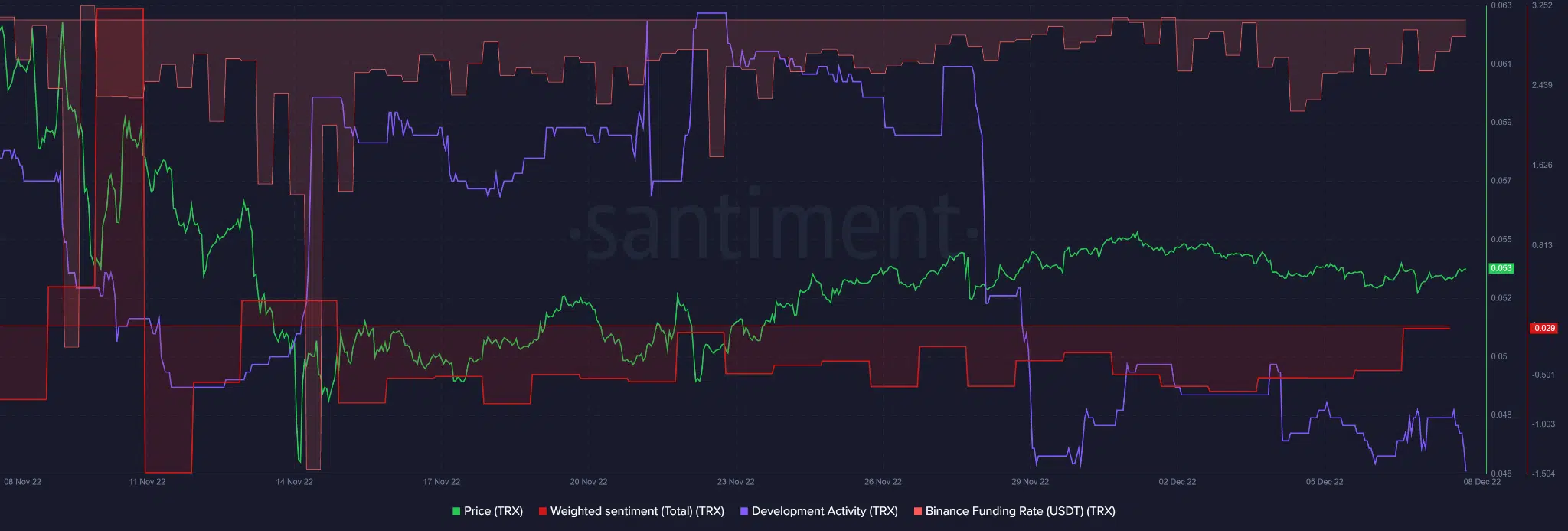

TRX also recorded an improvement in weighted sentiment. According to Santiment, weighted sentiment pulled back from negative territory and was neutral at the time of publication.

This indicates a change in sentiment from bearish. A strong bullish outlook could further boost TRX’s price rally if sentiment turns positive and moves higher.

Accordingly, the Binance Funding Rate rose from deeply negative territory and climbed to the neutral level. This shows that the TRX derivatives market is also moving towards a bullish outlook. Taken together, these metrics indicate additional room for a further TRX price rally.

However, TRX’s development activity took a nosedive at the time of publication. Moreover, any bearish sentiment on BTC could undermine a further price rally. Therefore, TRX investors should closely monitor BTC’s performance.

![Magic Eden crypto [ME] surges post-listing, but concerns rise](https://ambcrypto.com/wp-content/uploads/2024/12/Magic_Eden-1-400x240.webp)