Analysis

TRON [TRX] price drop: Could short traders see gains in 2023

![TRON [TRX] price drop: Could short traders see gains in 2023?](https://ambcrypto.com/wp-content/uploads/2022/12/night-926455_1920-1000x600.jpg)

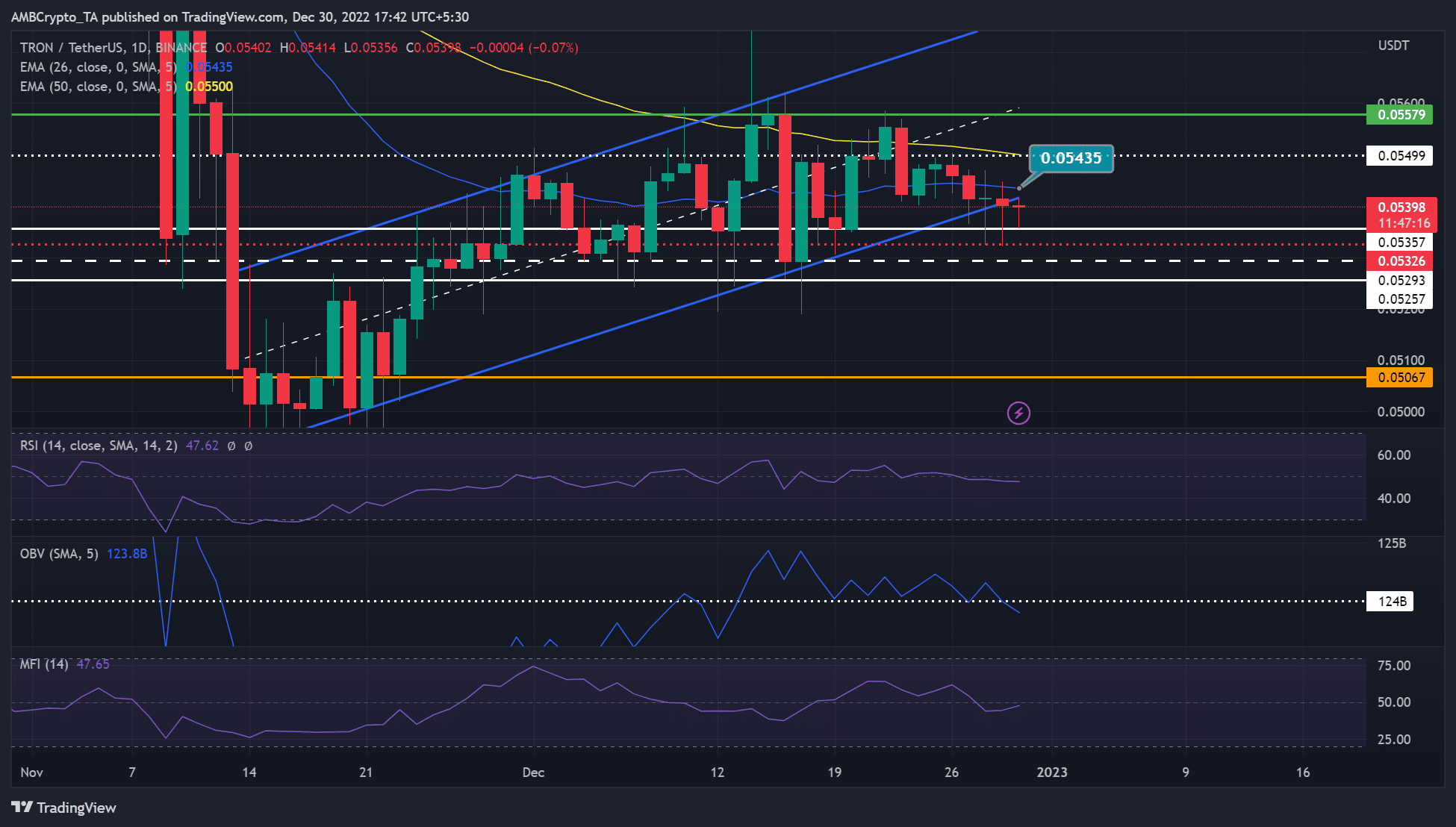

- TRX was in a price correction that could break below $0.05357.

- A break above the 50-period EMA of $0.05500 would invalidate the above bias.

The TRON [TRX] network recently saw massive partnerships and development activity. Binance-pegged USD [BUSD] was the latest integration on the TRON platform, which allowed users to deposit and withdraw the stablecoin through the network.

?@binance has completed the integration of Binance-Peg BUSD on the #TRON network.

?Deposits and withdrawals for Binance-Peg BUSD are now open on #TRON.

?Ringing in more #TRONICS

support for @binance @BNBCHAIN! pic.twitter.com/Y6b42Ugotn— TRON DAO (@trondao) December 30, 2022

TRX, the network’s native token, also saw massive gains of over 25% after the crypto market crash. It rose from its November low of $0.04528 to a mid-December high of $0.05763.

At press time, TRX was trading at $0.05398. The price was in a pullback that could break below $0.05357 and settle at new support at the following level.

Read TRON’s [TRX] Price Prediction 2023-24

Will short-term support for TRX at $0.05367 hold?

TRX’s rally and price action after the market crash formed a rising channel pattern on the daily chart. Rising channel patterns are common bearish patterns.

However, TRX broke below the channel but was kept in check by short-term support at $0.05357. Nevertheless, TRX could fall to $0.05326 or $0.05293 in the next few days/weeks if buying pressure weakened.

The Relative Strength Index (RSI) slowly moved below the mid-range after a gentle drop from the upper range. This suggested that buying pressure had eased slightly as the bulls faced intense resistance from the sellers.

The on-balance volume (OBV) has also steadily declined since mid-December, undermining the necessary trading volume that could increase buying pressure.

Therefore, TRX could fall to $0.05326 or $0.05293, providing short-selling opportunities.

However, a break above the 50-period EMA of $0.05500 would invalidate the above bias. First, the bulls must overcome the short-term obstacle at the 26-period EMA of $0.05435. Such an upswing will also give the bulls leverage to target the bearish order block at $0.05579.

Investors should watch for an upswing if MFI convincingly rises above the midpoint of 50. Such a move would indicate a massive continuation of accumulation.

TRON saw increased development activity, and NFT trade volumes

TRON saw a steady increase in development activity after 25 December. The growth boosted investor confidence only briefly before weighted sentiment fell deeper into negative territory.

Are your TRX holdings flashing green or red? Check with Profit Calculator

In addition, TRON saw an increase in NFT trading volume from $350,000 after 25 December to approximately $1 million on 29 December. At press time, NFT trading volume was $420,000.

But the above growth metrics didn’t change sentiment at the time of publication. Although they could positively impact TRX prices in the long run, investors should add BTC’s performance to their watch list to gauge TRX’s potential price direction.