Analysis

Tron (TRX) pulls back: Is now the time to buy for a $0.223 rally?

The Fibonacci extension level at $0.2 and the 100% extension at $0.223 would be the next long-term bullish targets.

- The performance in September compared to BTC was subpar

- The higher timeframe outlook was firmly bullish and large gains were likely

TRON [TRX] could not keep up with the market-wide bullish sentiment in the latter half of September. However, this lack of short-term bullishness is not an indictment of the buyers’ strength.

TRX’s performance in recent months has been remarkably bullish. While Bitcoin [BTC] and the rest of the altcoin market have slumped since April and May, TRX has managed to surpass those highs.

Range breakout and consolidation for TRON (TRX)

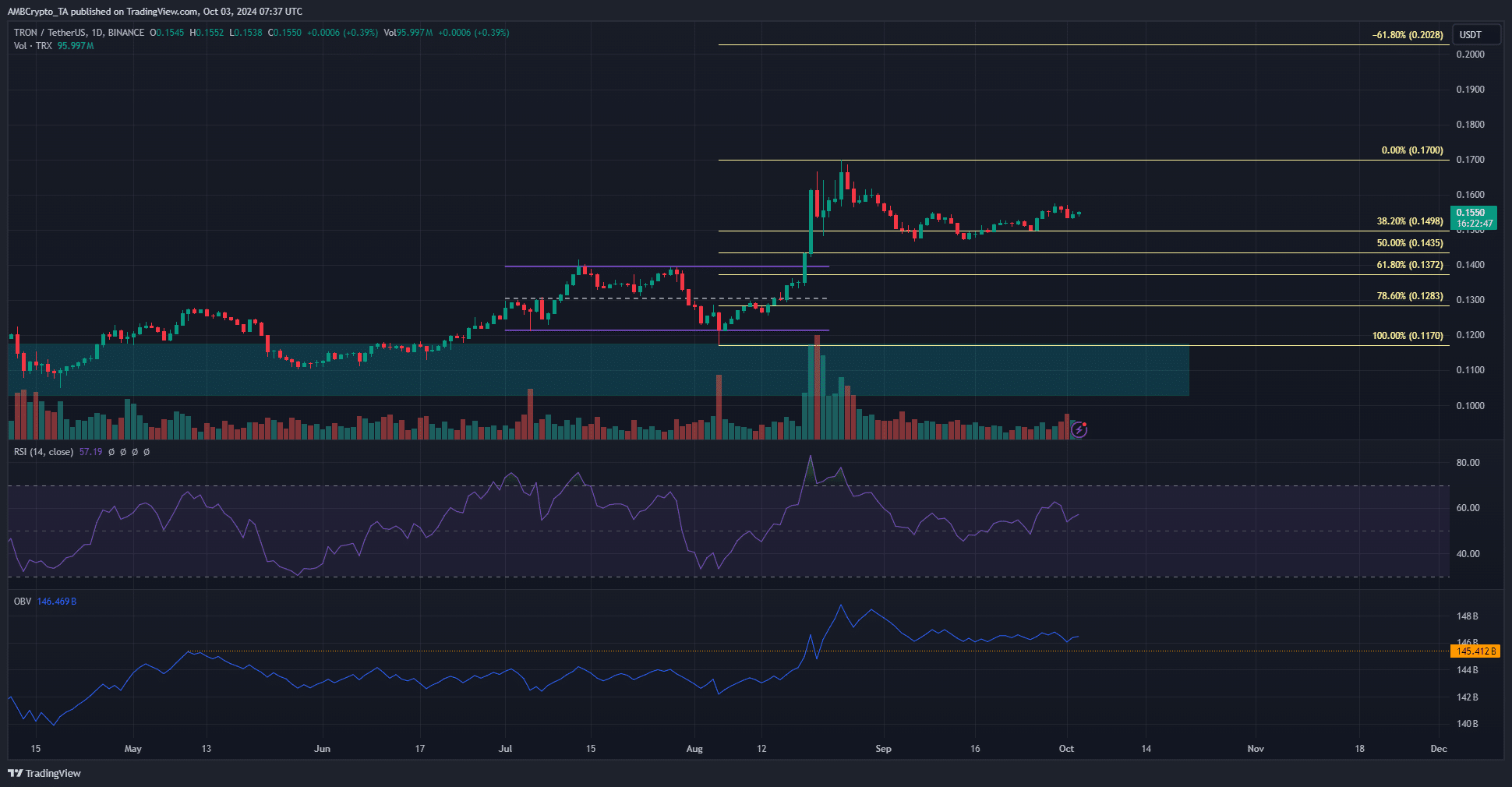

In mid-August, TRON prices raced past a local range formation, moving 22% higher than the local highs at that time. Since then, the price has pulled back to the 38.2% retracement level at $0.15 and consolidated around this zone.

The RSI on the daily chart remained bullish in the past month, and the OBV did not sink beneath the May highs. This showed that selling pressure was not strong enough to warrant expectations of a downtrend.

The steady TRX consolidation above $0.144, the highs from February, was an exciting sight for long-term holders. The stable price action and reduced selling pressure promised large gains in due time.

The Fibonacci extension level at $0.2 and the 100% extension at $0.223 would be the next long-term bullish targets. Swing traders can wait for a drop to $0.128-$0.137 before buying in the coming weeks.

Price targets for October

Source: Coinglass

The liquidation heatmap showed that the nearest magnetic zones for the price were at $0.152 and $0.158. In the coming days, these would likely be the areas where a bullish and bearish reversal respectively is expected to occur.

Read TRON’s [TRX] Price Prediction 2024-25

In particular, the cluster of liquidation levels around the $0.16 level could attract prices to it before a reversal in the short-term momentum.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion