Tron’s [TRX] Stake 2.0 launch failed to meet expectations: Decoding why

![Decoding why Tron’s [TRX] Stake 2.0 launch failed to meet expectations](https://ambcrypto.com/wp-content/uploads/2023/04/TRX-2.png)

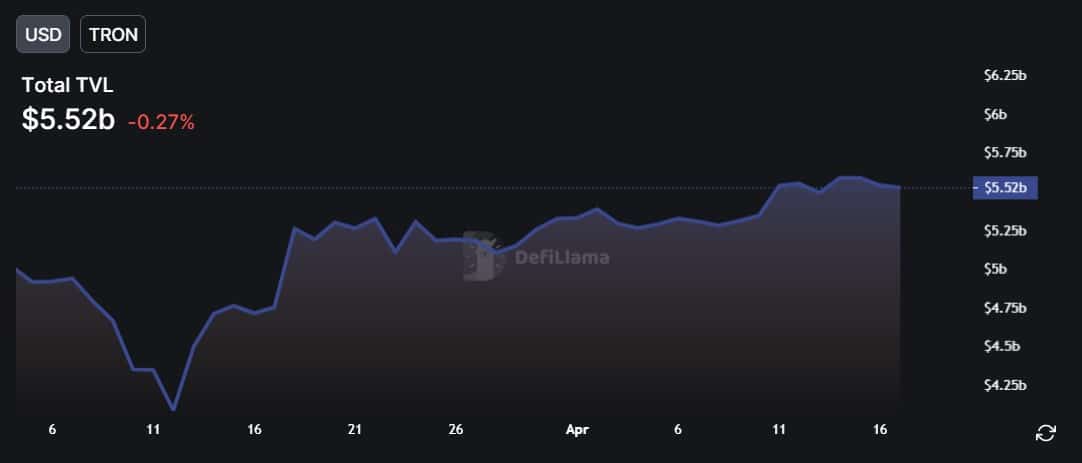

- TRON’s TVL has not increased much since the Staking 2.0 launch

- Tron still remained the top blockchain by daily users, but revenue declined slightly

Tron [TRX] posted its weekly highlights on 16 April, which mentioned all the notable developments of the week. Needless to say, the Stake 2.0 launch was the major event of the week.

?Check out #TRON Highlights from this week (Apr 8, 2023 – Apr 14, 2023).

?We'll update you on the main news about #TRON and #TRON #Ecosystem. So stay tuned, #TRONICS! pic.twitter.com/pjnQIBbfwU

— TRON DAO (@trondao) April 16, 2023

Realistic or not, here’s TRX market cap in BTC’s terms

A few days after the launch, NOW Wallet integrated Stake 2.0, allowing users to stake TRX. Several expected TRON’s TVL to go up with the launch of Stake 2.0 as it brought flexibility to stakers. However, this does not seem to be the case, as its TVL did not increase much.

Not many expected Stake 2.0’s launch

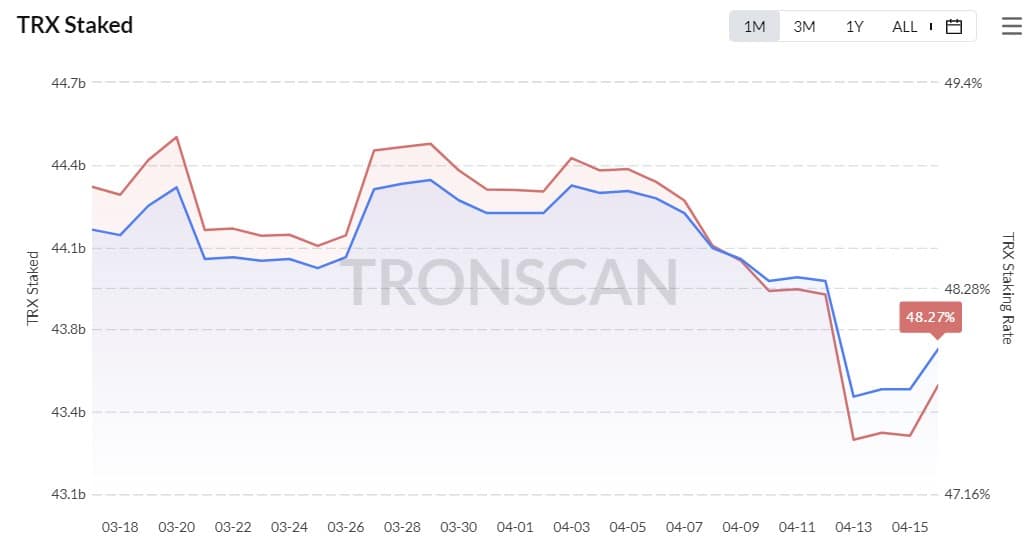

Considering the added capabilities and features that Stake 2.0 brought, it was likely that more stakers would be interested in staking TRX. However, the opposite happened as the number of TRX holders declined sharply over the last week.

As per TRON scan, the number of both TRX stakes and stakers declined sharply since the Stake 2.0 launch.

Tron still #1, but there’s more to the story

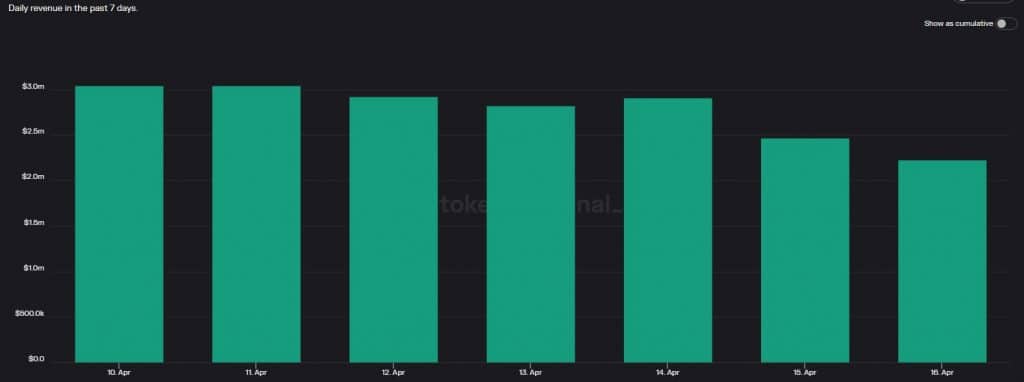

According to Token Terminal, Tron was still sitting in the top position on the list of blockchains with the highest number of daily active users. However, the growth might have halted, as despite the increase in total accounts, active accounts have declined since 12 April. A marginal decline was also noted on the revenue front last week, which was a negative signal for Tron.

Assessing TRX’s weekly performance

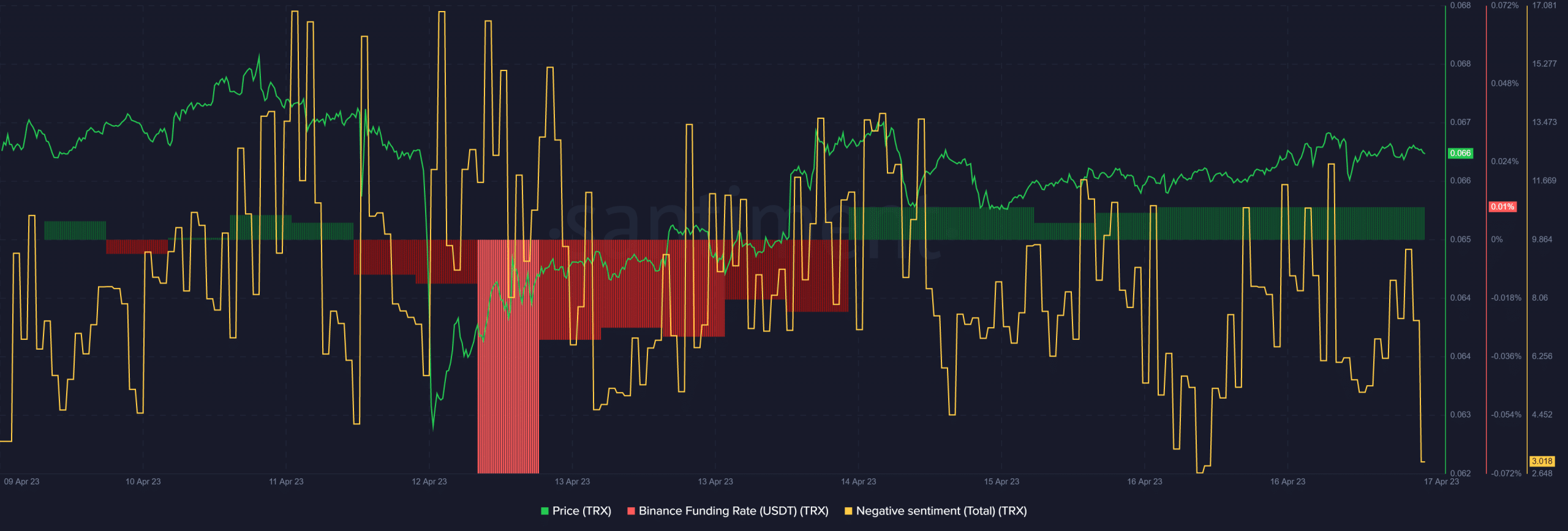

TRX also had a rough week as its price plummeted drastically on 12 April. The decline was caused when Binance revealed that TRX would be among the cryptocurrencies to be delisted from the exchange.

Nonetheless, TRX made a quick recovery, and at the time of writing, it was trading at $0.0664 with a market capitalization of over $6 billion. TRX’s burn rate, however, remained decent as the network burned 15,263,107 TRX on 16 April.

Thanks to the decline, negative sentiments around TRX were dominant in the market last week. During the price drop, TRX’s demand fell drastically in the derivatives market. It was good to see that later on, TRX’s demand went up, as evident from its Binance funding rate.

How much are 1,10,100 TRXs worth today?

Few days of dormancy to follow

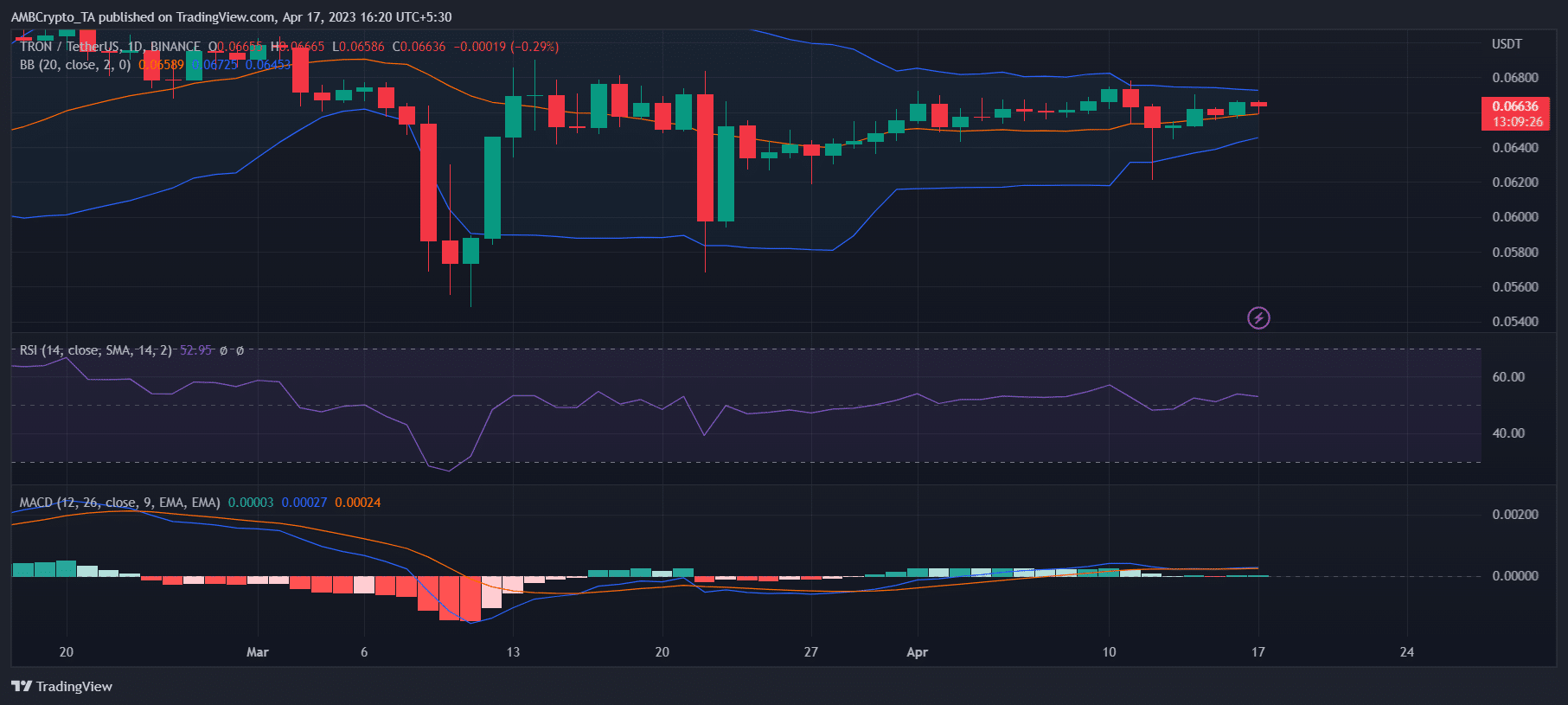

A look at TRX’s Bollinger Bands revealed that the token’s price was entering a less volatile zone, increasing the chances of sideways price action in the near term.

The Relative Strength Index (RSI) was also resting just above the neutral mark of 50, giving a similar notion of dormancy. As per the MACD, the bulls and the bears were fighting to flip each other. It will therefore be intriguing to see who triumphs in the coming days.