Troubled SushiSwap investors could ease up thanks to SUSHI’s latest…

- SushiSwap’s trade volume stayed below that of Uniswap’s as per data from Kaiko

- On the price front, SUSHI witnessed a drop of 0.35% in the last seven days

Decentralized exchange SushiSwap [SUSHI] hasn’t been at its best for a while now. The exchange had an even worse time over the last few days.

Just recently SushiSwp fell victim to a white-hat exploit that led to a loss of almost 1800 ETH. To add to the list of bad news, SushiSwap’s trade volumes painted a disappointing picture especially in the last year.

As per crypto analysis platform Kaiko, SushiSwap stayed below Uniswap’s trade volumes for most part of the year. However, the former’s trading volume did manage to surpass Uniswap only once.

?SushiSwap has had a rough year.

Trade volumes surpassed Uniswap V2 only once in the past 66 weeks (not even looking at V3).

What is the future of the once second largest #DEX? pic.twitter.com/wKYwcOLVjc

— Kaiko (@KaikoData) April 11, 2023

Read SushiSwap’s [SUSHI] Price Prediction 2023-24

Who’s up for some SUSHI?

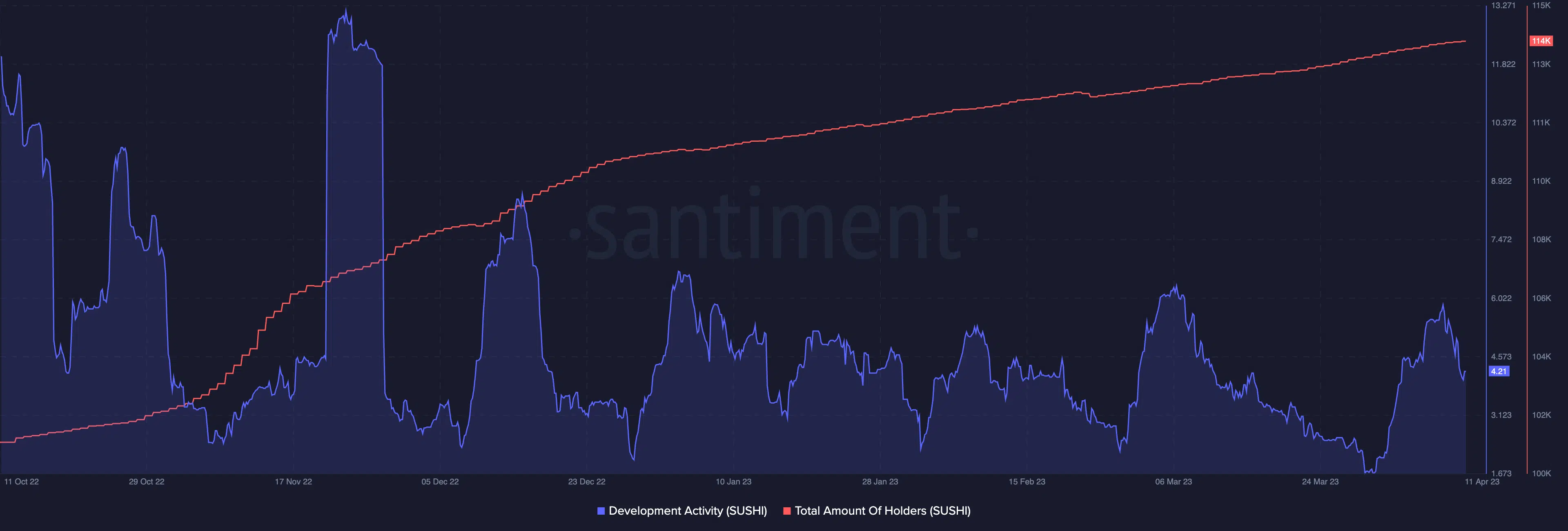

At the time of writing, SushiSwap failed to hold up its fort. As per data from Santiment, development activity on the SushiSwap network didn’t seem at its best.

Furthermore, it witnessed a drop after it managed to surged a little on 8 April. However, the total amount of holders didn’t witness a significant drop as expected and managed to remain on the same lines as compared to the last few days.

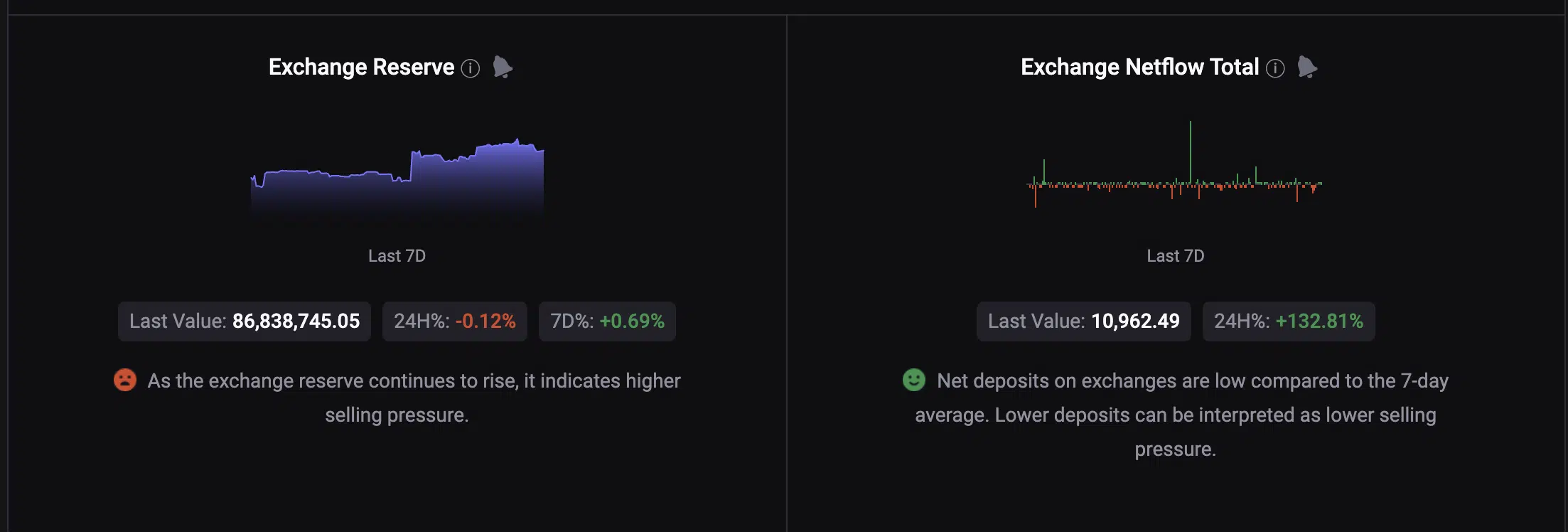

As per additional data from data analytics platform CryptoQuant, SUSHI’s total exchange netflow witnessed a downfall over the last seven days. This could be taken as a positive update.

However, SUSHI’s exchange reserves over the last 24 hours witnessed a rise. A surge in the exchange reserves could indicate a higher selling pressure for SUSHI in the coming days.

Upon taking a look at the address growth, data from Glassnode showed that there was no significant movement in the number of new addresses on the network. At press time, the number of new addresses stood at 87, which was on the lower end as compared to the last seven days.

Hang in there SUSHI!

At the time of writing, SUSHI was exchanging hands at $1.14. As seen in the chart given below, SUSHI flashed green at press time. Furthermore, its Relative Strength Index (RSI) seemed to moving away and upwards from the neutral line. At press time, SUSHI’s RSI stood at 53.50.

How much are 1,10,100 SUSHIs worth today?

Additionally, the Moving Average Convergence Divergence (MACD) also stood in favor of the token. With the MACD line crossing over the signal line, it could be seen the price could witness a surge. The histogram too flashed green which was an indication of a price surge for SUSHI.

A look at the Money Flow Index (MFI) further indicated that the price could witness an uptick with the indicator moving hovering above the neutral line.

So has SUSHI left behind its bad days? That can only be the case if SUSHI continues on its bullish trajectory over the course of the next few days. Traders are however advised to maintain caution.