Trump signs order for U.S. Bitcoin Reserve—But there’s a catch…

- Trump’s executive order calls for the creation of a U.S. Bitcoin reserve, utilizing existing government-held cryptocurrency assets.

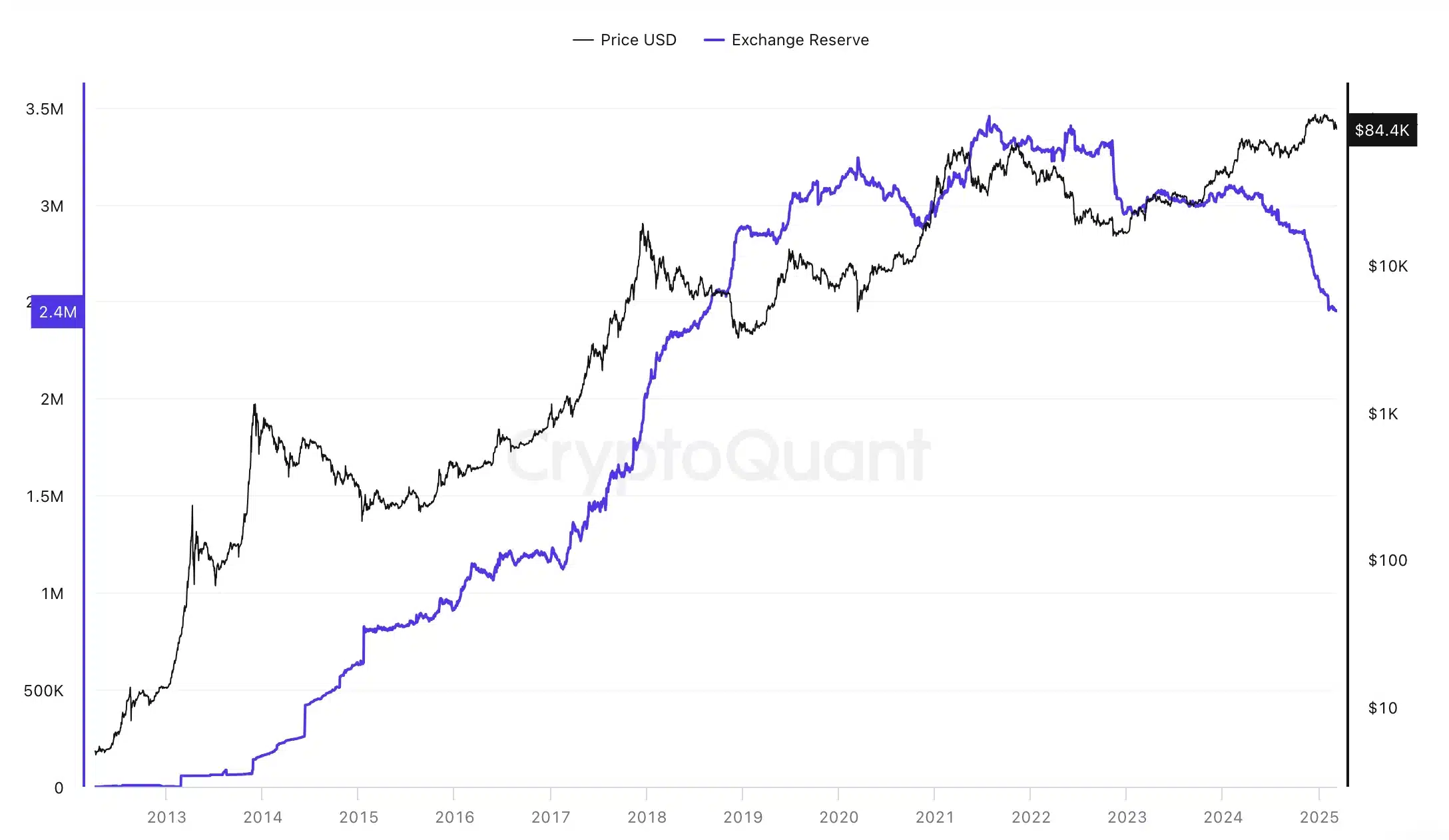

- Declining exchange reserves signal bullish sentiment but raise concerns over market liquidity.

In a groundbreaking move, U.S. President Donald Trump has taken a significant step toward integrating cryptocurrencies into the nation’s financial strategy.

Trump’s Bitcoin Reserve plan takes shape

On the 6th of March, Trump signed an executive order to establish a strategic reserve of digital assets, leveraging tokens already in government possession rather than acquiring new ones—falling short of market expectations for fresh purchases.

Trump hosted an exclusive White House summit with top cryptocurrency leaders, building on this initiative, and outlining his vision for a government-backed crypto stockpile.

This unprecedented engagement signals a shifting regulatory landscape, with potential implications for Bitcoin [BTC] and the broader digital asset market.

Additionally, the possibility of the U.S. establishing a Bitcoin reserve has gained momentum, with market predictions shifting from 24% to 32%, according to Polymarket data.

This growing speculation has already sparked discussions across several states, with Utah, Arizona, and Ohio actively discussing the potential implications of a government-backed Bitcoin reserve.

However, not all states are on board—South Dakota, Montana, and others have outright rejected related legislative efforts.

As perspectives continue to diverge, the anticipation surrounding a U.S. Bitcoin reserve is intensifying.

Why are exchange reserves declining?

Meanwhile, exchange reserves are plummeting, signaling a potential supply squeeze, as highlighted by Moon Whales.

“The US is creating a Strategic #Bitcoin Reserve. Meanwhile, exchange reserves are in free fall.”

CryptoQuant data further reinforces this trend, revealing that exchange reserves continue to decline.

Investors are increasingly moving their holdings to private wallets, showing a preference for long-term storage over immediate selling.

A shrinking exchange reserve often indicates bullish sentiment, as reduced supply can create a potential supply squeeze if demand rises.

This trend also reflects growing interest in DeFi, staking, and cold storage solutions for enhanced security and alternative yield opportunities.

While lower reserves can boost prices, they may also reduce market liquidity, increasing volatility due to fewer tradable assets.

What lies ahead?

Meanwhile, Bitcoin’s price remains under pressure, trading at $84,557.57, at press time, after a 1.89% drop in the past 24 hours, according to CoinMarketCap.

Additionally, some segments of the market continue to show bullish optimism, anticipating long-term gains, yet overall momentum appears fragile.

As expected these shifts have kept traders on edge, with Bitcoin’s next move likely hinging on broader adoption trends and institutional interest.

![Ripple [XRP]’s subtle rebound – Will strong derivatives bets trump weak on-chain signals?](https://ambcrypto.com/wp-content/uploads/2025/04/E3CB2045-31A3-4BD4-B5BC-2142FF334BE1-400x240.webp)

![Shiba Inu [SHIB] price prediction - A 70% rally next after 300%+ burn rate hike?](https://ambcrypto.com/wp-content/uploads/2025/04/Erastus-2025-04-12T132907.604-min-400x240.png)