Trump’s crypto plan raises alarm bells: What’s going on?

- Trump’s crypto support fuels election optimism; forecasts give him a 64.8% chance of winning.

- Concerns arise over potential conflicts of interest with Trump’s proposed financial projects.

Since the start of this election cycle, former President Donald Trump has been outspoken in his support of cryptocurrency, gaining backing from various supporters who believe he should win the presidency.

In a recent post by Autism Capital, they pointed out how Elon Musk also sees potential for a revival of the U.S. economy if Trump secures a win.

The post included a video of Musk speaking at an event, where he said,

Crypto community supports Trump

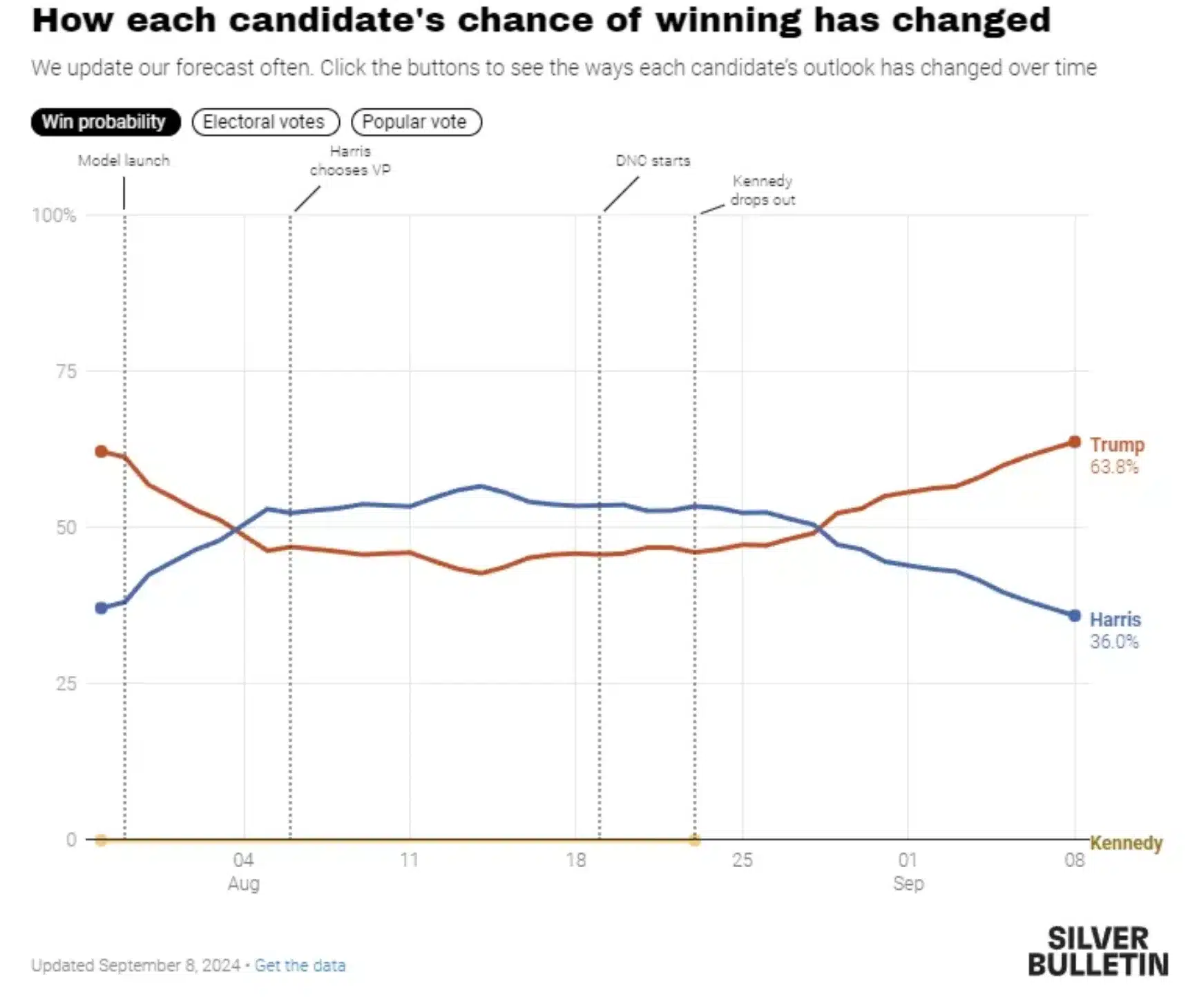

Additionally, a recent post by Crypto Rover, founder of @cryptoseacom, shared election forecasts suggesting that Trump has a 64.8% chance of winning.

He also added,

“Also $725 billion Bernstein predicts that if Trump is re-elected, #Bitcoin could reach $90,000 by the end of this year. BULLISH!”

This highlighted the growing support Trump is garnering from the crypto community and beyond.

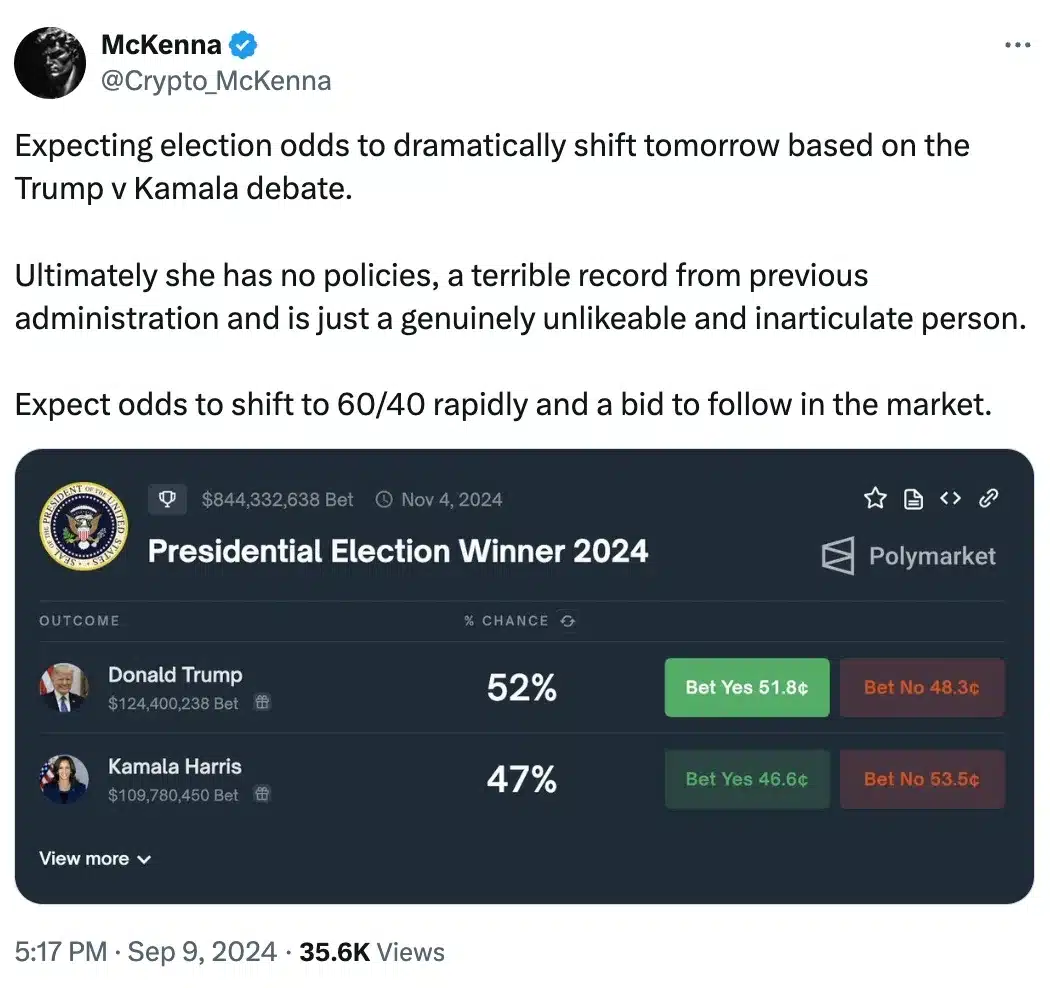

The confidence is so strong that, despite the scheduled debate between President Trump and Vice President Kamala Harris, on the 10th of September, many believe the election odds are unlikely to see any significant shift.

Reiterating the same, X (formerly Twitter) user Crypto_McKenna added,

Lingering concerns surrounding Trump’s new plan

Amidst the prevailing optimism surrounding Trump’s potential victory, a recent Wall Street Journal report has raised concerns about potential conflicts of interest tied to his re-election.

The report highlights the World Liberty Financial project, which, while details remain limited, aims to promote “U.S.-pegged stablecoins around the world” and reinforce the dominance of the U.S. dollar.

This initiative could introduce new layers of complexity and scrutiny, potentially leading to fresh conflicts of interest if Trump secures another term.

The concern over Trump’s potential influence on cryptocurrency regulations stems from fears that he might promote rules benefiting his own projects, such as World Liberty Financial.

There is also apprehension that businesses could be drawn to invest in Trump’s financial products in an effort to gain favor with his administration.

This is because, during his first last presidency, Trump’s business dealings raised ethical issues, with 2022 documents revealing that foreign officials spent large sums at the Trump International Hotel in hopes of securing advantageous deals.

While the president cannot directly control the dollar’s value, his fiscal policies could indirectly affect it.

What’s more to it?

This initiative has even faced criticism from Trump’s supporters within the crypto community, such as Nic Carter of Castle Island Ventures, who labeled it a “huge mistake.”

Adding to the fray was Jordan Libowitz, a spokesperson for the government watchdog group Citizens for Responsibility and Ethics in Washington, who said,

“Taking a pro-crypto stance is not necessarily troubling; the troubling aspect is doing it while starting a way to personally benefit from it.”

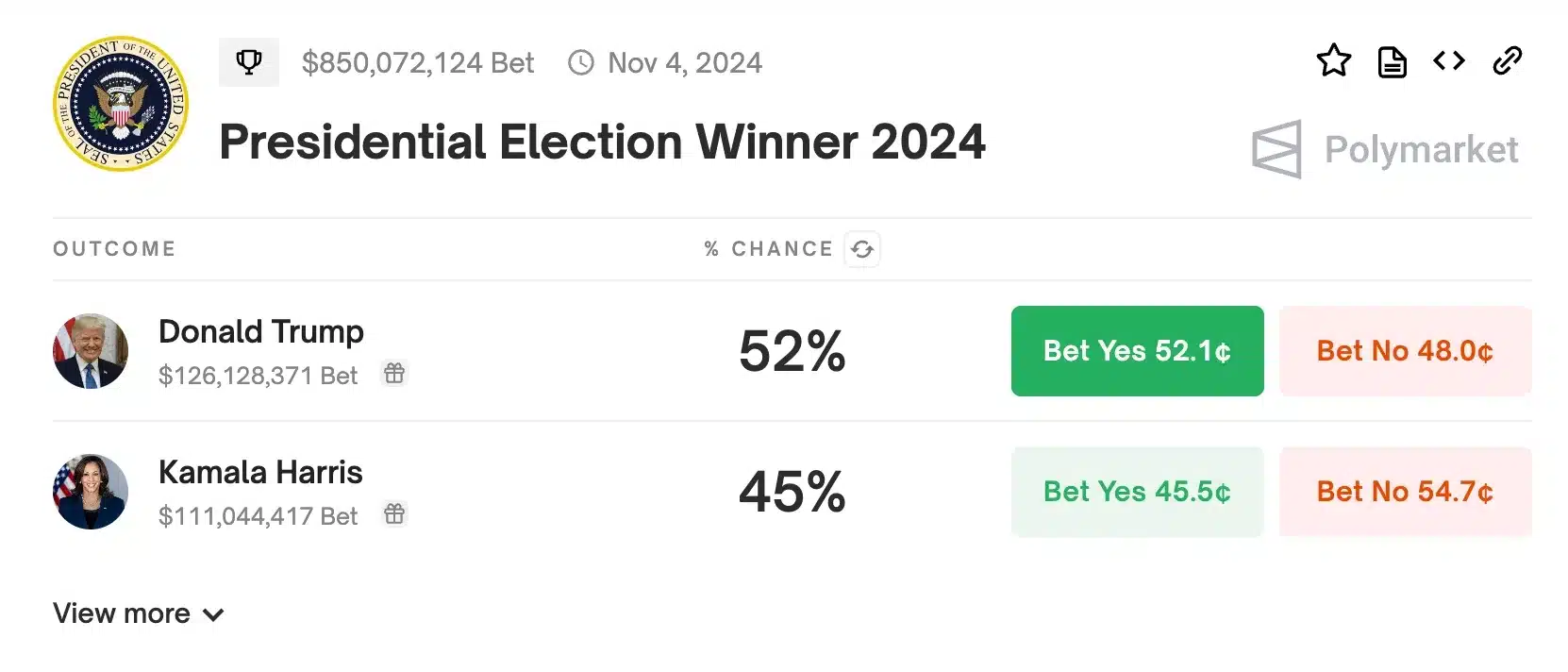

Despite these concerns, the Polymarket prediction market remains unaffected.

As of the latest update, Trump leads with 52% of the projected votes, while Harris has dropped from 47% to below 45%.