Trump’s presidency: A game changer for XRP, Solana ETFs?

- Bitcoin and Ethereum ETFs experienced significant outflows on the 1st of October, totaling millions.

- U.S. election results could shape the regulatory landscape for XRP and SOL ETFs.

Bitcoin [BTC] and Ethereum [ETH] exchange-traded funds (ETFs) experienced significant outflows on the 1st of October.

BTC ETFs saw withdrawals totaling $242.6 million and ETH ETFs recorded outflows of $48.6 million.

Can Trump boost SOL and XRP ETFs?

Amidst this fluctuating ETF market, recent discussions have emerged suggesting that the outcome of the upcoming U.S. presidential election could influence the regulatory landscape for crypto ETFs, particularly those involving assets like Ripple [XRP] and Solana [SOL].

Speculation abounds that a potential victory of Donald Trump might impact these digital asset ETFs’ future approvals and performance.

In a recent thread on X (formerly Twitter), Bloomberg analyst Eric Balchunas highlighted the challenges faced by new cryptocurrency ETFs, such as those for SOL and XRP, under the strict regulatory oversight of SEC Chairman Gary Gensler.

Balchunas emphasized that Gensler’s firm stance on the crypto market has complicated the approval process for these ETFs, impacting major industry players like Binance and Coinbase.

Reiterating Trump’s pledge to fire Gensler upon taking office, Balchunas in a post on the 2nd of October said,

“You’ve heard of the Fed Put. This is like the Trump Call.. filings for XRP or Solana or any other alt coins are basically like a cheap call option on a Trump win as Genz will be gone and anything’s poss. Harris wins no way these get approved, and the “call” expires worthless.”

Bitwise’s move to launch XRP ETF

This comment comes on the heels of Bitwise’s recent move to establish an XRP ETF, which was marked by the registration of a trust entity in Delaware.

The timing is significant, as it aligns with the SEC’s impending deadline to appeal Judge Torres’ ruling, which determined that secondary XRP sales on exchanges do not qualify as securities.

Execs weighing in…

Providing further insights on the same, Alex Thorn, Head of Firmwide Research at Galaxy Digital noted,

However, there was another X user who urged an important question to Balchunas and said,

“If there has been no demand for Ethereum ETF, why would there be demand for XRP ETF?”

However, in defense Balchunas noted,

What’s lies ahead for Trump and Harris?

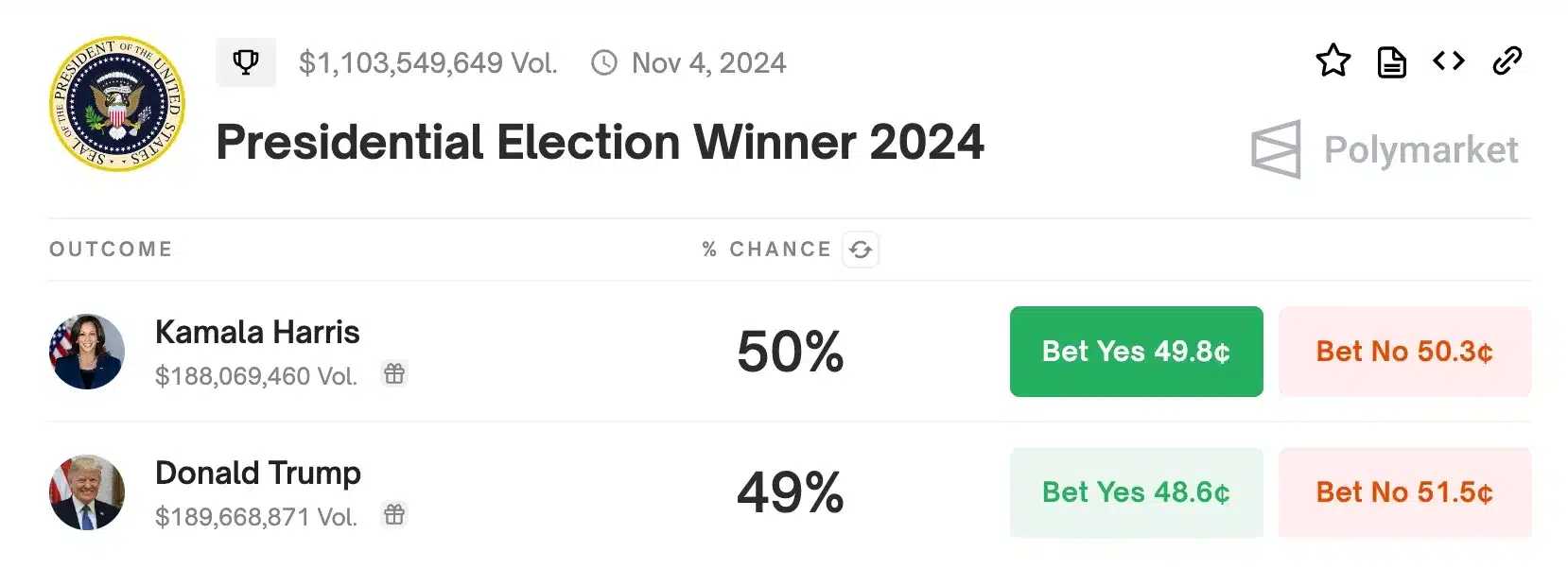

Despite the ongoing political shifts reflected in Polymarket data, with Kamala Harris leading Trump in votes by a narrow margin, analysts at VanEck remain confident in Bitcoin’s resilience.

Mathew Sigel believes that, regardless of the outcome of the 2024 U.S. elections, Bitcoin will remain largely unaffected.

However, he noted that a Kamala Harris administration could potentially offer more favorable conditions for Bitcoin’s growth compared to a Trump presidency.

Thus, with only 33 days remaining until the election, it will be intriguing to see who wins and how the outcome will impact the crypto sector.