TRX drops to $0.15: Are Tron memecoins to blame?

- Tron network has experienced a meme-wave, reducing stablecoin dominance to 75%.

- In short, the network may be exposed to higher volatility.

Tron [TRX] has plunged more than 6% in the past seven days, driven by Bitcoin’s [BTC] downward trajectory, trading at $0.15 at press time.

Interestingly, TRX saw a significant surge after the launch of SunPump, a Tron-based platform focused on memecoins. Currently, memecoin activity has overtaken stablecoin transfers on the network.

Given that memecoins are notoriously volatile, their dominance over stablecoins raises an important question: Could this shift in activity pose a risk to TRX’s long-term value?

Memecoin culture threatens Tron stability

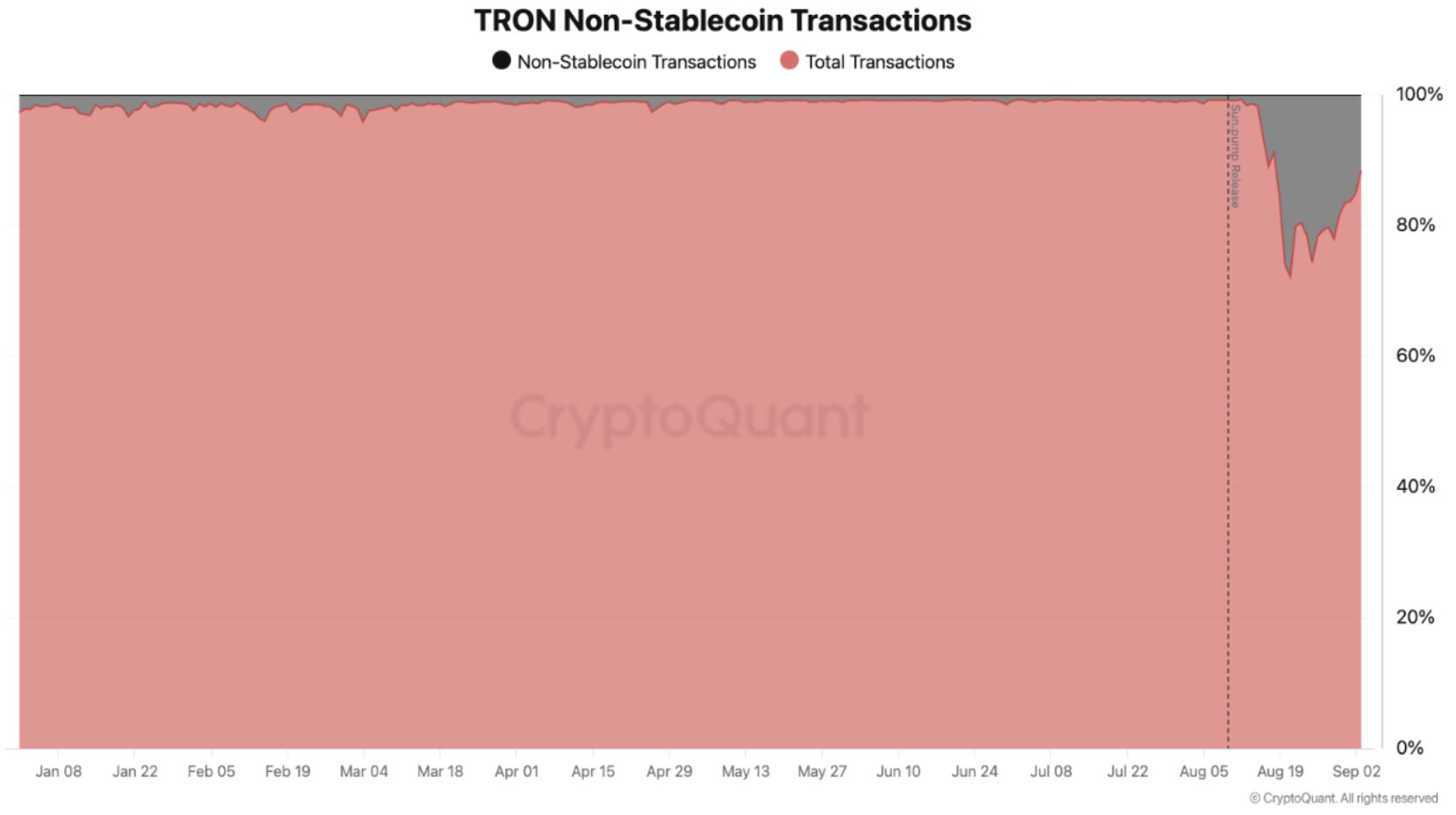

Earlier this year, stablecoins dominated Tron network activity, making up about 98% of transactions.

However, since SunPump launched on the 9th of August, this has shifted dramatically, with stablecoin activity now accounting for roughly 75% of the network’s transactions.

This indicated a striking trend where most Tron users are shifting towards volatile tokens, leaving TRX’s value more unstable.

For context, investors holding SUNDOG, the largest memecoin on the Tron network by market cap, have surged to 220,269 within just 20 days.

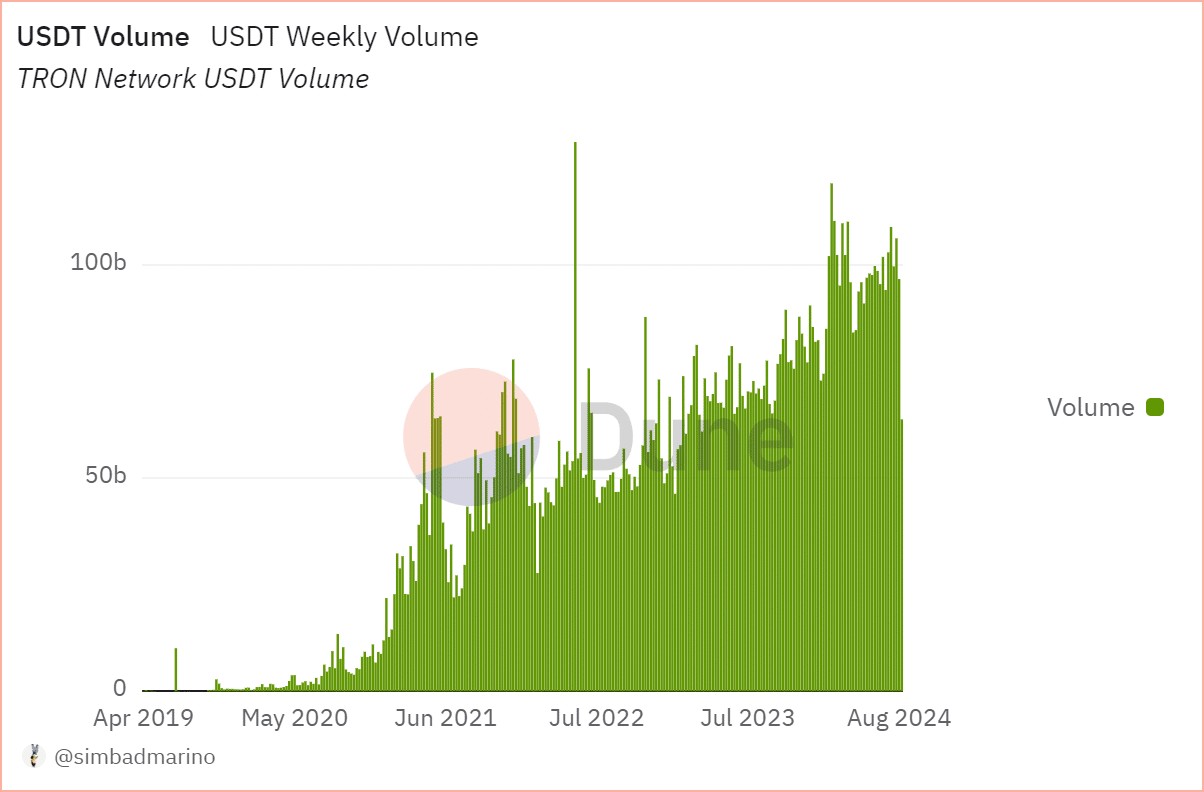

Meanwhile, USDT volume on the Tron network has declined significantly. Just before the SunPump launch, USDT volume reached $100 billion, but it now stands at $63 billion, marking a staggering 37% decrease.

According to AMBCrypto, this indicated a potential instability in Tron’s ecosystem, as a decline in stablecoin volume coupled with rising memecoin activity might lead to increased volatility, pushing TRX downwards.

So, has it?

USDT net flow has the answer

It is no surprise that SunPump boosted TRX’s value for two consecutive weeks since its early August launch, pushing it to test the $0.17 resistance.

However, the optimism faded sooner than expected, as TRX fell back and absorbed a bearish pullback below the $0.15 price range.

Put simply, even memecoin dominance couldn’t shield TRX from the effects of Bitcoin’s volatility.

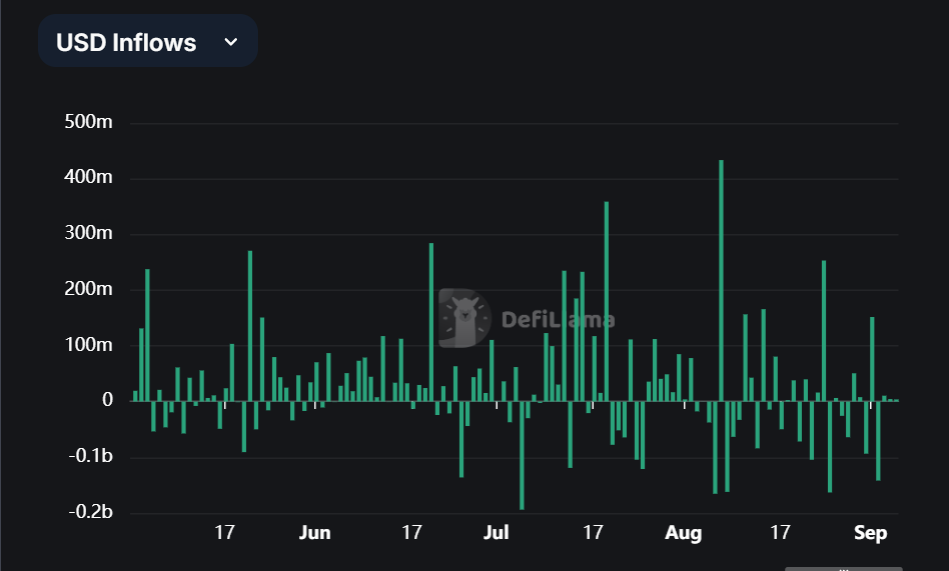

Surprisingly, the chart below shows a staggering $0.142 billion USDT outflow on the Tron network, signaling renewed investor confidence in stablecoins.

As stablecoin outflows increase, it could prompt a TRX price correction, indicating that more investors are exchanging USDT for TRX when the price dips or when they reach a profitable position.

Realistic or not, here’s TRX’s market cap in BTC’s terms

Overall, TRX might be heading towards a reversal if these exchanges occur.

However, if investors opt to buy memecoins instead, it could push TRX into uncertainty, as most memecoin holders are short-term traders aiming for quick gains.