Analysis

Turbo crypto gains 49% in 3 days – Minor dip next?

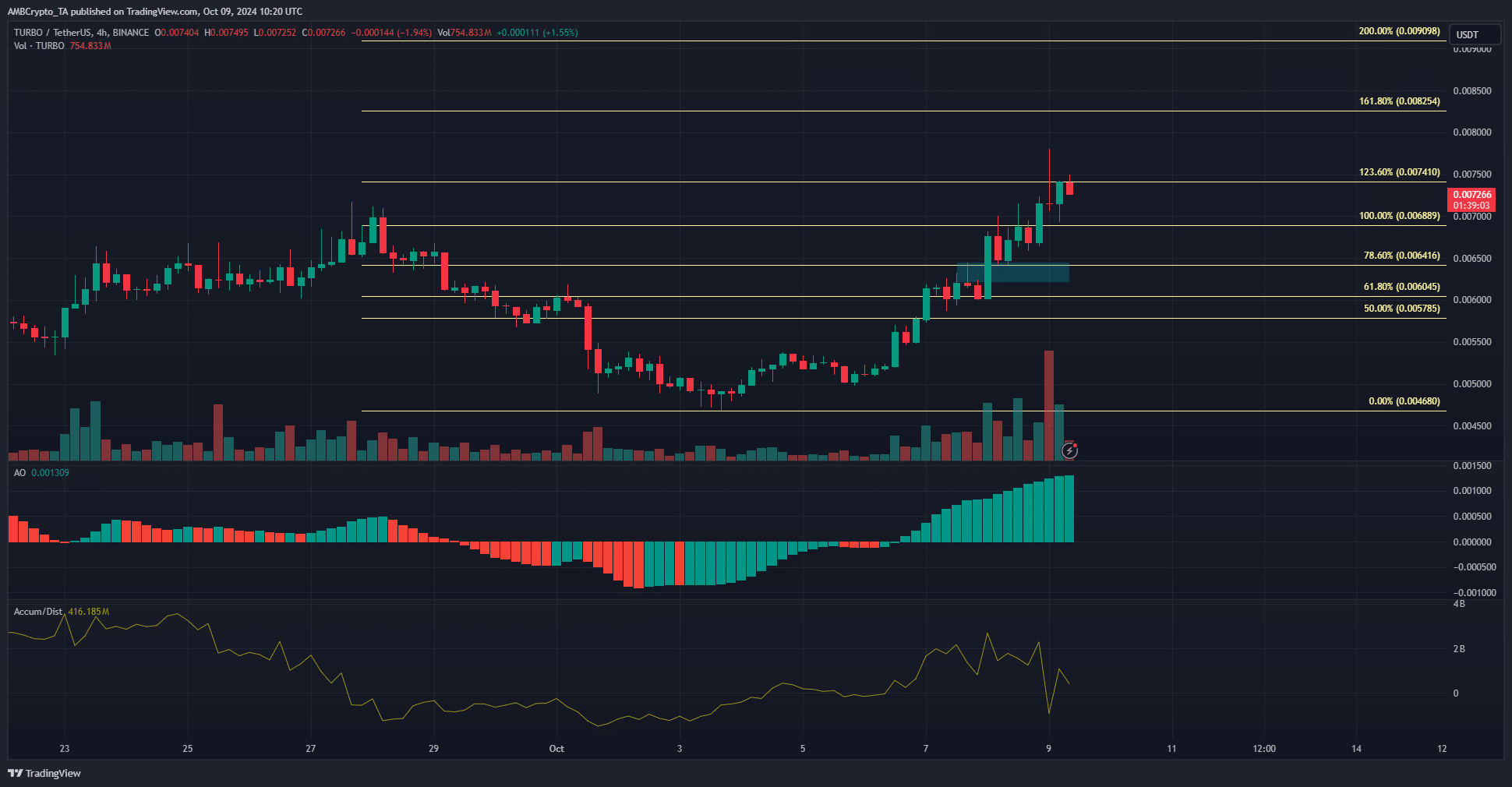

The large candle wick to the upside showed rejection beyond the $0.0074 level.

- The quick gains since last Saturday occurred on sizeable demand.

- Liquidation levels highlighted a potential range formation around $0.007.

Turbo [TURBO] was quick to recover from the slump it saw in early October. Last weekend, after flipping the $0.005 level to support, TURBO rocketed higher to reach the $0.0074 resistance level.

This represented a 49.2% price move in three days before the minor dip of the past few hours.

Earlier on the day of writing, Turbo crypto bulls attempted to flip the $0.0075 level to support. The high trading volume session ended in failure for the bulls.

Is the recent selling pressure an early reversal sign?

The price action on the 4-hour chart was strongly bullish, and key resistance levels such as $0.006 and $0.0065 have been converted into demand zones. The Awesome Oscillator histogram showed firm bullish momentum.

In the past three days, Turbo crypto bulls have hardly taken a break from driving prices higher. This changed in the past 24 hours.

The large candle wick to the upside showed rejection beyond the $0.0074 level. The selling volume of the past two days saw the accumulation/distribution indicator fall lower to signal increased selling pressure.

Swing traders can use these clues and wait for a deeper TURBO dip. The $0.0065 and $0.00689 levels can offer a buying opportunity in the event of a retest.

Further north, the 61.8% and 100% extension levels at $0.00825 and $0.009 respectively would be the bullish targets for October.

Liquidity pockets around TURBO prices

Source: Coinglass

The volatility in the early hours of Wednesday marked out two levels where liquidation levels have built up. These were the $0.00689 and $0.00786 levels.

It is likely that a sweep of either level would see a short-term trend reversal.

Read Turbo’s [TURBO] Price Prediction 2024-25

This reversal would be because prices are attracted to liquidity. Both of the mentioned liquidity pools are attractive in the lower timeframes. A retest of $0.00689 would present a buying opportunity.

A move toward $0.00786 might see a sustained rally, and traders should not be overeager to short the token at that liquidity cluster.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion