TUSD controversy: Will alleged ties to Sun’s Tron affect TRX and TUSD?

- Recent allegations have tied TUSD to Justin Sun, raising concerns about its impact on TRX.

- TUSD trading activity remains steady, while TRX appears to be weathering the storm with little impact on its bullish trend.

There has been a recent buzz around True USD [TUSD] and its purported ties to Justin Sun, the owner of Tron [TRX] and the majority owner of Huobi. While these allegations have caused speculation in the market, the big question remains: what impact will this have on TUSD and TRX?

In other words, the focus is on whether or not these rumors will have any tangible effect on the value and performance of these assets.

– How much are 1,10,100 TRXs worth today

Are TRX and TUSD one?

Binance made headlines on 30 April, announcing TUSD staking for Sui Network (SUI) farming. However, things took a curious turn on 1 May when a True USD wallet linked to Justin Sun, founder of Tron [TRX], transferred over $56 million worth of TUSD to Binance. Naturally, this raised some eyebrows among crypto enthusiasts.

To address any concerns, Binance CEO Chanpeng Zhao quickly stated that Sun had been warned not to use any of the transferred funds for the SUI airdrop. Nevertheless, on 3 May, a Twitter user, Adam Cochran alleged that Sun had already purchased TUSD. The TUSD team immediately responded, refuting the claim and warning of legal consequences for any alleged defamation.

TUSD flow in the last 24 hours

CoinMarketCap data showed that TUSD’s volume had fluctuated between 2% and 5% over the past 24 hours, indicating a steady level of trading activity. However, the market cap had taken a hit, experiencing a decline of over 10%.

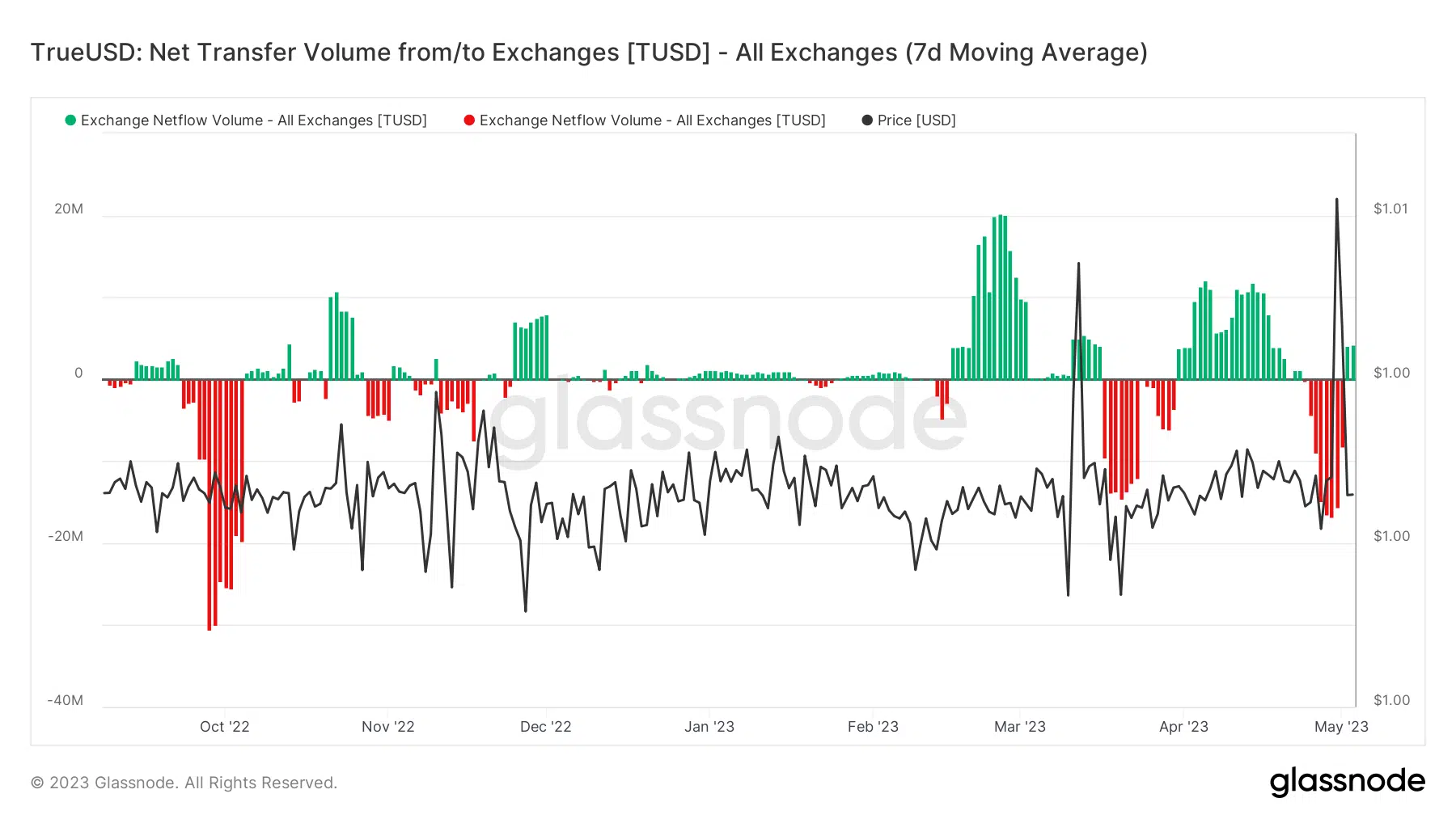

Interestingly, the Glassnode chart tracking the exchange NetFlow metric revealed a dominance of inflow, with a positive NetFlow of over 4.2 million. This indicated that more TUSD was flowing into exchanges than out. The current state of the metric could suggest that investors were looking to sell off their holdings or trade TUSD for other assets.

Did TRX react?

A closer examination of TRX on the daily timeframe chart revealed that the recent developments surrounding TUSD had had little impact on the asset.

As of this writing, TRX was trading at around $0.06, experiencing only a slight loss. Before this trading period, TRX had been making modest gains over the past 48 hours, which could be taken as a positive sign.

– Realistic or not, here’s TRX’s market cap in BTC’s terms

Despite the slight dip in value, TRX was still bullish, according to its Relative Strength Index (RSI).