Two years of BAYC: Sales surge, financialization grows, APE struggles

- Bored Ape Yacht Club (BAYC) celebrated the second anniversary of the NFT launch with impressive figures since its inception.

- ApeCoin has experienced a recent downturn but shows signs of a rebound, while NFTs continue to have an expanding impact on the DeFi ecosystem.

The Bored Ape Yacht Club (BAYC) recently shared a post stating that 23 April marked the second anniversary of the NFT’s launch.

It’s fascinating to ponder how much progress the NFT has made and the extent to which it has impacted its ecosystem coin APE.

Read ApeCoin (APE) Price Prediction 2023-24

BAYC clocks two

In a recent post by BAYC, its community, and the NFT community were alerted that it has been two years since the popular ape-themed NFT launched.

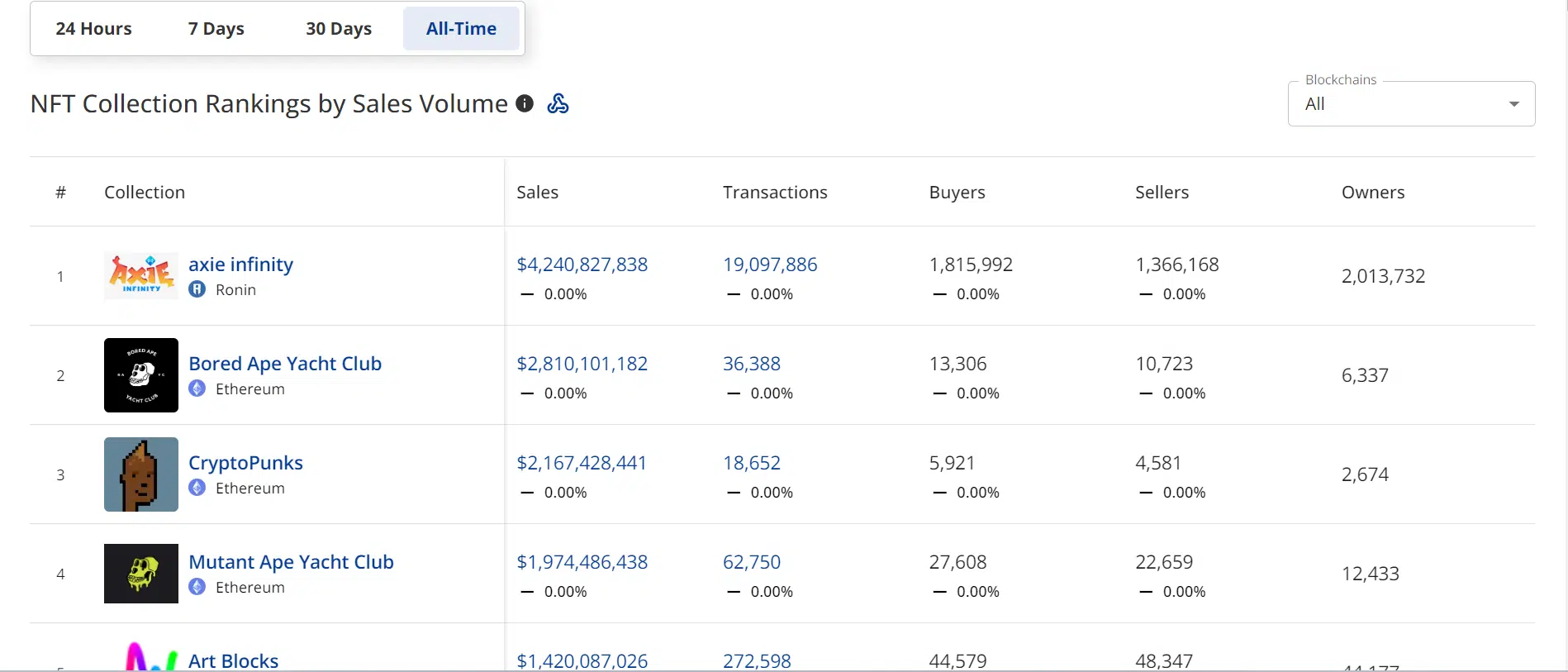

DappRadar and Crypto Slam’s data revealed that BAYC had achieved remarkable figures since its launch. Crypto Slam’s data illustrated that BAYC had the second-highest sales volume, with $2.8 billion as of this writing.

Since its inception, BAYC has witnessed over 36,000 transactions involving more than 13,000 buyers and 10,000 sellers. Furthermore, the NFT has attracted over 6,337 unique holders.

BAYC extends beyond collectibles

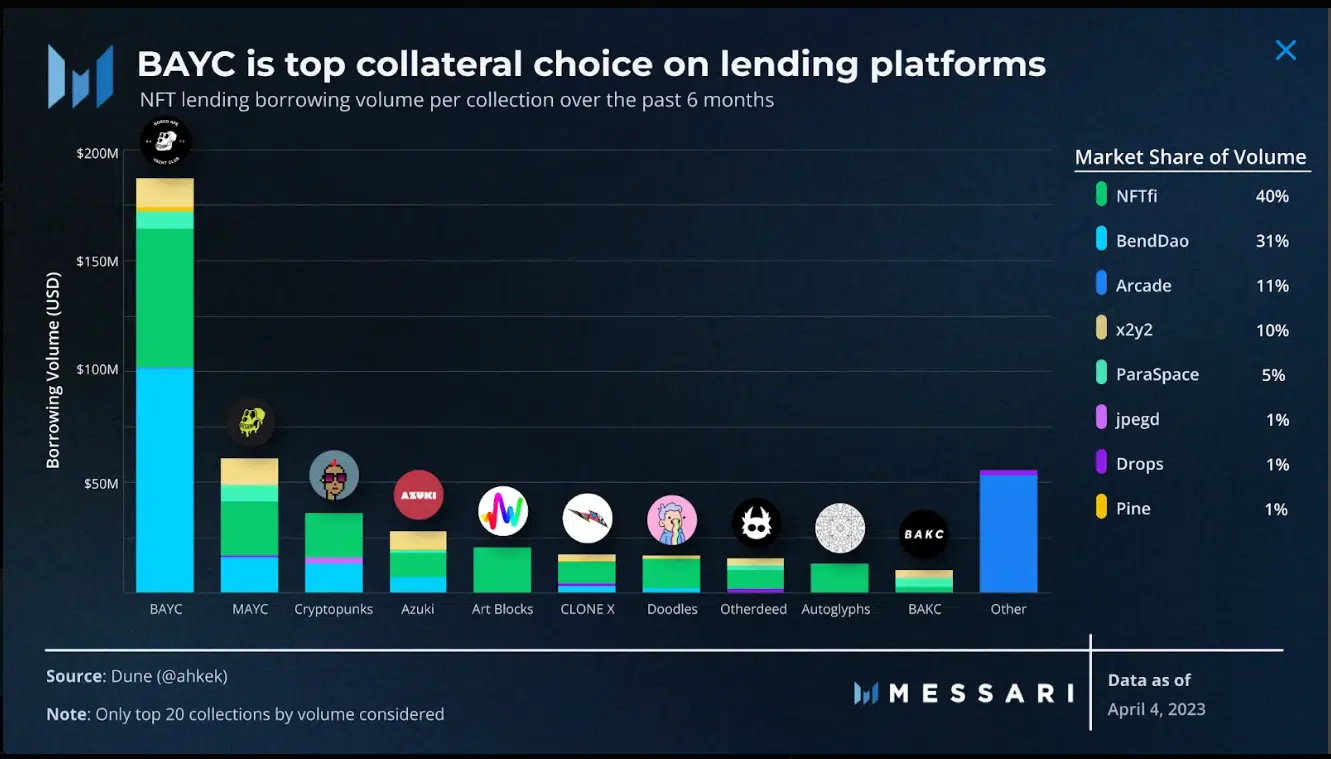

Messari’s report stated that NFTs have emerged as a significant financial instrument in the Decentralized Finance (DeFi) space.

Their use as collaterals, according to the report, has gained prominence. BAYC NFTs are among the leading collaterals in the space, according to the report. The financialization of NFTs is a growing trend, with their applications expanding beyond digital art and collectibles.

Now, NFTs are being utilized as collateral for loans, giving NFT owners access to liquidity without the need to sell their assets. Recently, there has been an upsurge in user interest in NFT lending, indicating the increasing importance of NFTs in the DeFi ecosystem.

The report on the leading NFT collateral choices on lending platforms also revealed an intriguing observation.

Mutant Ape Yacht Club (MAYC), another creation by Yuga Labs that drew inspiration from Bored Ape Yacht Club (BAYC) collection, was the second most popular NFT utilized as collateral.

Is your portfolio green? Check out the ApeCoin Profit Calculator

The State of ApeCoin

Lately, ApeCoin, the ecosystem coin of Bored Ape Yacht Club (BAYC) and other NFTs in the Yuga Labs ecosystem, has been experiencing a downturn.

The token’s value has decreased when viewed on a daily timeframe chart. However, this trend has been reversed in the past few days, with the token closing in the green zone.

As of this writing, APE was trading at approximately $3.9, representing an almost 1% increase. Nevertheless, despite the recent price surge, APE’s value was insufficient to surpass 40 on the Relative Strength Index.