U.S. Congress to address stablecoin regulation with this new bill, details inside

– The U.S. proposed a bill to regulate stablecoins, with fines and prison sentences for non-compliance.

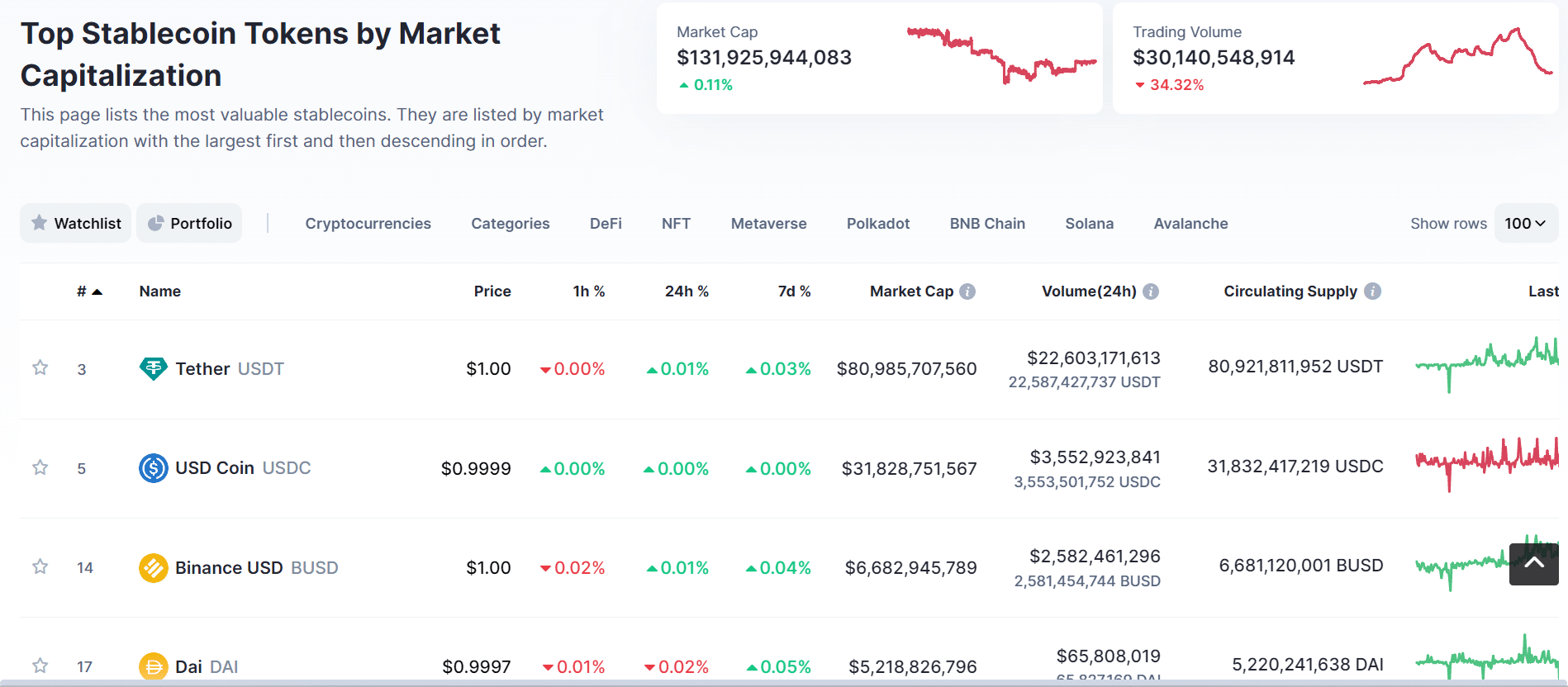

– Circle CEO endorses the proposed bill, while Tether and other stablecoins dominate the market with a total capitalization of over $131 billion.

The United States has moved towards regulating cryptocurrencies, beginning with a focus on stablecoins. Despite previous concerns about the ambiguous nature of crypto regulations, the U.S. is taking a proactive step in regulation.

They also seem to be starting with the bridge between digital currencies and traditional fiat money.

Stablecoin bill draft surfaces in U.S HOR repository

A draft document dated 14 April, which surfaced in the United States House of Representatives’ repository, showed steps toward regulation. The proposal stated that insured depository institutions seeking to introduce stablecoins would be subject to oversight by the relevant agencies.

In contrast, non-bank institutions would come under Federal Reserve scrutiny. Non-compliance could result in a penalty of up to $1 million and a prison sentence of up to five years. Foreign issuers would also need to register to conduct business within the U.S.

Approval of stablecoin issuance would depend on various factors, including the applicant’s capability to maintain adequate reserves to support the stablecoins. The reserves must be U.S. dollars, Federal Reserve notes, or Treasury bills with a maturity period of 90 days or less.

Additionally, repurchase agreements with maturities of seven days or less, supported by Treasury bills with maturities of 90 days or less, as well as central bank reserve deposits, may also be used to fulfill the reserve requirement.

Circle onboard with the bill draft?

On 15 April, the CEO and co-founder of Circle [USDC], Jeremy Allaire, appeared to endorse the proposed bill in a tweet.

2/ It's an extraordinary moment for the future of the dollar in the world, and the future of currency on the internet. There is clearly the need for deep, bi-partisan support for laws that ensure that digital dollars on the internet are safely issued, backed and operated.

— Jeremy Allaire (@jerallaire) April 15, 2023

He emphasized the moment’s significance for the dollar’s future and the role of digital currencies on the internet. He also stressed the need for strong, bipartisan backing of regulations that guarantee secure issuance, support, and operation of digital dollars on the internet.

If the bill is passed, projects such as Tether [USDT] will be required to disclose the backing of their stablecoin. It could help alleviate concerns raised in the past about the lack of transparency around Tether’s reserves.

Tether has faced criticism over its ability to prove its backing in the past. These criticisms have caused Fear Uncertainty and Doubt (FUD) around the stablecoin.

The current state of stablecoins

According to data from CoinMarketCap, as of this writing, the market capitalization of stablecoins stood at over $131 billion. The trading volume was over $30 billion, although it had decreased by over 30% in the last 24 hours.

Tether continued to dominate the market with a volume of over $80.9 billion, representing the highest proportion of the total market cap. Its 24-hour trading volume stood at over $22 billion.

Circle’s USDC remained in second place with a market cap of over $31 billion, but a much lower 24-hour volume of over $3.5 billion. Other stablecoins in the top five included Binance USD [BUSD], Maker [DAI], and True [TUSD].

The proposed stablecoin bill is still a draft, and a hearing is set for 19 April to further discuss the specifics of the bill.