U.S. moves Bitcoin worth $4M: Sell-off fears mount once again

- The U.S. government moved some BTC from its portfolio to Coinbase Prime.

- Will this spark another government-induced wave of sell pressure?

Is the U.S. government starting to sell its Bitcoin [BTC] holdings? Recent data suggests that this could be a possibility that could lead to another massive wave of sell pressure.

U.S. presidential candidate Donald Trump’s support for Bitcoin may have built up some confidence regarding the U.S. government’s BTC holdings.

This comes after the German government’s decision to offload their BTC, an outcome that many criticized. A recent development points to the possibility that the U.S. might still sell their Bitcoin.

On-chain analysis revealed that the U.S. government moved 58.74 BTC from its website to Coinbase Prime. This action was presumably with intent to sell.

The amount moved was valued at just below $4 million, while the government wallet still holds 213,239 BTC, valued at over $14 billion.

Will the U.S. government betray Bitcoin?

The moved BTC only represented a small and perhaps inconsequential amount to BTCs price. However, the concern to the Bitcoin community is the transaction could be the first of many that might take place soon.

But what about Trump’s favorable Bitcoin stance?

The U.S. elections are still three months out. This means the current administration has ample time to dump their BTC holdings within that time.

So far there is no confirmation of that intent, although the recently moved funds might offer some indication.

What could be the extent of the potential fallout?

Germany’s BTC sale offers a rough idea of what to expect. The European country had almost 50,000 BTC to dump, and its impact was certainly felt in the market.

The U.S. holds over four times that amount, hence a sale of all or even half of its BTC holdings would be more severe.

The news that the U.S. moved BTC from its wallet would first trigger a reaction from whales if it was a major sale. Bitcoin’s performance in the last 48 hours indicated that the hype has slowed down.

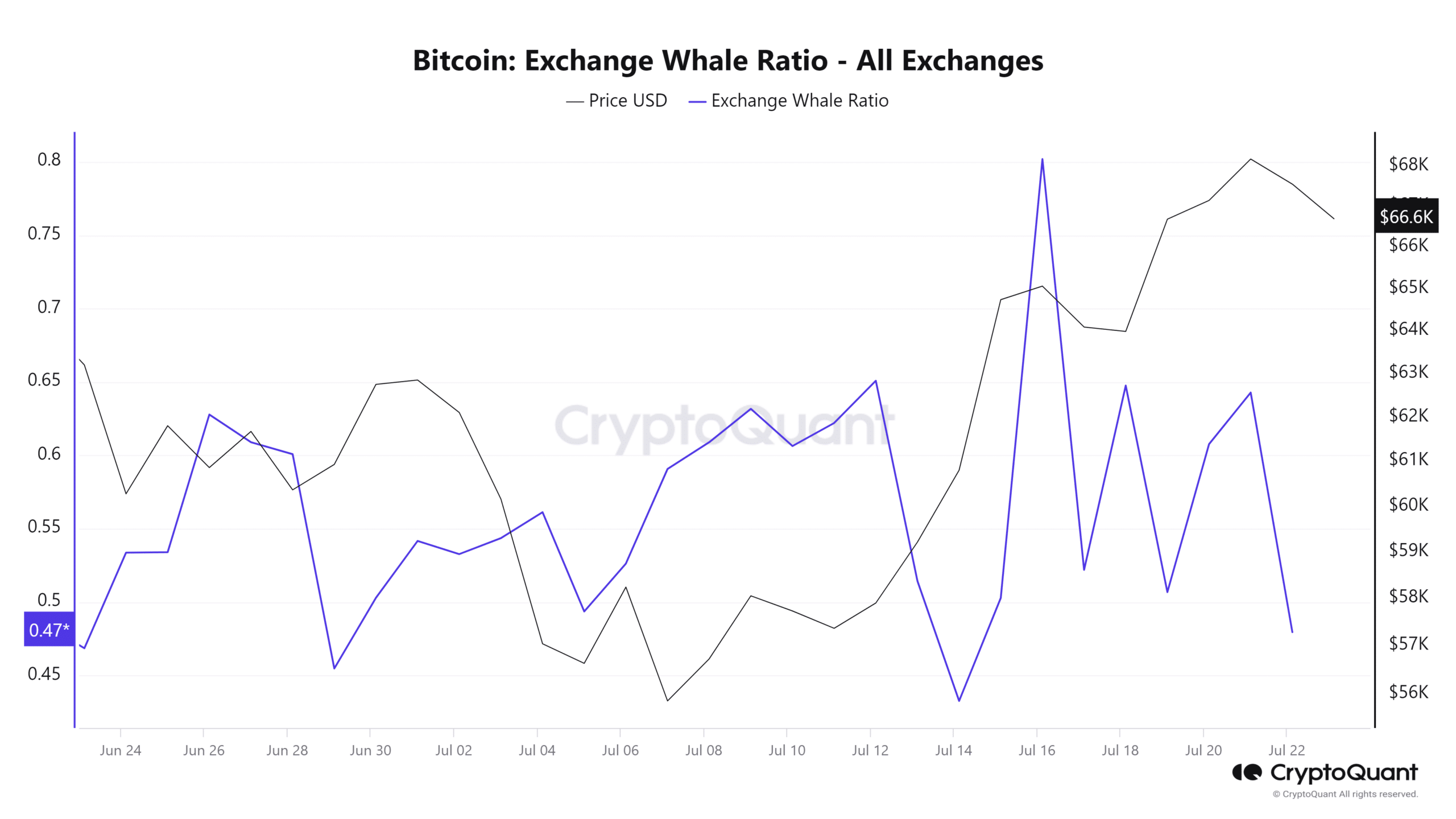

Bitcoin’s exchange-whale ratio slid slightly in the last two days. This indicated slowing whale activity after the previous spike in activity in mid-July.

The other side of the coin points to a situation where the U.S. could be incentivized to hold on to its BTC.

CNBC recently explored the idea of Bitcoin becoming a reserve currency. According to the U.S-based news outlet, moving those BTC holdings to treasury would give the U.S. a leg-up in the race for crypto dominance.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Bitcoin, as a reserve currency asset for the U.S., would put it in the list of the biggest HODLers. Another possible outcome is that it would make BTC more desirable and bolster demand.

For now, either of these two scenarios have not played out. The jury is still out on how the U.S. will impact Bitcoin’s future.