U.S. ‘should recognize blockchain’ or fall behind, says Paxos CEO

- Paxos CEO urged regulatory reforms to maintain U.S. leadership in digital finance.

- Trump was viewed as a crypto-favorable candidate, driving market optimism.

With the U.S. elections just days away, the political landscape is intensifying, and crypto leaders are stepping into the debate over the country’s financial future.

Paxos CEO’s urgent plea

In a recent open letter addressed to presidential candidates Kamala Harris and Donald Trump, Paxos CEO and co-founder Charles Cascarilla underscored the importance of digital assets in preserving America’s financial leadership.

Cascarilla warned that the next administration’s stance on digital currency could impact the nation’s economic standing.

He urged both leaders to recognize blockchain technology and stablecoins as tools for modernizing the U.S. financial landscape.

Additionally, he stressed that without a regulatory framework fostering innovation, the U.S. could lose its global financial influence.

“The next presidential administration will determine whether America continues to lead the global financial industry—or forfeits that leadership. We are at risk of becoming the Rust Belt of financial services, and American prosperity and jobs are at stake.”

What else did Cascarilla add?

Highlighting the advantages of blockchain-powered, dollar-backed stablecoins, he argued that these technologies have the potential to enhance transparency.

He supported this by saying that, these can foster a more inclusive financial system, which is essential for maintaining the country’s economic resilience.

The CEO advocated for bipartisan backing to implement stablecoin regulations, stressing their importance for preserving U.S. financial leadership and competitive strength.

“We look forward to collaborating with the next administration and lawmakers of both parties to craft and implement a stablecoin framework that drives innovation and demonstrates U.S. leadership on digital assets.”

Needless to say, the push for regulatory change has roots in the perceived hostility from the U.S. SEC during President Joe Biden’s administration under Chair Gary Gensler.

Coinbase CEO joins in

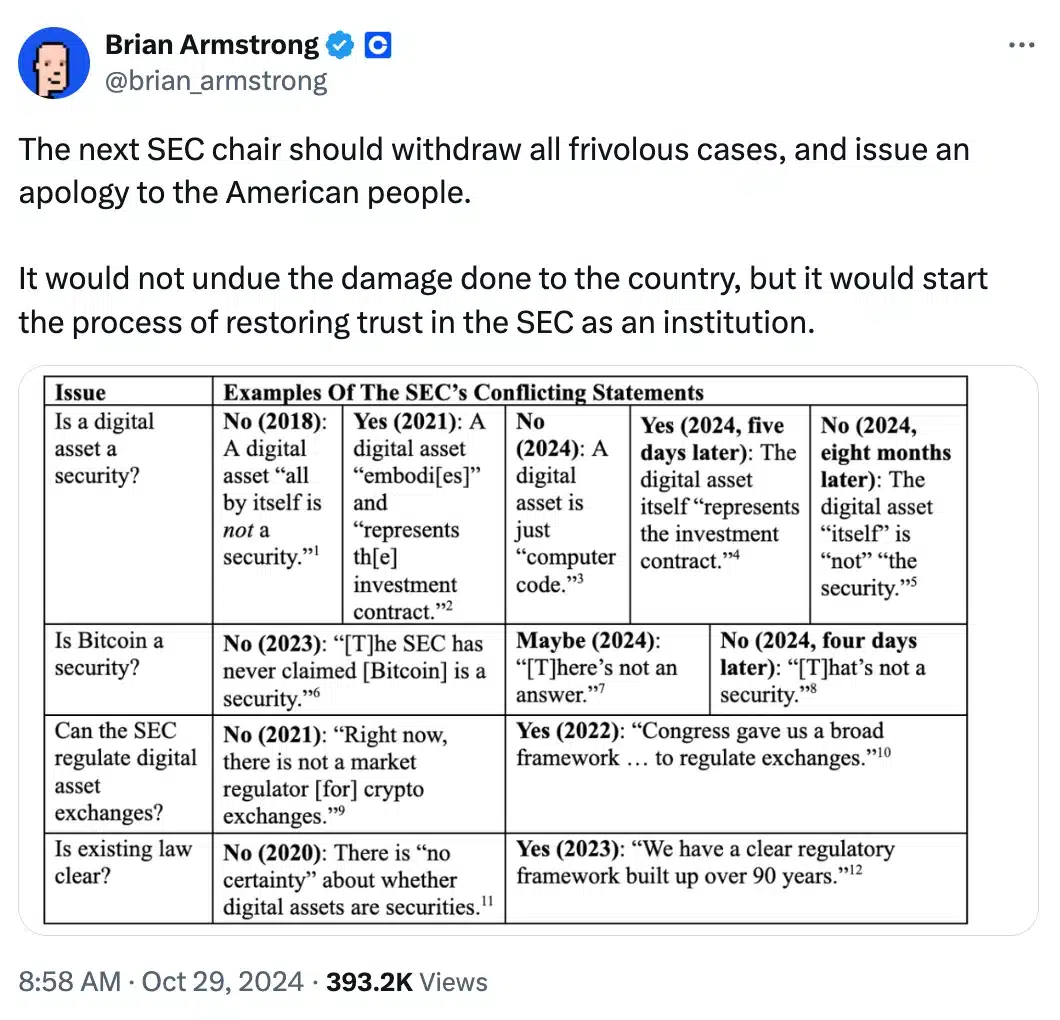

Coinbase CEO Brian Armstrong urged the incoming SEC Chair to abandon “frivolous” legal actions against crypto companies.

He also called for a formal apology to the American public. This highlights a growing demand for regulatory reform within the industry.

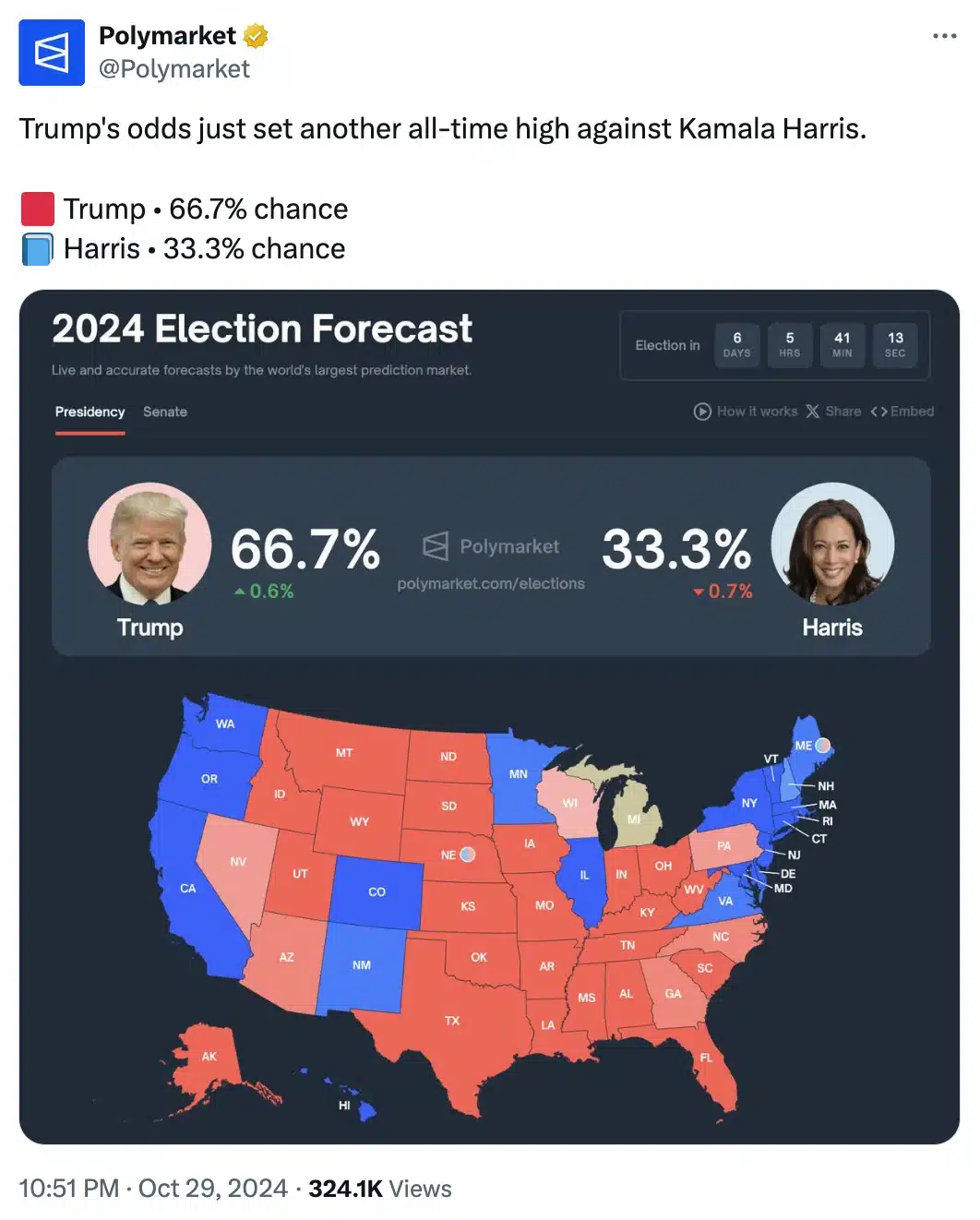

Amidst this growing debate, Trump is increasingly perceived as the more crypto-friendly candidate compared to Harris.

A recent update from Polymarket revealed Trump’s odds of winning have reached an ATH against Harris. This underscores the belief among some that his administration may favor a pro-crypto stance.

Coinciding with these developments, the crypto market also witnessed a surge, with Bitcoin [BTC] climbing to $72,000 just days before the election.