Uncertainty over SEC’s decision on spot ETFs leads to capital exodus

- Last week digital asset investment products saw outflows that exceeded $50 million.

- According to CoinShares, this might have been due to the fears that the SEC would reject the pending ETF applications.

Digital asset investment products recorded outflows last week, erasing all inflows recorded in the previous week, digital asset investment firm CoinShares found in a new report.

The report found that digital asset investment products saw outflows that totaled $55 million last week, compared to inflows of $29 million the week before.

In addition to last week’s huge deleveraging event that sent Bitcoin [BTC] to lows last recorded in June, CoinShares opined that the outflows might be a “reaction to recent media highlighting that a decision by the US Securities & Exchange Commission in allowing a US spot-based ETF is not imminent.”

On 13 August, former SEC attorney John Reed Stark tweeted that he believes the SEC will not approve a US spot-based ETF. Stark referred to a letter addressed to the regulator from Washington-based nonprofit Better Markets.

Will the SEC Approve Any Of The Recent Bitcoin Spot ETF Applications?

People often ask for my opinion on whether the SEC will approve any of the recent spate of bitcoin spot ETF applications, which is an interesting and important question.

My take is that the current SEC will… pic.twitter.com/lPXebl03Y4

— John Reed Stark (@JohnReedStark) August 13, 2023

According to Better Markets, SEC should refuse the ETF applications because the spot BTC markets:

“have a history of artificially inflated trading volumes due to rampant manipulation and wash trading, are highly concentrated, and rely on a select group of individuals and entities to maintain bitcoin’s network.”

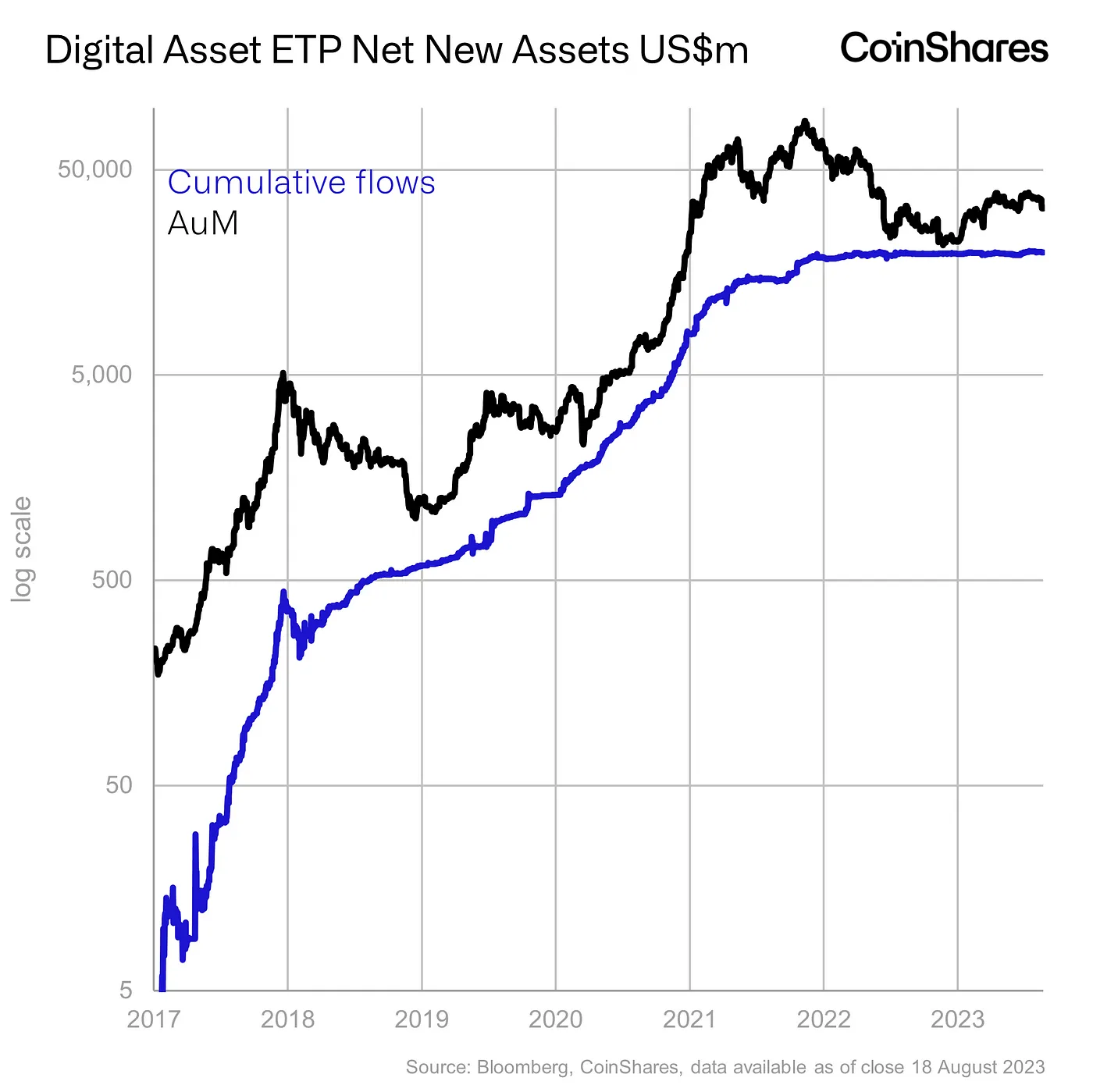

In addition to last week’s outflows, CoinShares found further that trading volumes remained below the yearly average. Due to last week’s panic sell-offs the value of total assets under management (AuM) fell by 10%.

Bitcoin suffered the most hit

Bitcoin investment products accounted for most of last week’s outflows at $42 million. This represented 76% of all monies removed from the market during the period under review.

After three weeks of seeing investors pull money out, Bitcoin investment products recorded their first inflows in August in the week before last, totaling $27 million. However, with the inflows logged last week, the asset’s month-to-date outflows were $101.9 million, CoinShares found.

Continuing its trend of outflows, Short-Bitcoin products experienced the removal of $2.2 million last week.

The altcoins were not spared

Last week, altcoins suffered outflows as well. As reported by CoinShares, leading alt Ethereum [ETH] registered outflows of $9 million, completely wiping off the $2.5 million it saw in inflows in the week before.

Likewise, other altcoins, such as Polygon [MATIC], Litecoin [LTC], and Polkadot [DOT] witnessed outflows of $900,000, $600,000, and $500,000, respectively.