UNI, CRV, and SUSHI holders have every reason to tread lightly

- Popular DeFi tokens fail to see price growth despite the increased activity on decentralized exchanges.

- Market cap of DeFi tokens declines along with the volume across protocols.

According to recent data, concerns arise as popular DeFi tokens such as Uniswap [UNI], Curve [CRV], and SushiSwap [SUSHI] fail to exhibit substantial growth in their prices.

Is your portfolio green? Check out the UNI Profit Calculator

Will tokens be able to DeFi the odds?

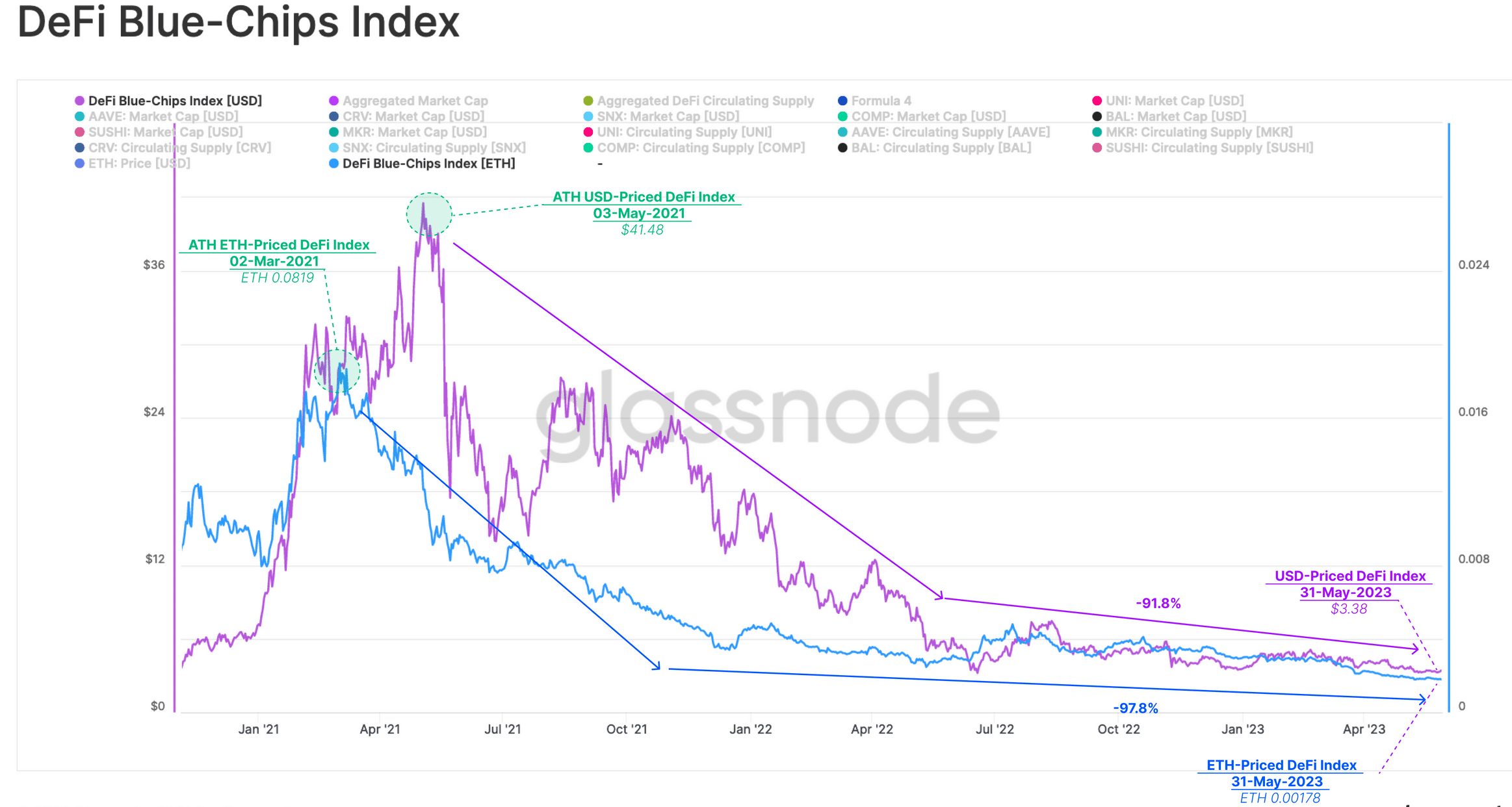

Glassnode’s report revealed that the aggregated market cap of these tokens, which peaked in popularity around May 2021, steadily declined since the “DeFi summer” event in mid-2020. This was when most of these tokens were minted and issued.

The DeFi Blue-Chip market cap, at the time of writing, stood at a mere 12% of its all-time high, experiencing a significant decrease.

Comparing the price of ETH with the DeFi Blue-Chip Index, Glassnode highlighted that after the initial bullish surge following “DeFi Summer” in January 2021, DeFi tokens witnessed a sharp decline in May 2021. This was followed by a continuous downward trend.

Even during the latter half of the 2021 bull cycle, DeFi tokens showed limited responsiveness to the market upswing. This could be potentially due to the market’s preference for NFTs at the time. The DeFi index remained 42% below its previous all-time high in May, despite ETH prices reaching new highs in November 2021.

The declining interest in DeFi protocols was also evident in the falling volume of decentralized exchanges (DEXs), as reported by Dune Analytics. The DEX volume significantly decreased over the past month, indicating a diminishing level of activity.

Low activity means…

A plausible reason for the declining token prices could be the dwindling number of new addresses on these networks. Glassnode’s data showed that the monthly average of new addresses consistently remained below the yearly average. This was except for a notable spike during the FTX collapse.

This spike was primarily associated with divestment from DeFi tokens, reflecting the market’s heightened perception of risk.

Moreover, there has been a rapid decline in new addresses since March. A meager 600 new wallets were seen holding DeFi tokens that were being created per day at press time.

Realistic or not, here’s CRV market cap in BTC’s terms

In terms of market capitalization, UNI, CRV, and SNX dominated the sector, according to CoinGecko’s data. At press time, UNI held a market cap of $3.4 billion, followed by SNX at $674 million, and CRV at $617 million. Only time will tell whether these tokens retain their dominance in the future.