UNI may recover well in Q3 only if these holders escape the profit trap

- Uniswap took a hit in Q2 in terms of volume and here’s how severe the impact was.

- UNI’s sell pressure prevails as it cools down from the recent upside.

Coinmarektcap just released its Q2 2023 report on exchange performance. The report reflected Uniswap’s performance during the same period but what does this mean for its performance in Q3?

Is your portfolio green? Check out the Uniswap Profit Calculator

According to the CMC report, most top exchanges in the world registered a drop in volume in Q2. Uniswap is likely within this category not only because it was the top DEX by exchange volume but also because the impact extended to DEXes. The latter reportedly registered a 24% lower volume in Q2 than in Q1.

CMC report shows that Top 20 exchanges saw a significant 36% drop in Q2 2023 spot trade volume, contributing $1.67 trillion; Binance remains dominant in H1 2023 with 59.99% spot trading volume share, stable compared to last year; Q2 DEX volume was $189 billion, 24% lower than…

— Wu Blockchain (@WuBlockchain) July 11, 2023

The 24% drop represented an approximate drop of $60 billion from the previous quarter. So, how did Uniswap fair in terms of volume during Q2?

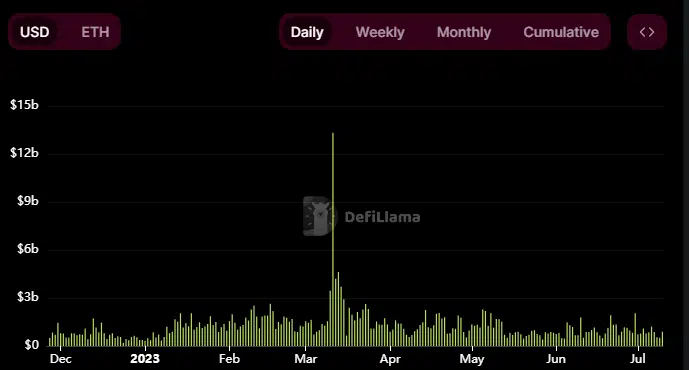

A look at Uniswap’s on-chain volume revealed that it peaked towards mid-March during which daily volume soared over $13 billion. For perspective, the highest Uniswap volume in Q2 was roughly $2.27 billion.

Source: DeFiLlama

A major reason for this drop could be that we saw the return of euphoria into the market in Q1 after a slow Q3 and Q4 2022. However, the wave of buying pressure slowed down in Q2 2023 as the market experienced some regulatory FUD.

Will things turn out differently for Uniswap in Q3?

The market is off to a good start in Q3, especially with the recent talks of major companies venturing into spot ETFs. As such, the next three months look promising especially if those ETFs receive regulatory approval.

Such an outcome could set a strong pace for the remainder of 2023. Uniswap would likely be among the biggest beneficiaries. But what about its native token UNI? UNI has been cooling down for the last 10 days after previously delivering a 60% rally.

It has so far tanked by 10% from its recent top to its $5.20 press time price.

UNI’s prospects will likely improve if the market leans in favor of the bulls in Q3 and Q4. This wasn’t only because of online demand but largely because UNI has been trading in tandem with the market for the most part.

Furthermore, on-chain analysis revealed that some address categories have been buying the recent dip. However, whales were still seen contributing to UNI’s ongoing sell pressure.

Read Uniswap’s price prediction for 2023/2024

Addresses holding between 1 million and 10 million UNI held 33.33% of UNI’s circulating supply. This means they are the most dominant whales and thus have the most impact on the market. The latest supply distribution data revealed that these whales were taking profits.