Uniswap’s $38B milestone – Here’s what that means for UNI’s price action

- UNI showed strong on-chain signals with significant growth in large transactions and network activity

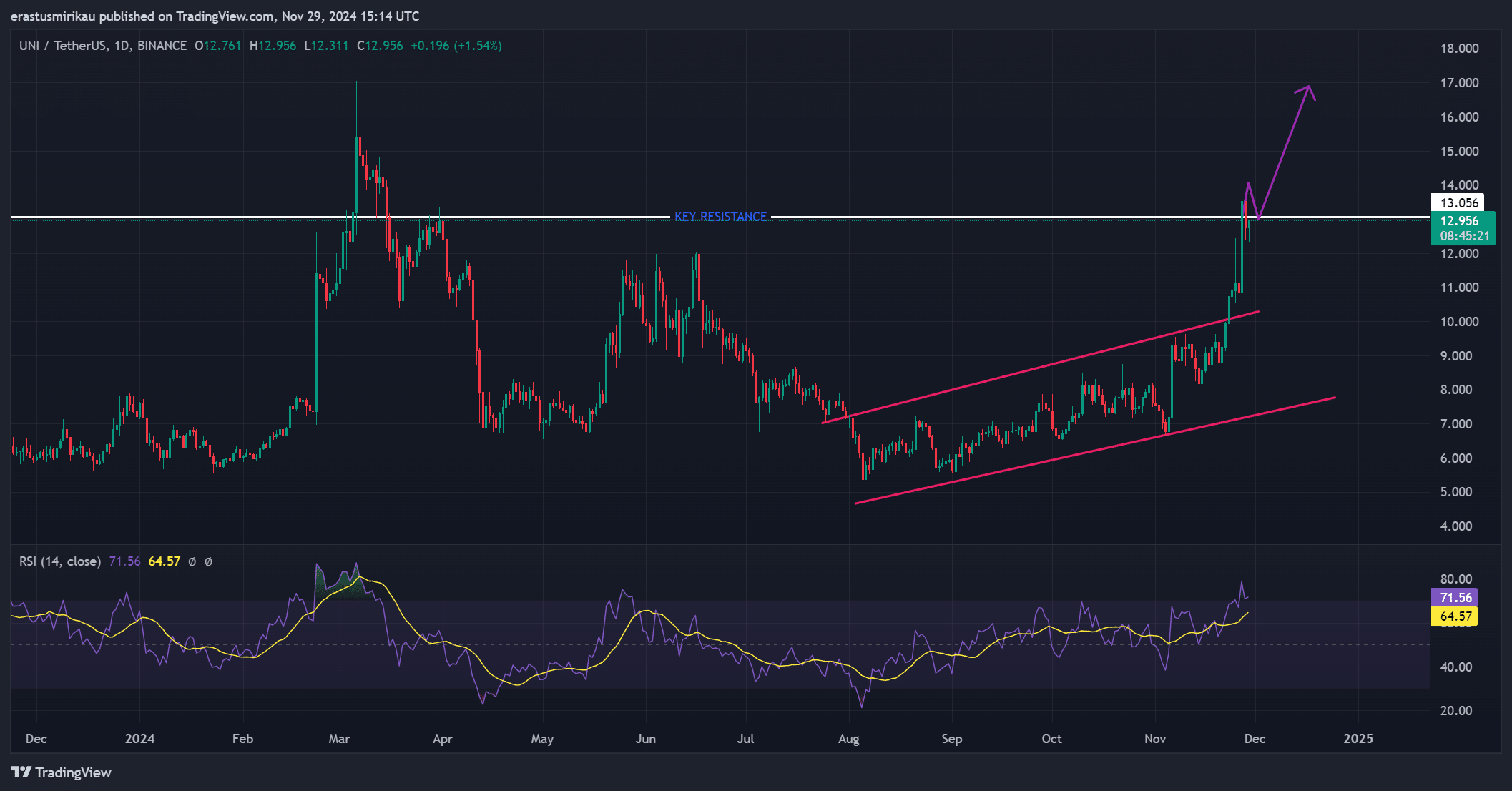

- UNI, at press time, was testing its key resistance at $13, with potential for further gains if breakout occurs

Uniswap [UNI] has been gaining significant momentum lately, fueled by a massive $38 billion in monthly volume across Ethereum Layer-2 networks like Base, Arbitrum, Polygon, and Optimism. This surge in activity has translated into strong bullish sentiment, with UNI trading at $12.95 at press time – Up 2.16% in the last 24 hours.

As liquidity and usage continue to rise, UNI finds itself at a critical juncture. Can it maintain this momentum and push past key resistance levels, or will it face a pullback in the near future?

Are the on-chain signals signaling more bullish action?

Uniswap’s on-chain data revealed a range of bullish indicators. Net network growth saw a moderate hike of 0.34%, suggesting that more users are adopting the platform. Similarly, into the money transactions rose by 1.56%, implying that more investors are now in profitable positions.

Additionally, concentration grew by 0.04%, indicating a shift towards higher confidence among holders.

The most noteworthy metric, however, seemed to be the spike in large transactions, which surged by 6.92%. This jump highlighted the growing involvement of institutional investors and large traders – A sign that big players are positioning themselves for potential upside in UNI’s price.

What does UNI’s price action say about the future?

Testing the $13 resistance level at press time, Uniswap’s price action was at a pivotal point. A breakout above this level could propel UNI to as high as $17, where the next resistance seemed to be.

However, RSI had a reading of 71.56, which suggested that UNI was nearing overbought conditions.

Consequently, while the bullish trend remains intact, investors should be cautious of potential pullbacks or consolidation before any breakout.

Exchange reserves and liquidations – Mixed signals ahead?

Exchange Reserves saw a modest hike of 0.12% in the last 24 hours, bringing the total to 68 million UNI tokens. This uptick suggested that investors may be holding onto their tokens or preparing to sell, depending on their outlook for the market.

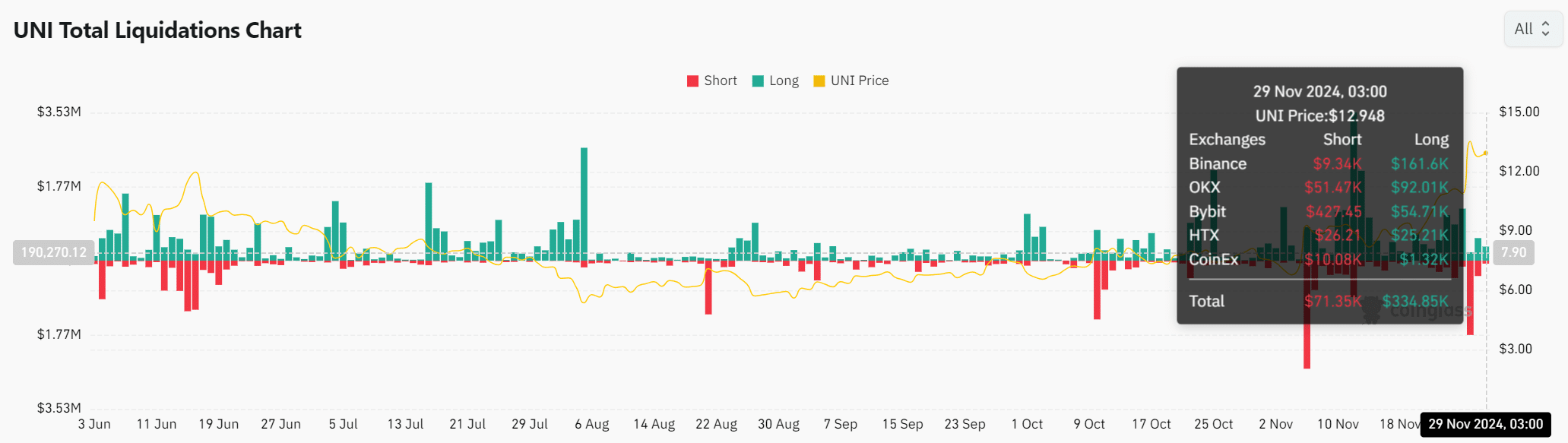

Meanwhile, the total liquidations revealed a higher concentration of long positions – $71.35k in short positions and $334.85k in long positions. This disparity indicated that the majority of traders are betting on sustained bullish momentum.

However, it also leaves UNI vulnerable to short squeezes if the market moves against the long crowd.

Realistic or not, here’s UNI’s market cap in BTC’s terms

Will UNI continue its upward trend?

Uniswap’s recent price hike, combined with strong on-chain signals and an hike in large transactions, pointed to a bullish outlook for the token. However, with the RSI approaching overbought territory and the exchange reserves showing mixed signals, traders should proceed with caution.

A breakout above $13 could lead UNI higher, but the risk of a pullback remains present. Therefore, if UNI can maintain its press time momentum and break through resistance, further gains may be likely.