Uniswap: All you need to know about Binance’s latest ‘move’ on the protocol

On 18 October, the world’s largest centralized crypto exchange by volume Binance, delegated 13.2 million UNI tokens to its own wallet on Uniswap, granting it the power to propose governance votes on decisions affecting the protocol.

The amount of UNI tokens delegated represents 5.9% of the voting power on Uniswap, making Binance the second-largest entity by voting power in the Uniswap DAO after venture capital firm Andreessen Horowitz, (a16z), data from Sybil revealed. a16z currently holds 6.70% of the voting power on Uniswap.

With the token delegation, Binance is able to propose governance votes as the delegated tokens exceed the 0.25% threshold required for the same.

However, the number of tokens delegated falls below the 4% quorum requirement to pass votes on Uniswap DAO, keeping Binance’s involvement in Uniswap DAO at bay.

Uniswap’s CEO Hayden Adams took to Twitter to express his concerns over Binance’s move. According to Adams, the situation was a “very unique” one “as the UNI technically belongs to its users.”

Yesterday @binance delegated 13M UNI from its books, making it one of the largest UNI delegates (this is only 1.3% of current delegated UNI so governance voting power remains quite distributed)

Very unique situation, as the UNI technically belongs to its users. pic.twitter.com/bwsVb1IwKR

— hayden.eth ? (@haydenzadams) October 19, 2022

While confirming that more governance participation is good for the protocol, Adams noted that it remains “unclear how Binance intends to engage.”

He opined that “Binance users would prob prefer to keep these gov rights (similar to what compound has done with cUNI).” He then called on Binance CEO Changpeng Zhao to offer more insights into the move “in the spirit of transparency.”

In the early hours on 20 October, Zhao responded and said that UNI transfers between internal Binance wallets automatically delegated the UNI tokens.

According to him, “Binance don’t vote with user’s tokens. Uniswap misunderstood the situation. Tokens come to popular platforms.”

UNI transferred between internal Binance wallets, causing the UNI to be automatically delegated. This is part of their protocol, not "we intended". Binance don't vote with user’s tokens. Uniswap misunderstood the situation. Tokens come to popular platforms. #Binance https://t.co/KYPqFx5GrW

— CZ ? Binance (@cz_binance) October 20, 2022

UNI since the Binance “move”

According to data from CoinMarketCap, UNI exchanged hands at $6.47 with a 1% rally in its price in the last 24 hours. Its trading volume was up by almost 20% within the same period.

Following Adam’s tweets on 19 October, the price of the asset quickly rallied by 5% before proceeding to shed the same by press time.

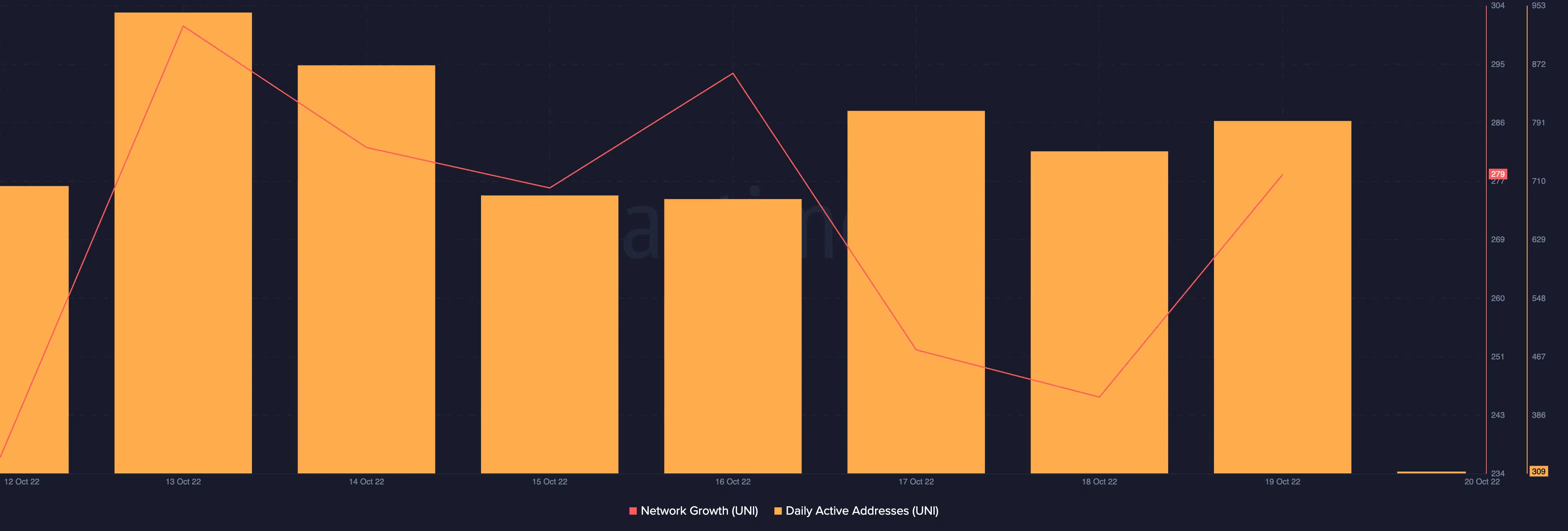

On the chain, UNI recorded a rally in network activity in the past two days. Between 18 and 19 October, daily active addresses that traded UNI jumped by 6%. At press time, the count of daily active addresses that have traded UNI stood at 309, data from Santiment showed.

In the same light, new addresses on the network rallied between 18 and 19 October. This grew by 13% within the period under review.

In case you are looking to trade UNI, the crypto asset currently enjoys some positive bias toward it.