Uniswap: Assessing the prospects of ‘true’ recovery for UNI

The cryptocurrency market has been at its lowest since the beginning of May 2022. However, that is not the case for Uniswap. UNI hasn’t rallied or even projected any sort of momentum for almost a year now.

A trip down Uniswap’s memory lane

Trading at $5.6 at press time, UNI seemed to be struggling to recover from the woes witnessed in May. In fact, it has already been placed under the critical support of $8.4. Tested multiple times in the past, this support level is essential for Uniswap if the token wishes to hike on the charts.

Uniswap price action | Source: TradingView – AMBCrypto

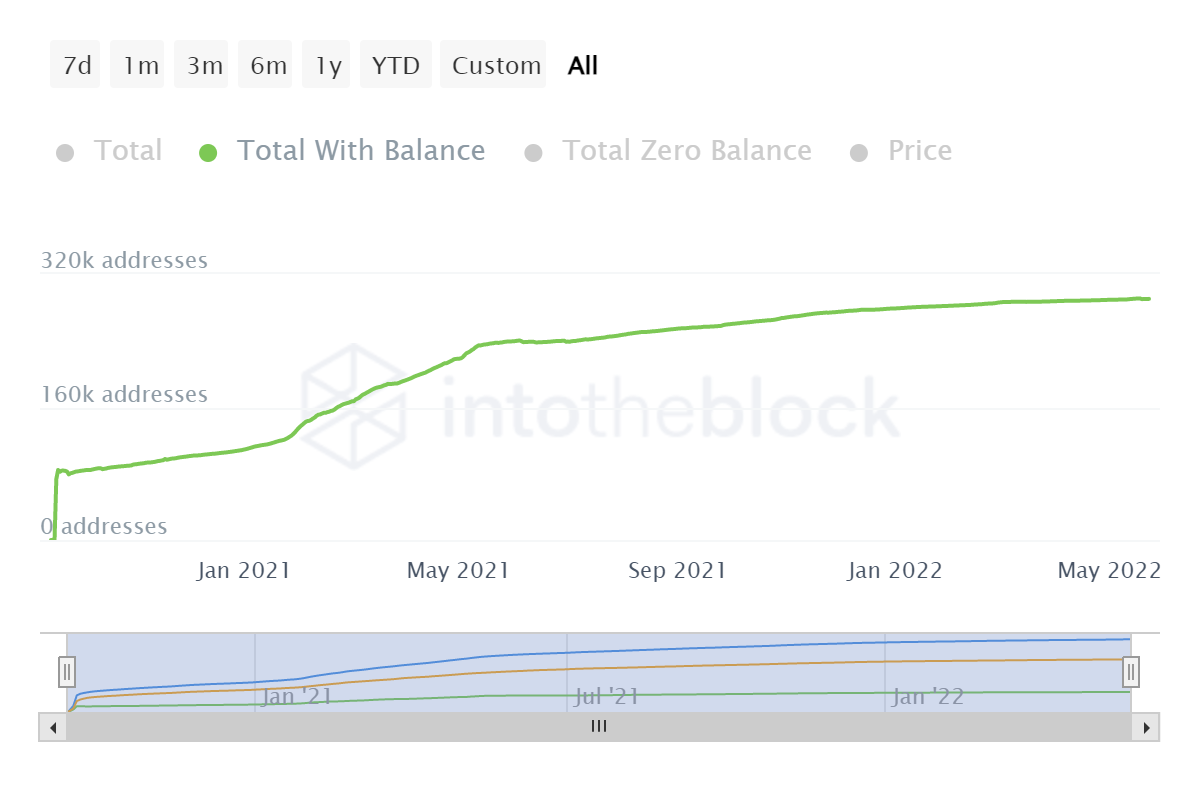

However, despite all the crashes and the dips, UNI did not see a single holder of the DeFi cryptocurrency leave the network. UNI HODLers remained where they were months ago.

Curiously, the total number of UNI holders didn’t just stay constant. Over the last one month, the total number of UNI investors has spiked by almost 3k. The number of Uniswap holders stood at 290k, at the time of writing.

Uniswap investors | Source: Intotheblock – AMBCrypto

Furthermore, UNI holders are unfazed by the events of 9 May and are surprisingly still bullish on the asset. In the last 24 hours alone, about 1 million UNI amounting to a total of $5.6 million was bought by investors as the crypto “recovered” by a mere 3%.

Uniswap supply on exchanges | Source: Santiment – AMBCrypto

Furthermore, one of the biggest concerns going forward is the asset’s correlation with Bitcoin. Sharing a correlation this high, Uniswap has placed its investors under the threat of bearishness should BTC ever drop again.

Trading at $29k at press time, BTC has the attention of every trader and investor now. Especially since a further decline would impact the entire market. However, a close above $30k could do the opposite trick.

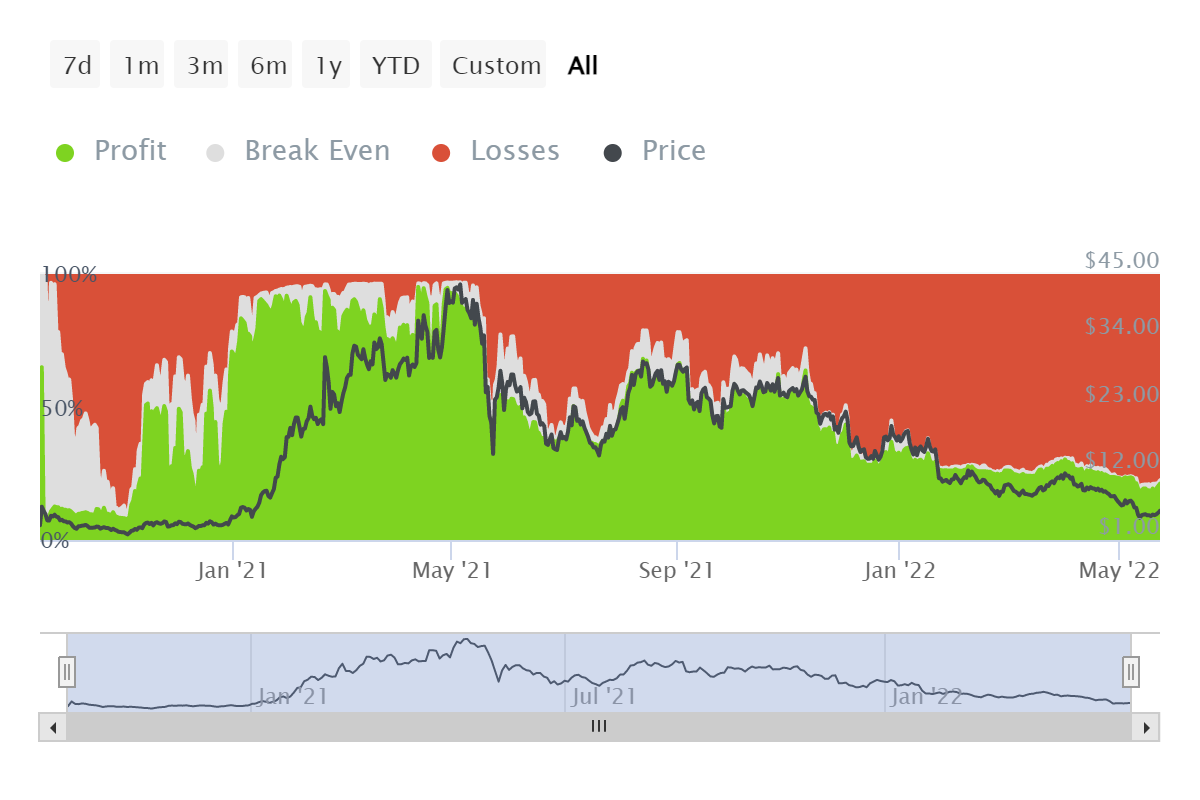

The last time all UNI investors were together in profits was back in May 2021 when UNI peaked at $48. This will be unlikely this time considering the ongoing bloodbath in the market.

Uniswap investors in loss | Source: Intotheblock – AMBCrypto

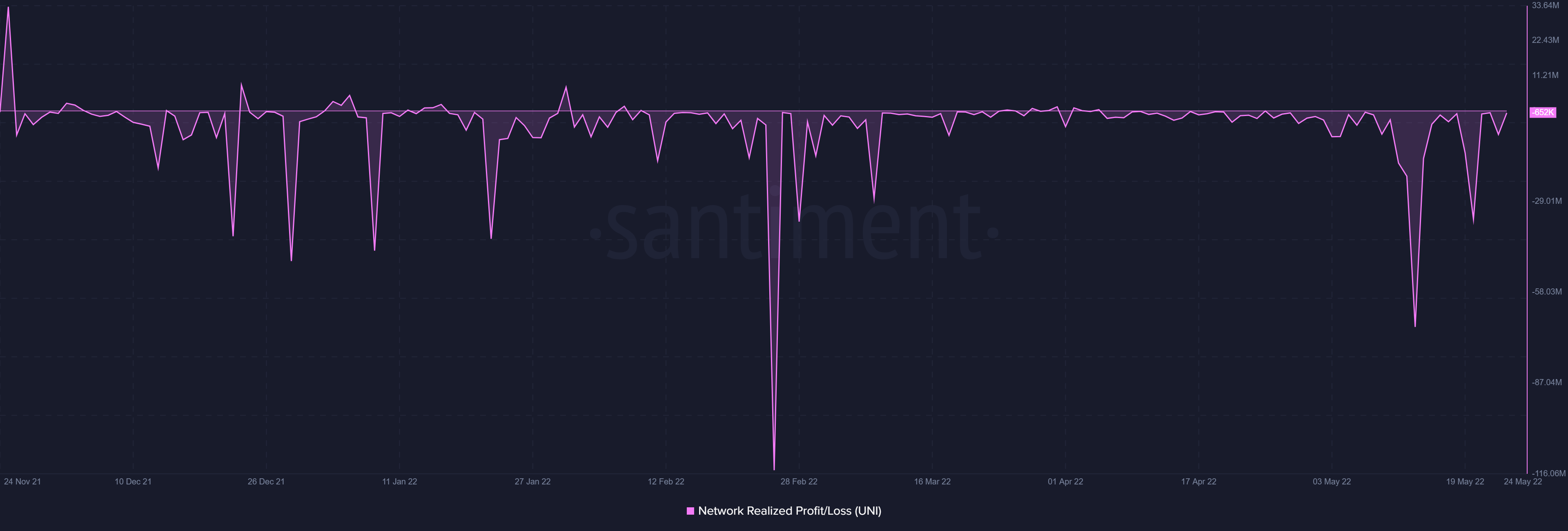

In fact, the network-wide supply of UNI has also been sitting in losses for five months now. This may discourage new investors from entering, even at lows of $5.6. However, given the current situation, Uniswap is better off without more bearishness over the next few months.

Uniswap supply in loss | Source: Santiment – AMBCrypto