Uniswap breaks key trendline—Can UNI target $8 next?

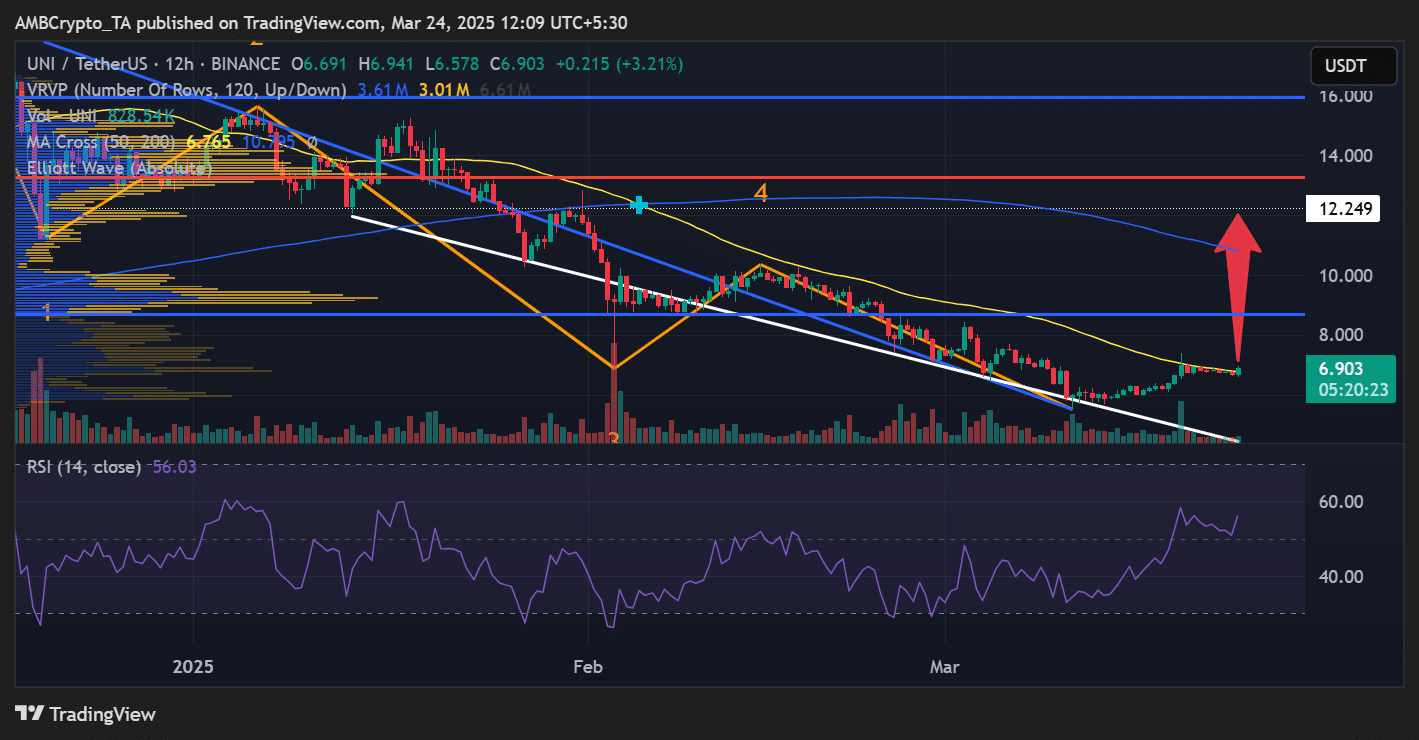

- UNI surged past $6.90, breaking out of a multi-week downtrend with RSI at 56 and rising volume.

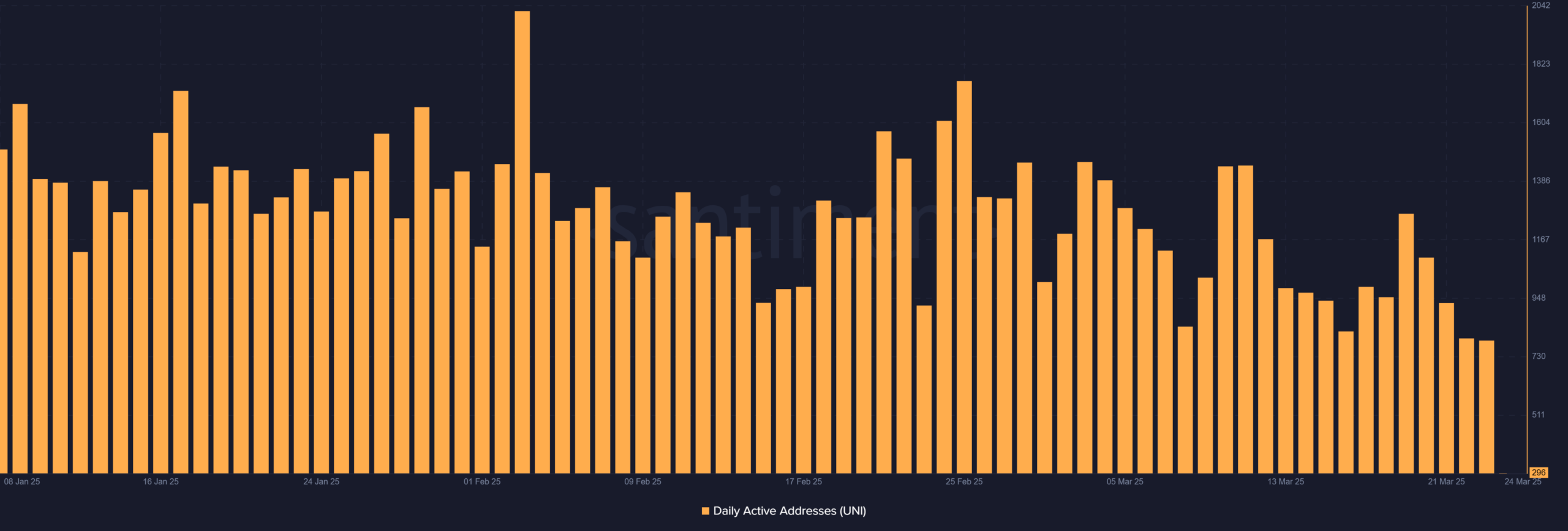

- Despite the rally, daily active addresses plummeted to 296, raising sustainability doubts.

After a prolonged downtrend, Uniswap [UNI] finally broke above a key descending resistance level, sparking hopes of a potential bullish reversal.

The breakout, backed by increased buying pressure, could push UNI towards higher resistance levels if the trend continues.

A breakout backed by momentum

Uniswap was trading at $6.90, recording a 3.21% gain over the last 12 hours. More importantly, it broke out of a descending channel pattern that had capped price movement since early February.

The breakout came after the altcoin reclaimed the 50-day Moving Average (MA) at $6.26, historically a key resistance-turned-support level.

From a technical standpoint, the Relative Strength Index (RSI) reading of 56.03, at press time, suggests growing bullish momentum but not yet overbought territory. Moreover, the volume profile shows a significant spike in activity near the breakout zone, reinforcing the move’s strength.

The next key target for bulls is the 200-day MA near $10.25, while immediate resistance lies at the volume node around $8.00. A close above $8.00 could accelerate a move toward $12.24, a high last seen in January.

Uniswap active addresses fail to confirm enthusiasm—yet

Despite the positive price action, on-chain activity has not responded similarly. According to Santiment data, Uniswap’s daily active addresses dropped to 296 on the 24th of March—the lowest in over three months.

This divergence between price and user activity could raise short-term caution.

Typically, a breakout accompanied by rising on-chain participation provides more reliable confirmation of sustained momentum. The current mismatch may signal hesitation among network participants or a speculative-driven rally.

What next for UNI?

While UNI’s price action is technically bullish, its ability to hold above $6.90 and breach the $8.00 zone will be key to sustaining upward momentum. If on-chain activity recovers and more addresses interact with the network, it would strengthen the case for continuation toward $10 and beyond.

Conversely, failure to maintain the breakout level, especially if daily active addresses continue to decline, could lead to a retest of the $6.20 support.

Bulls have the upper hand for now, but Uniswap will need broader user participation to turn this breakout into a longer-term trend reversal.