Uniswap breaks out — Will Grayscale’s call spark a 36% UNI rally?

- At the time of writing, Uniswap had gained by over 4% in just 24 hours

- L2 trading volume and Grayscale’s prediction seemed to have an impact on the price action

Uniswap (UNI) is one of the top decentralized protocols in the cryptocurrency market, known for facilitating large volumes of trades using smart contracts to create liquidity pools.

At press time, UNI was at the end of some promising performance, with its price rising by 4.16% to hit $7.47 on the charts. Additionally, the 24-hour trading volume climbed by 22.13%, hitting $156 million. This resulted in a 3.5% volume-to-market ratio.

Simply put, this highlighted the potential for UNI as a solid investment option.

Uniswap price prediction

Analyzing the UNI/USDT pair, the technical indicators pointed to a bullish trend for UNI as it recently broke out of an ascending triangle pattern. Such patterns often signal accumulation, indicating that large investors and institutions are entering the market.

This particular pattern had been forming for a month, and the breakout led to a price surge of over 10%. However, its performance over the last 24 hours settled with gains of 4% – A healthy consolidation.

Hence, the question remains – Can UNI continue its upward trend? Well, external factors are aligning, with the potential for the price to reach $10 by Q4 2024, offering gains of 36% from its press time price.

The MACD flipped bullish too, confirming that buyers remain in control. The histogram bars also indicated positive momentum, even though it was not at its peak.

Additionally, the RSI revealed that UNI was overbought, but still had room for further gains before reaching reversal levels. These factors, combined, suggest a bullish outlook for UNI in the near term.

Monthly L2 trading volume and UNI v4 update

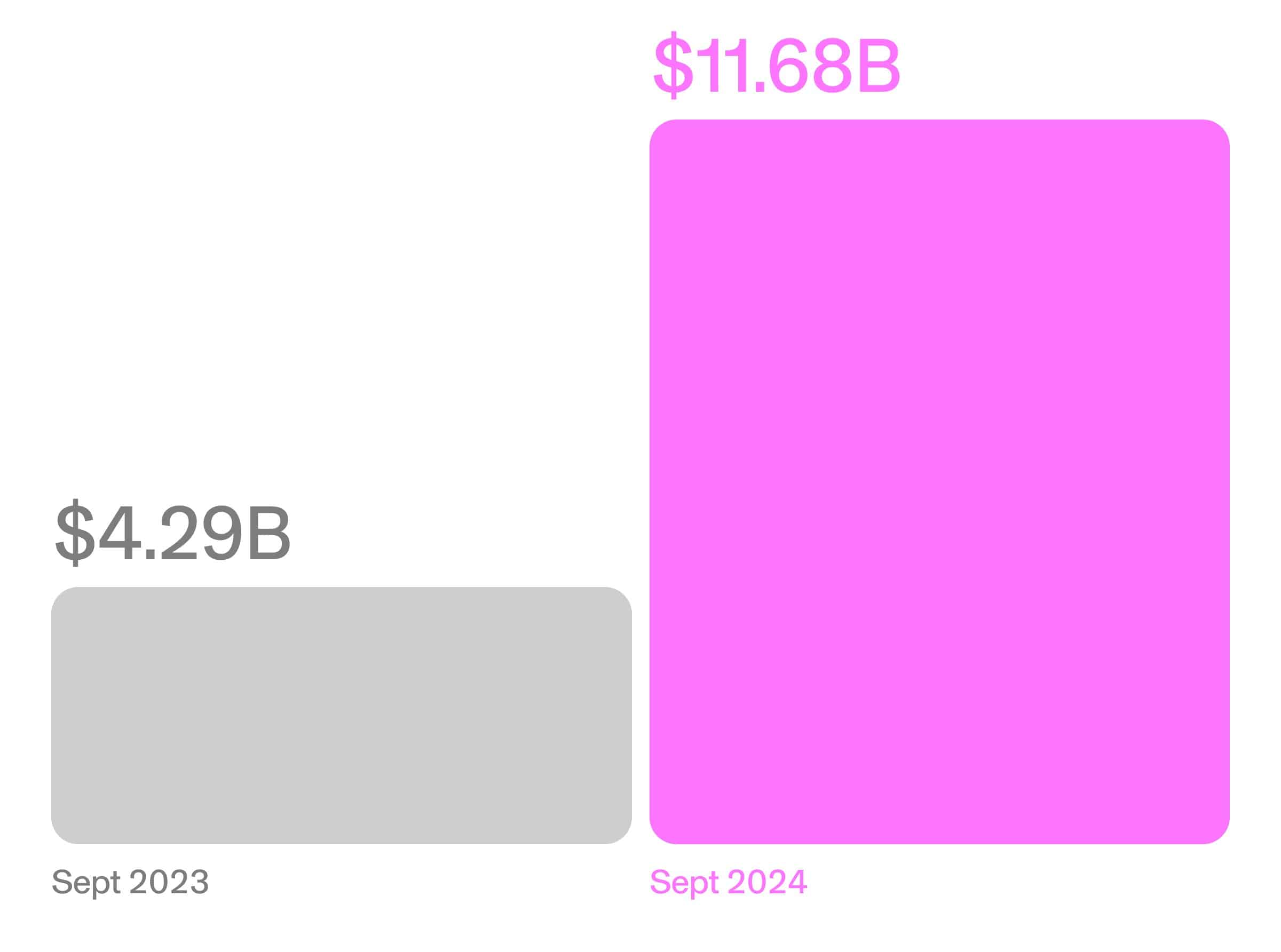

Uniswap’s on-chain metrics also supported this positive outlook. The monthly Layer 2 (L2) volume on the Uniswap protocol has nearly tripled compared to last year, and the month isn’t even over yet.

This significant increase in L2 trading volume is a sign of growing interest and activity on Uniswap.

Moreover, Uniswap’s upcoming v4 update introduces “Hooks,” a new feature that allows liquidity pools to set specific requirements.

This opens the door to various useful features but also raises concerns. Especially as one community-created “KYC” hook would restrict access to only those with a verified KYC wallet.

Grayscale’s latest call

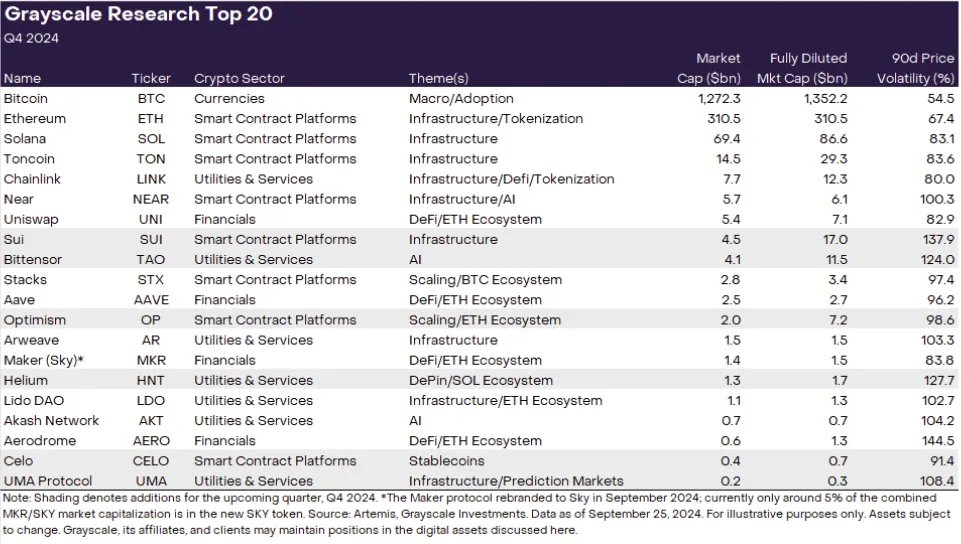

Finally, Uniswap continues to attract attention from top research teams. Grayscale recently added UNI to its list of cryptocurrencies predicted to perform well in Q4.

The list includes other promising assets like Sui Network (SUI), BitTensor (TAO), and Optimism (OP), among others. On the contrary, some tokens, such as Render (RENDER) and THORChain (RUNE), were removed from the list.

Uniswap’s press time price action, technical indicators, and on-chain metrics, all suggested a bullish outlook for Q4 2024. With increasing trading volumes and strong market positioning, UNI may be poised for further gains now.

![Ethereum's [ETH] short-term price targets - Is the $2,300 resistance too strong?](https://ambcrypto.com/wp-content/uploads/2025/03/Evans-1-min-400x240.png)