Uniswap buyers should look for THESE price levels before going long

- Bears took over as UNI fell below key support levels and long-term EMAs.

- Crypto’s derivates data showed a bearish edge with slight hope for buyers.

After the recent market crash, Uniswap [UNI] slipped below key support levels alongside its peers as it fell toward a relatively low liquidity zone at press time.

Can the bulls step in to stop the immediate bleeding? The Crypto & Fear and Greed index plunged to show a strong bearish edge in the market.

If the sellers continue to defend the $5.7 resistance, UNI could see short-term volatility before witnessing a bullish rebuttal. UNI traded at $5.2 at the time of writing, down by over 31% in the past week.

UNI saw a streak of red candles amid market mayhem

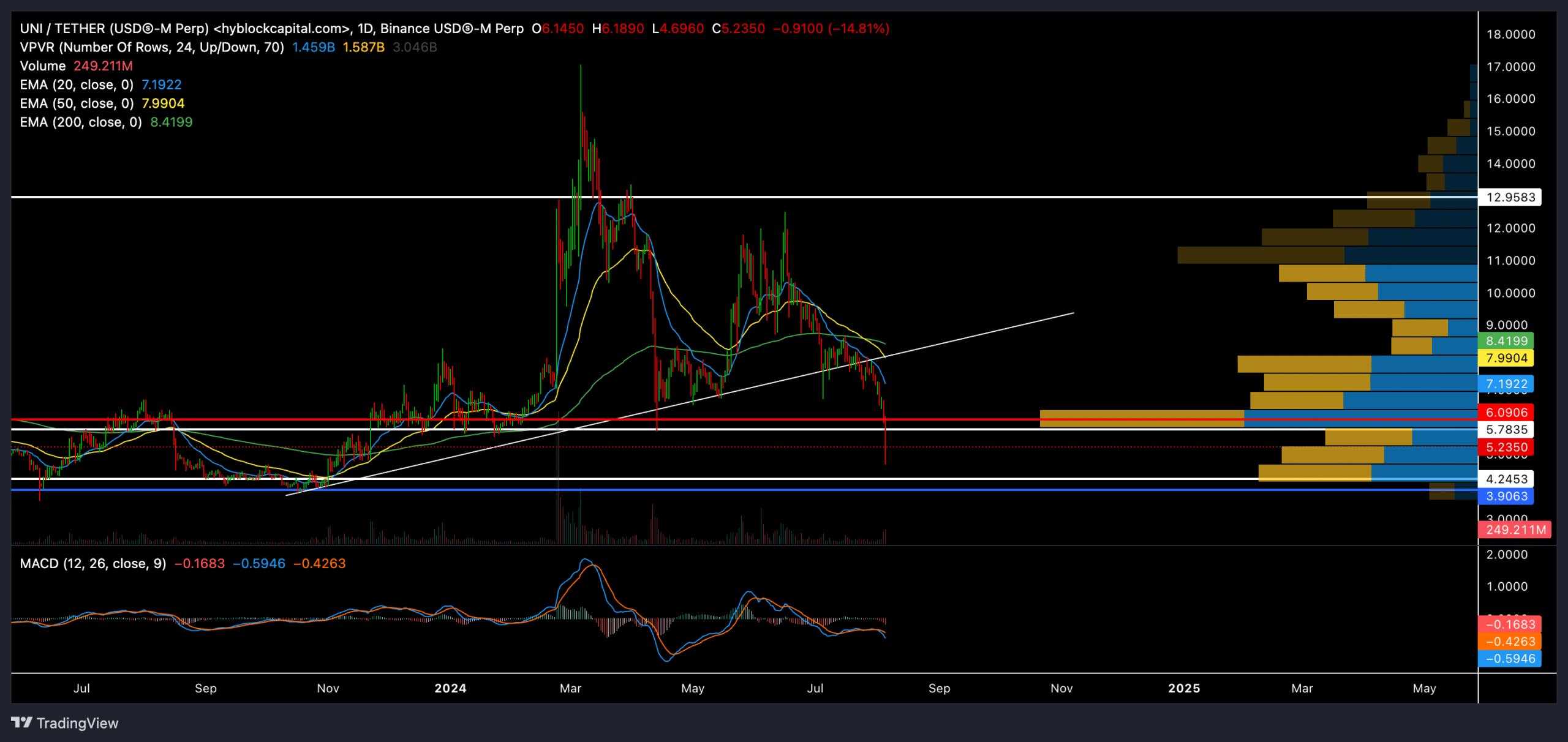

The altcoin’s extended bullish run saw a reversal from around the $13 support in early April this year. Since then, UNI found support near the 9-month trendline resistance (white, then support) despite the downtrend.

However, the recent market uncertainty has caused huge bearish waves across the stock and crypto markets. Consequently, UNI witnessed a steep downtrend on its daily charts and plunged toward its nine-month low on 5 August.

Uniswap also saw a bearish crossover, with 20-day and 50-day EMAs falling below the 200-day EMAs. In the meantime, the price action was in a relatively low liquidity zone per the VPVP indicator.

Thus, UNI will likely see high volatility in the coming days. Should market conditions improve, buyers will look to retest the Point of Control (POC, red) level of the VPVR near the $6 mark. However, UNI could struggle to cross this level without a one-sided bullish edge.

On the other hand, a likely bearish edge in the market can pull UNI down toward the $3.9- $4.2 support range in the coming sessions.

The MACD continued its downtrend after witnessing a bearish cross below the equilibrium. Buyers should wait for a bullish crossover between these lines, as it would indicate an ease in near-term selling pressure.

Open interest declined

According to Coinglass data, an analysis of the funding rates showed a strong edge for the sellers.

Is your portfolio green? Check out the UNI Profit Calculator

The reduction in open interest alongside increased volume suggests that many traders are closing their positions due to market volatility and profit-taking.

Despite the overall market downtrend, long/short ratios on Binance and OKX show a strong bullish sentiment, especially among top traders.