DeFi

Uniswap, Curve Finance, SushiSwap make a killing amidst market uncertainty

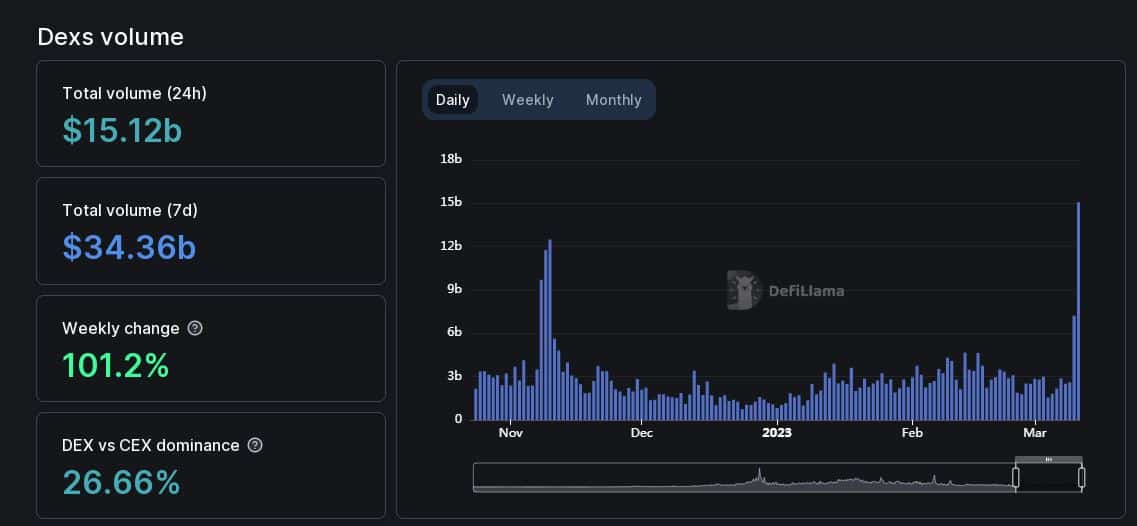

- The total DEX trading volume surged to a four-month high of $15.12 billion on 11 March.

- Total fees collected on Uniswap hit its highest value since 10 May.

Decentralized exchanges (DEXes) registered an exponential rise in trading activity in the last 24 hours after the collapse of Silicon Valley Bank (SVB) triggered FUD in the broader crypto market and depegged the USD Coin [USDC].

As per DeFiLlama, the total DEX trading volume surged to a four-month high of $15.12 billion on 11 March, with a weekly growth rate of more than 100%.

The DEX dominance over aggregated DEX and centralized exchange (CEX) volume rose to 26.66% at the time of writing.

Popular DEXes register impressive growth

The fall of centralized entities has acted in favor of DeFi protocols in the past. It was exemplified during the post-FTX collapse period when users started to prefer self-custody over centralized exchanges.

Curve Finance [CRV], a DEX designed for stablecoin swapping, recorded its biggest daily trading volume, nearly $8 billion in the last 24 hours.

Due to high trading traffic, the total fees collected on the platform jumped to $952,000, the highest in four months, as per Crypto Fees

.Similarly, the largest DEX in terms of trading volume, Uniswap [UNI] posted its best performance in four months after its volume surged to $3.45 billion in the last 24 hours.

The transaction fees paid by the users hit a 10-month high of $8.75 billion at press time.

Another popular DEX, SushiSwap [SUSHI] also witnessed a jump in activity and it became one of the most used smart contracts by top Ethereum whales in the last 24 hours.

JUST IN: $SUSHI

@sushiswap one of the MOST USED smart contracts among top 100 #ETH whales in the last 24hrs?Check the top 100 whales here: https://t.co/N5qqsCAH8j

(and hodl $BBW to see data for the top 5000!)#SUSHI #whalestats #babywhale #BBW pic.twitter.com/JtN7rwz8zX

— WhaleStats (tracking crypto whales) (@WhaleStats) March 12, 2023

The future is DeFi!

DEXes have grown by leaps and bounds over the past 3-4 years. The development activity across different projects has increased manifold as per a tweet by Token terminal, with developers working on as many as 20 different projects as of 10 March.

This argues well for the future of decentralized finance (DeFi).

Bullish on the future of DEXs pic.twitter.com/0ITgzUo7n3

— Token Terminal (@tokenterminal) March 11, 2023

Lastly, USDC lost its dollar peg on some exchanges, over concerns that reserves backing the second-largest stablecoin by market cap, were stuck in the failed Silicon Valley Bank (SVB). At the time of writing, USDC recovered to $0.95 as per CoinMarketCap.