Uniswap dominates Polygon: A look at volume, TVL and UNI’s rollercoaster ride

- Uniswap racks up 42% of trading volume on Polygon.

- UNI has seen a slight uptrend after four days of downtrend.

Uniswap’s [UNI] recent update highlighted its achievement as the top Decentralized Exchange (DEX) regarding volume on the Polygon [MATIC] network. While this is certainly an impressive milestone, what has been the overall trading volume, particularly for its V3?

How much are 1,10,100 UNIs worth today

Uniswap leads in volume on Polygon

In a Uniswap post dated 11 September, the platform proudly announced its status as the leading Decentralized Exchange (DEX) on the Polygon network, boasting an impressive weekly trade volume of over $213 million. According to the DEX, this volume represented a substantial 42% share of the total trading activity on the Polygon network.

1/ Uniswap is the top DEX by volume on Polygon, with over $213m weekly trade volume ?

That’s 42% of all trading volume on Polygon ?#ScalingSummer continues with @0xPolygonLabs. Time to check out the next @layer3xyz quest!https://t.co/UYDMRcF7iO

— Uniswap Labs ? (@Uniswap) September 11, 2023

Furthermore, when examining the Total Value Locked (TVL) ranking of Uniswap’s DEX on Polygon, it was evident that the platform played a significant role. As of this writing, the V3 held a TVL of approximately $73 million on the Polygon network.

The TVL made it the third-highest contributor in terms of TVL among all participants on the Polygon network.

Analyzing the overall Uniswap volume and TVL

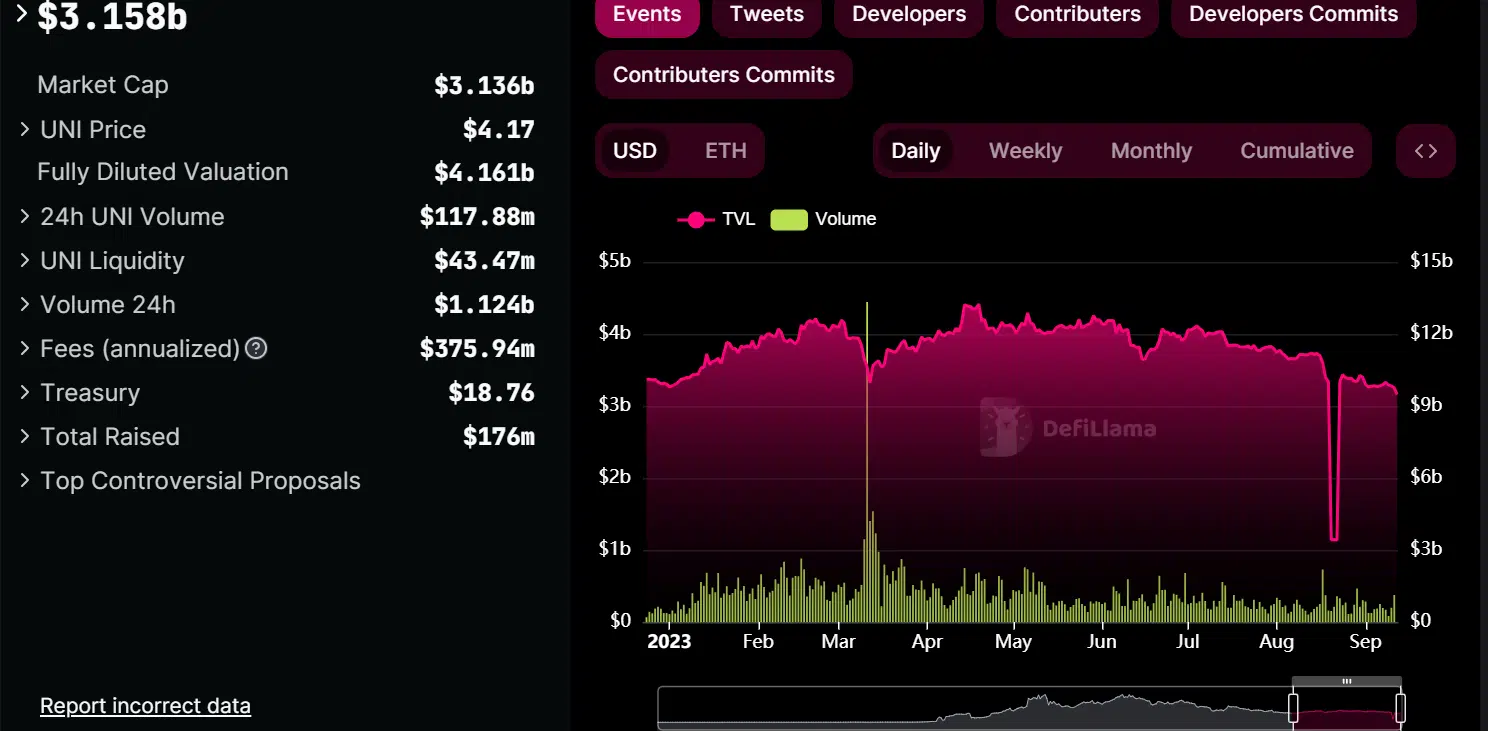

According to DefiLlama data, there was a noticeable uptick in Uniswap’s trading volume on 11 September. It reached a significant milestone by surpassing $1.1 billion in daily volume.

This marked a noteworthy achievement as it was the first time during the month that its daily trading volume had exceeded the $1 billion threshold. Until then, the highest recorded volume was approximately $902 million.

However, it’s worth noting that the Total Value Locked (TVL) on Uniswap displayed some signs of a downtrend. As of this writing, the TVL has reached over $3.1 billion.

Furthermore, DefiLlama’s data revealed that Uniswap V3 played a pivotal role in trading volume and TVL within the Uniswap ecosystem. As of this writing, Uniswap V3 boasted a TVL of over $2 billion. Also, it contributed significantly to the platform’s trading volume, which stood at over $990 million.

UNI sees little respite

Over the past few days, Uniswap has experienced a consistent downtrend, as evident from its daily timeframe chart. During this period, it saw a decline in value exceeding 8% over four days. However, there has been a recent positive development. As of this writing, UNI was trading at approximately $4.1, reflecting a modest increase in value of more than 1%.

Source: TradingView

Realistic or not, here’s UNI’s market cap in BTC terms

The consecutive downtrends that Uniswap encountered initially pushed it deep into a bearish trend, a condition highlighted by its Relative Strength Index (RSI). The RSI indicated that UNI had entered the oversold zone.

Nevertheless, as of this writing, the RSI had risen slightly above this oversold threshold, largely attributed to the recent uptick.