Uniswap investors HODL despite 45% rise; is it confidence or fear?

It becomes a matter of celebration when the price charts display a bullish signal after almost a quarter of bearishness. Now, in an event of a price rally, investors, either cash out or the chain observes the arrival of new investors. Furthermore, in case of a price rise, there seems to be a change in the activity of investors.

But not in the case of Uniswap

The on-chain activity of UNI investors observed a peculiar behavior from the investors’ end. Even after a 57.28% fall, investors didn’t exit their position. On the other hand, surprisingly, a rally of 44.83% didn’t see investors acquiring UNI in their portfolio.

On-chain activity shows that throughout the price fall of January, transaction volume did not observe any significant change as Uniswap’s daily trades amounted to about $40-$50 million on average.

And, even over the last two weeks, no significant difference has been detected despite price recovery. The only time volume spiked was on 27 February, when UNI shot up by 7.8% in a day.

Uniswap transaction volumes | Source: Intotheblock – AMBCrypto

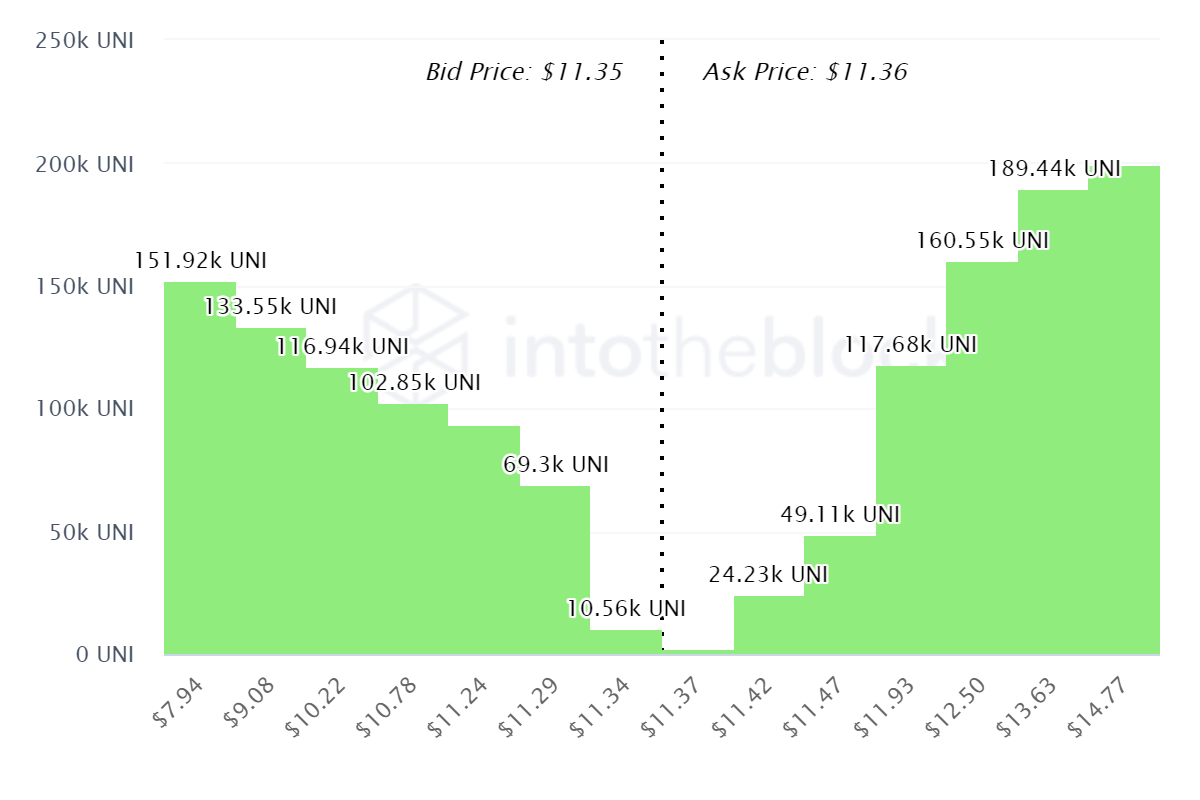

Backing the same is data from Coinbase, where the buy and sell orders are not only at a difference of mere 44k UNI (worth $484k) but also significantly lower than what the exchange usually handles in the case of Uniswap.

Uniswap buy and sell orders | Source: Intotheblock – AMBCrypto

This could mean that either the investors are HODLing in the confidence of Uniswap, expecting a stellar rise soon or they are waiting for the right time to recover their losses.

However, the scenario might change in the months to come since investors’ interest looks skewed towards the positive side after three months.

Notably, a spike was registered when a rally began on 17 March, but the gradual incline places the metric on the verge of flipping the trend.

Uniswap investor sentiment | Source: Santiment – AMBCrypto

This could push UNI towards the critical resistance of $14, which will help the token recover losses of the last two months. Eliminating the year-to-date losses is another challenge that will require a lot more time for Uniswap.

Uniswap price action | Source: TradingView – AMBCrypto

For now, trading at $10.75 at press time, the altcoin is looking at consolidation with the price indicators steady in the bullish zone.